Basel 3.1 for Small- and Medium-sized Banks with Limited or no Trading Book Exposures

Key Changes impacted:

- Credit Risk: Standardised Approach (SA)

- Operational Risk: Standardised Approach (SA)

- Credit Valuation Adjustment: Alternative Approach (AA-CVA) & the Basic Approach without hedging effect (‘Reduced’ BA-CVA)

- Market Risk: Simplified Standardised Approach (SSA) and the Advanced Standardised Approach (ASA)

- Pillar 3 disclosure requirement: For non-listed ‘other institutions’

- Reporting changes: Update to reporting requirements in line with new Basel rules

This document presents an overview of the Basel 3.1 revisions tailored for smaller and medium-sized banking institutions, specifically those with limited or nonexistent trading book exposures. The modifications are centered around various areas of banking regulation, including credit and operational risks, credit valuation adjustments, market risks, and updated disclosure and reporting mandates.

1. Credit Risk Enhancements

The refined Standardised Approach (SA) introduces additional sub-classes for exposures, implementing a nuanced grading system for unrated corporations and institutions. This grading is contingent upon an internal assessment or rating. The Prudential Regulation Authority (PRA) of the UK is also set to mandate due diligence for the application of external credit ratings to accurately represent counterparty creditworthiness. Scheduled for July 1, 2025.

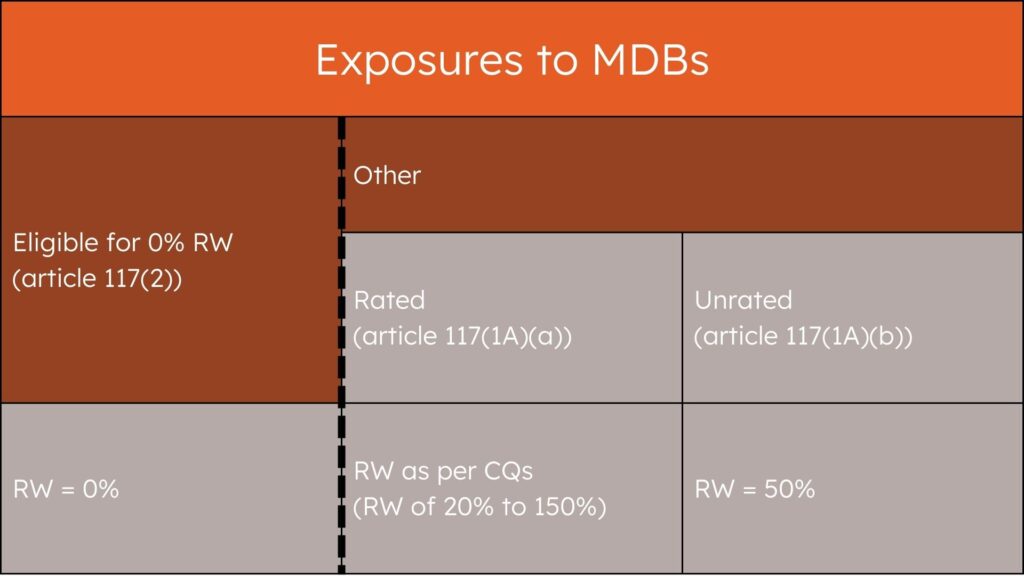

a) Multilateral Development Banks (MDBs):

The key alterations are twofold: rated MDBs will have risk weights assigned based on Credit Quality Steps (CQS), varying from 20% to 150%, while unrated MDBs will be uniformly assigned a 50% risk weight. This nuanced approach replaces the binary system and is designed to more accurately reflect the credit risk of MDBs, facilitating a more discerning and robust risk management process within financial institutions.

