Corporate Sustainability Reporting Directive (CSRD): Embracing Sustainability

WHY THE EU HAS ADOPTED THE CSRD

The CSRD aims at addressing important deficiencies related to corporate sustainability reporting within the EU. Below are the key problems with which the CSRD deals:

Lack of Consistency in reporting

In the absence of a standardized framework for reporting sustainability information, which made it challenging for stakeholders to assess and compare different companies’ ESG performance, the CSRD brings harmonization in reporting.

Greenwashing risks

Inconsistent and vague reporting standards can enable companies to make misleading claims about their sustainability practices, deceiving investors, consumers, and other stakeholders.

Incomplete Information in sustainability reports

Many companies provide insufficient information in their sustainability reports, making it difficult for stakeholders to evaluate the actual impact of their ESG activities. The CSRD seeks to improve the quality and comprehensiveness of sustainability disclosures.

Investors lacking reliable sustainability data

Investors increasingly consider ESG factors in their decision-making processes. However, the lack of standardized and reliable sustainability data can hinder their ability to make informed investment choices. The CSRD aims to provide investors with better ESG information to support sustainable investment decisions.

Regulatory Fragmentation

Prior to the introduction of the CSRD, the 27 EU member states had varying reporting requirements for sustainability information. This led to a fragmented regulatory landscape that made it challenging for multinational companies to comply with reporting obligations across different jurisdictions.

Lack of transparent and responsible corporate behavior

Ensuring the long-term sustainability of businesses and addressing pressing global challenges, such as climate change and social inequality, requires improved transparency and accountability in corporate reporting. The CSRD aims to encourage companies to integrate sustainability considerations into their core business strategies and operations.

CSRD - OVERVIEW

The Corporate Sustainability Reporting Directive (CSRD) marks a new era in corporate accountability, introducing significant changes in the scope and quality of sustainability disclosures by companies within the EU. It extends to roughly 50,000 entities, significantly up from the approximately 11,000 entities covered by its predecessor, the Non-Financial Reporting Directive (NFRD). Set to take effect in phases, beginning 2024, the CSRD not only enhances the granularity of reporting but also standardizes it across a digital framework for ease of access and evaluation. This comprehensive reform aims to address the critical gap in transparency identified by KPMG, where 80% of consumers favor firms with credible sustainability practices. As the demand for green products grows, the CSRD serves as a regulatory counterbalance to greenwashing, enforcing stringent disclosures that could reshape market dynamics and consumer trust in sustainability claims.

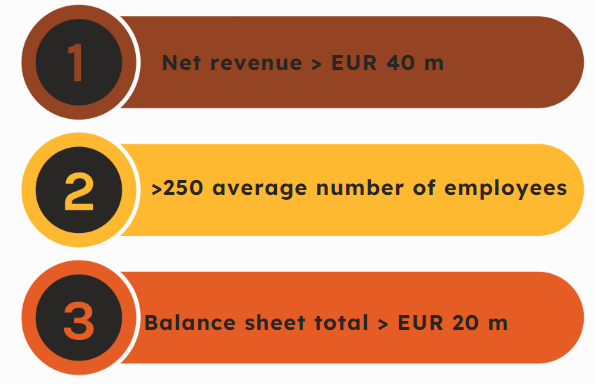

The CSRD applies to all listed companies and to all unlisted large companies that meet 2 of the below 3 criteria:

For financial services, the implementation of the CSRD represents a significant transition. With broader inclusion criteria and detailed rules regarding disclosures on sustainability practices, the EU directive is set to transform how the financial sector reports and manage their ESG risks, requiring a level of transparency and accountability that was previously unseen. The CSRD’s rigorous reporting framework compels firms to thoroughly assess and disclose how their operations and strategies impact sustainability matters—ranging from climate change to social welfare.

