Sustainability Reporting Evolves: An In-Depth Look at IFRS S1 and S2 Standards

ISSUES IFRS S1 & S2 AIM TO ADDRESS

In June 2021 the International Organization of Securities Commissions (IOSCO) called on the IFRS Foundation to urgently establish a global baseline of investor-focused sustainability reporting standards. The initiative was aimed at addressing several key problems related to sustainability reporting. These problems include:

Lack of Consistency in reporting standards

Prior to the adoption of IFRS S1 and IFRS S2, there was a lack of globally consistent sustainability reporting standards. Companies often used a variety of different frameworks and guidelines for reporting on their ESG performance. This lack of consistency made it difficult for investors to compare and assess the sustainability performance of different companies.

Incomparability of companies’ ESG performance

The absence of standardized sustainability reporting made it challenging for investors to compare the ESG performance of companies within the same industry or across different sectors. Without common reporting standards, it was challenging to determine which companies were truly excelling in sustainability practices and which ones were falling short.

Issues with Reliability and Trustworthiness of reported information

Inconsistent and fragmented sustainability reporting also raised concerns about the reliability and trustworthiness of the information provided by companies. Investors needed more confidence that the sustainability data they relied upon was accurate and trustworthy.

By calling on the IFRS Foundation to establish a global baseline of investor-focused sustainability reporting standards, IOSCO aimed to address these problems by creating a common framework that would enhance the consistency, comparability, and reliability of sustainability-related financial disclosures. This would provide investors with more accurate and comparable information to make informed investment decisions and promote transparency and accountability in ESG reporting across companies and jurisdictions.

IFRS S1 & S2: OVERVIEW

The arrival of the IFRS S1 and IFRS S2 standards represents a paradigm shift in corporate reporting, a movement towards a transparent, accountable, and sustainable global economy. These standards are designed to integrate sustainability into the financial narrative of organizations worldwide.

IFRS S1: General Sustainability Disclosures

IFRS S1 outlines the fundamental criteria for disclosing sustainability information, and it is meant to be applied in conjunction with IFRS S2 and any forthcoming standards released by the ISSB. IFRS S1 entails the following key points:

- Mandates the disclosure of significant details pertaining to sustainability-related risks and opportunities within financial statements, addressing investor information needs

- Calls for industry-specific disclosures and directs companies to refer to the industry-based SASB standards for guidance when identifying sustainability-related disclosures concerning risks and opportunities.

- Makes references to sources that can aid companies in identifying sustainability-related risks, opportunities, and information (except those within the scope of IFRS S2).

- Enforces disclosures that facilitate investors’ comprehension of the linkages between sustainability-related risks, opportunities, sustainability-related financial disclosures, and financial statements.

IFRS S2: Climate-Related Disclosures

IFRS S2 brings climate-related risks and opportunities into the spotlight and compels organizations to provide a clear picture of how they are managing and mitigating the risks associated with climate change, including detailed Scope 1, 2, and 3 GHG emissions data. This standard serves as a crucial tool for investors and stakeholders to gauge the climate resilience of their investments.

It covers the following:

- Disclosures pertaining to strategy, distinguishing between physical and transitional risks.

- Disclosure of strategies for addressing climate-related risks and opportunities, including the methodology for establishing climate-related objectives and any obligations imposed by legal or regulatory requirements.

- Conducting scenario analyses to describe how various climate-related events may affect the company’s operations in the future.

- Climate-related metrics and target disclosures. These should include the following: a. Metrics that are applicable across different industries, such as greenhouse gas emissions; b. Metrics tailored to specific industries; c. Company-specific metrics that the board or management considers when assessing progress toward established targets.

AREAS OF COMPLEXITY

Technical Complexities

The technical challenges are rooted in the need for robust data collection and reporting systems that can accurately capture and convey sustainability-related financial information. Entities must enhance their data architecture to ensure that they can quantify and report on sustainability metrics consistently and transparently. This involves not only the collection of relevant data but also its validation, analysis, and integration into financial reporting frameworks.

For climate-related disclosures under IFRS S2, the task becomes even more complex. Organizations must measure and report on a comprehensive set of greenhouse gas emissions data, including Scope 1, 2, and 3 emissions. This requires a detailed understanding of the carbon footprint across the company’s operations and value chain, which in turn demands sophisticated tracking and calculation methodologies.

Strategic Complexities

Strategically, entities must decide how to embed sustainability into the core of their business models. The IFRS S1 and S2 standards necessitate a strategic re-evaluation of how sustainability risks and opportunities impact long-term value creation. The shift towards sustainability reporting can have profound implications for an organization’s strategy, influencing investment decisions, operational processes, and even product offerings.

Operational Complexities

On the operational front, meeting the IFRS S1 and S2 standards will likely require significant changes to internal processes. Financial entities will have to establish new procedures and controls to manage and report on sustainability issues reliably. This may involve training staff, creating new roles or departments, and developing new internal reporting mechanisms.

The need for industry-specific disclosures adds another layer of complexity. Financial institutions must not only comply with the general standards but also tailor their disclosures to reflect the unique sustainability issues pertinent to the financial industry. This could involve nuanced considerations like the impact of climate change on investment portfolios or the sustainability of financial products and services.

Transitional Complexities

The transition provisions provided by the ISSB acknowledge the steep learning curve and adjustment period required for first-time application of the standards. Entities must navigate these transitional arrangements, which include exemptions on comparative data and certain emissions reporting requirements, without losing sight of the ultimate goal: full and effective compliance.

CONSEQUENCES FOR NON-COMPLIANCE

The IFRS S1 and IFRS S2 standards are not compulsory, and the ISSB does not have the authority to mandate their adoption by companies. The decision to require companies within a particular jurisdiction to adhere to these standards rests with the national authorities. Additionally, companies have the option to adopt the standards on a voluntary basis.

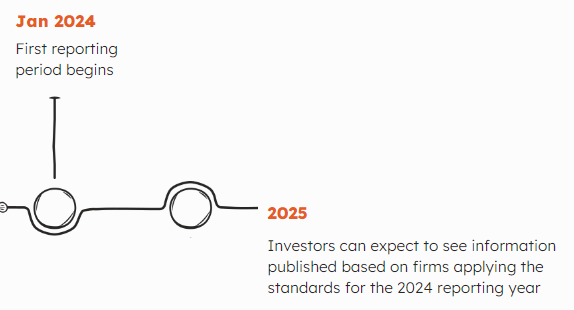

IMPORTANT DEADLINES

SERVICES

This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, T3 Consultants Ltd, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.