Existing and proposed Risk Weights:

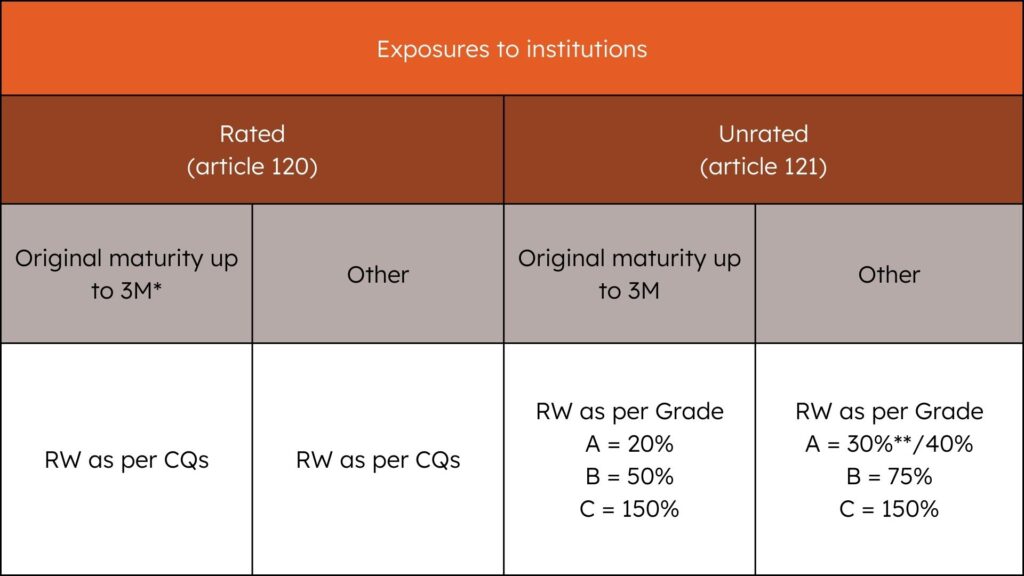

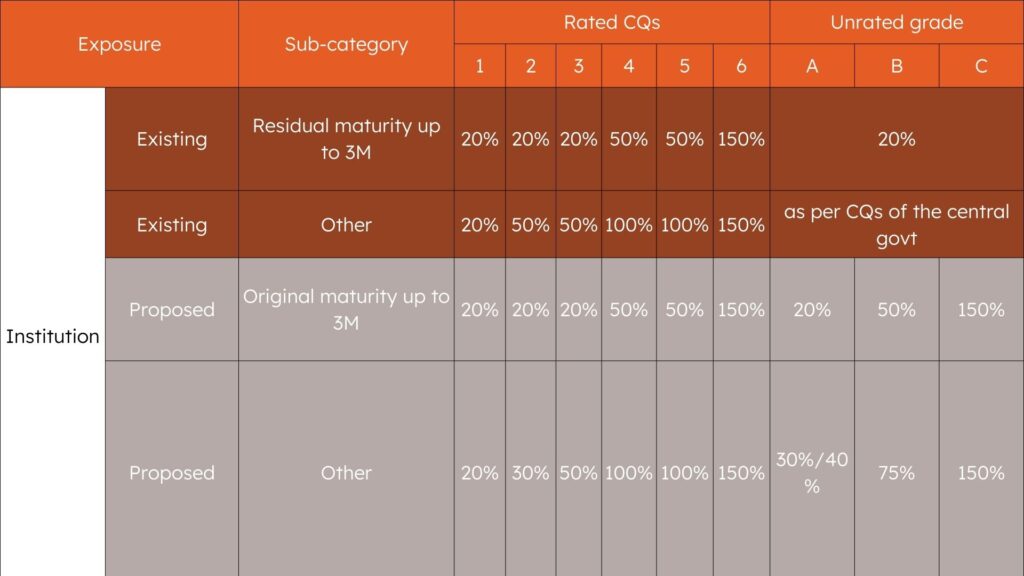

b) Institutional Exposures:

Key changes include reducing the risk weight for Credit Quality Step (CQS) 2 rated institutions from 50% to 30% and applying a 50% risk weight to unrated institutions. The approach also integrates due diligence requirements to ensure ratings accurately reflect creditworthiness. These measures aim to refine risk assessment and improve the alignment of capital requirements with the inherent risk in institutional exposures, ultimately contributing to financial system stability.