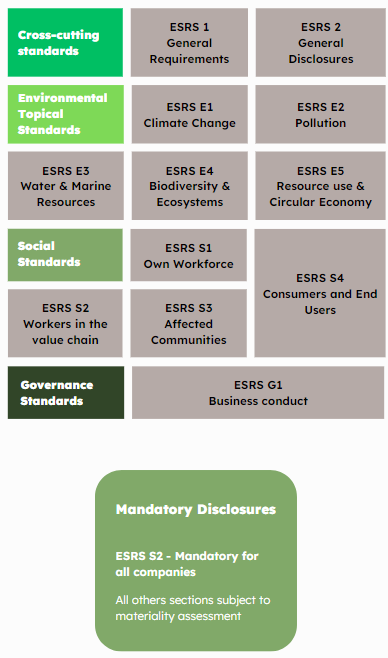

European Sustainability Reporting Standards:

AREAS OF COMPLEXITY

Understanding CSRD‘s Material Scope

Interpreting the CSRD’s expanded requirements and integrating them into existing reporting frameworks.

Data Acquisition and Quality

Ensuring the accuracy and completeness of the data required for detailed sustainability reporting.

System and Process Integration

Developing systems to align with the digitalization aspect of the CSRD, which demands a new level of data analysis and presentation.

Third-Party Verification

Establishing relationships with credible verifiers to validate the sustainability information being reported.

Continuous Disclosure

Maintaining an ongoing and dynamic reporting process to reflect the evolving nature of sustainability practices and regulations.

Stakeholder Communication

Effectively communicating the complexities and achievements of sustainability initiatives to stakeholders.

Transformation of Corporate Culture

Embedding a culture of sustainability within the organization to support the CSRD’s principles in daily business operations.

By addressing these areas proactively, financial firms can turn the challenge of CSRD compliance into a strategic advantage, showcasing their commitment to sustainable development and gaining trust from investors, customers, and regulators.

CONSEQUENCES FOR NON-COMPLIANCE

Financial and non-financial Penalties

As the CSRD is transposed into national law, EU Member States set different financial penalties. Criminal law liability and concomitant penalties of natural persons, such as company directors, is also a possibility, depending on the relevant national law.

Reputational Damage

Misleading or inadequate sustainability reporting can negatively affect a company’s reputation, leading to a loss of consumer and investor trust.

Operational and Strategic Setbacks

Non-compliant companies may encounter barriers to market access, especially in industries where sustainability is a key factor for consumers and investors.

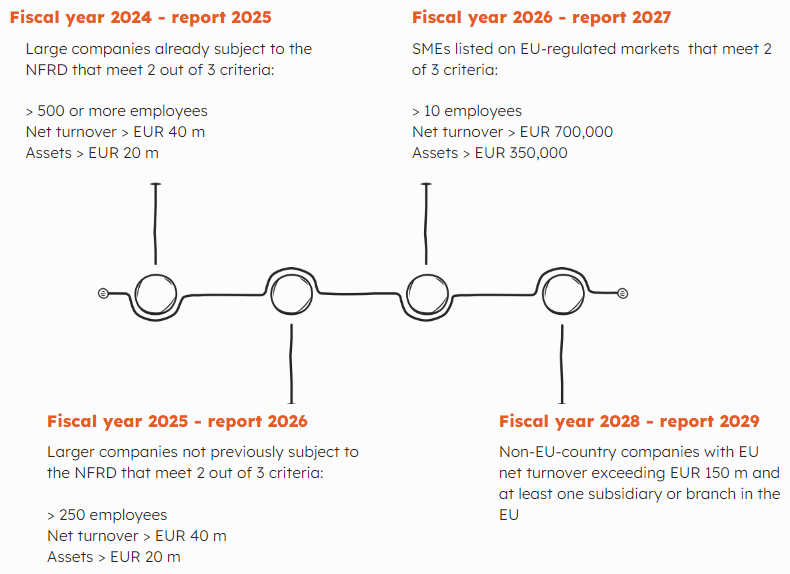

IMPORTANT DEADLINES

SERVICES

This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, T3 Consultants Ltd, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.