* Exposures to rated institutions where the original maturity of the exposure was six months or less and the exposure arose from the movement of goods across national borders shall be assigned a risk weight in accordance with the credit quality step for ‘original maturity up to 3 months

Existing and proposed Risk Weights:

Exposures to unrated institutions shall be classified into Grade A, Grade B or Grade C as given below:

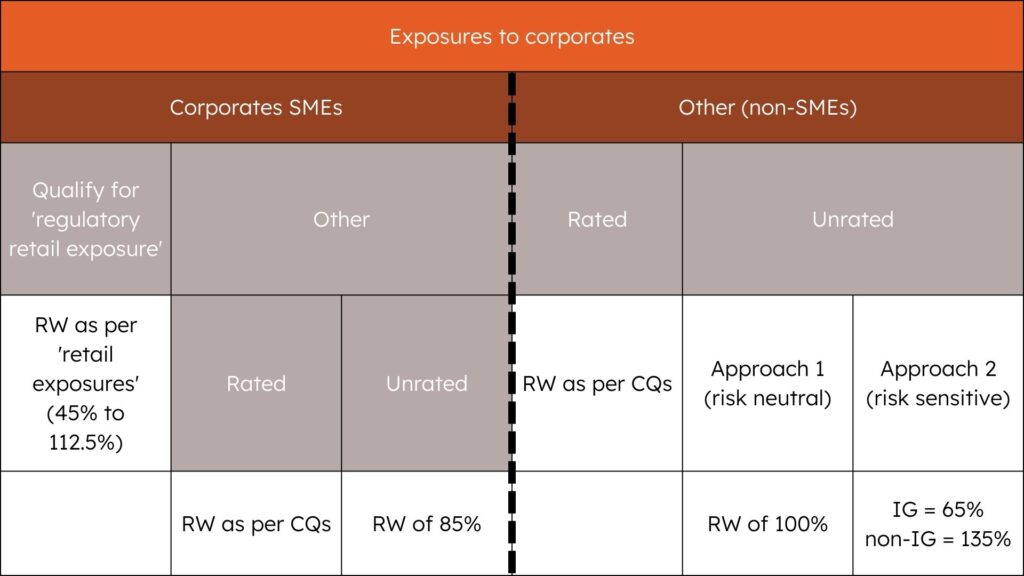

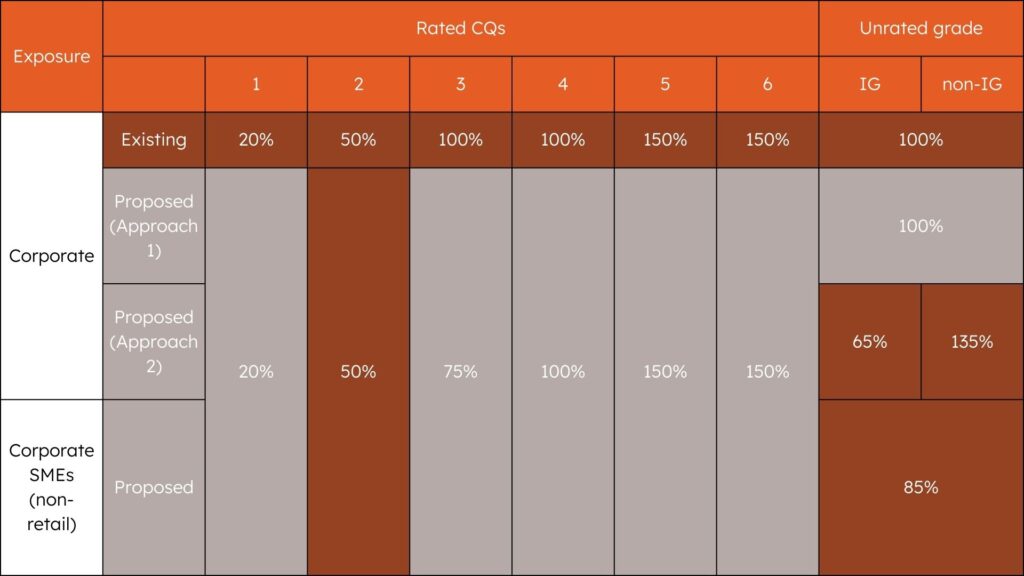

c) Corporate Exposures:

Changes for SMEs include the removal of support factors, replaced by an 85% risk weight for unrated SMEs, and for CQS 3 rated corporates, a reduced risk weight of 75%. Additionally, due diligence requirements will enforce more accurate external ratings. Two approaches for unrated corporates will be introduced: a risk-neutral approach with a flat 100% risk weight, and a more nuanced, risk-sensitive approach assigning 65% for investment grade and 135% for non-investment grade exposures. These updates aim to enhance the precision and efficacy of risk assessment in the banking sector.

Existing and proposed Risk Weights:

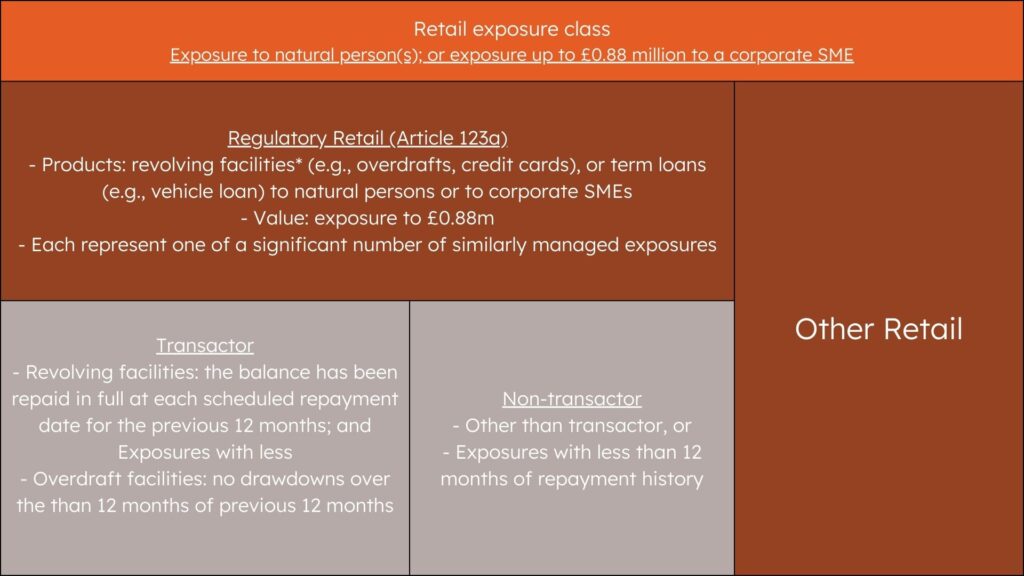

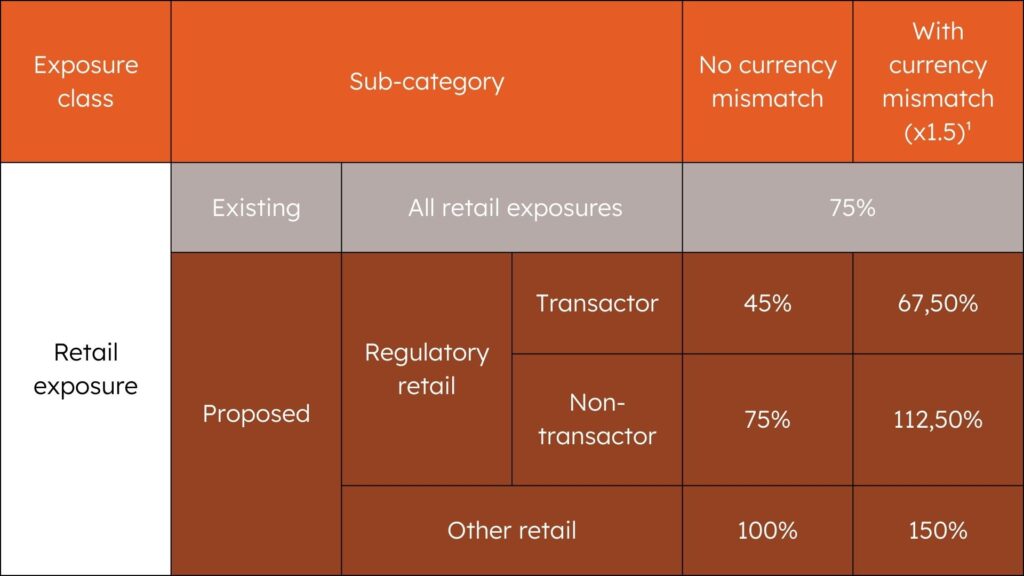

d) Retail Exposures:

This includes introducing variable risk weights ranging from 45% to 150% based on the type of exposure, a new 1.5 times risk sensitivity factor for currency mismatches, and an updated threshold for SME classification from EUR 1 million to GBP 0.88 million. By differentiating between ‘regulatory retail’ (both transactor and non-transactor) and ‘other retail’, the PRA aims to align the risk weights more closely with the actual risk presented by different types of retail exposures, ensuring a tailored and effective risk management framework.

‘*Any facility where the outstanding balance is permitted to fluctuate based on its decisions to borrow and repay, up to an agreed limit and in accordance with the terms of the facility agreement.

Existing and proposed Risk Weights:

¹Article 123B: If the currency of the exposure differs from the obligor’s main source of income, and there exists no natural or financial hedge between these, a factor of 1.5 is applied to the risk weight. For exposures incurred before the implementation date (i.e., 1 July 2025), the bank has the option to determine the currency mismatch based on the currency of the exposure and the domestic currency of the country of residence of the obligor (as a proxy).

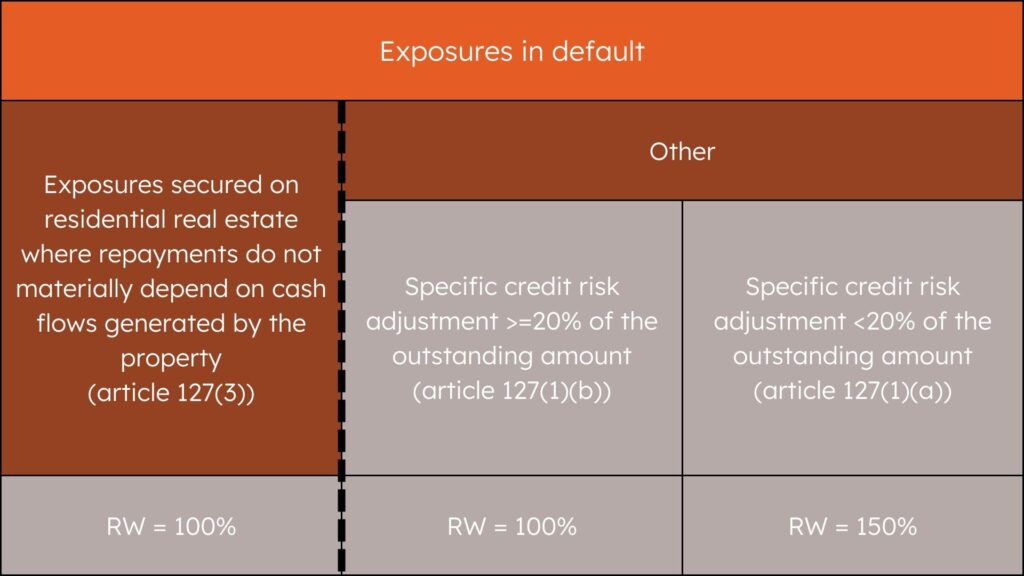

e) Defaulted Exposures:

The key changes propose considering the outstanding amount of the facility rather than the unsecured part for assessing specific credit risk adjustments. Residential real estate exposures with repayments not materially dependent on the property’s cash flows will now attract a 100% risk weight, harmonizing the treatment of secured and certain other exposures. For exposures where specific credit risk adjustments are equal to or exceed 20% of the outstanding amount, a 100% risk weight will apply, while those below 20% will attract a higher risk weight of 150%, indicating a more conservative approach to less secure credit positions.

Existing and proposed Risk Weights:

f) Real Estate Exposures:

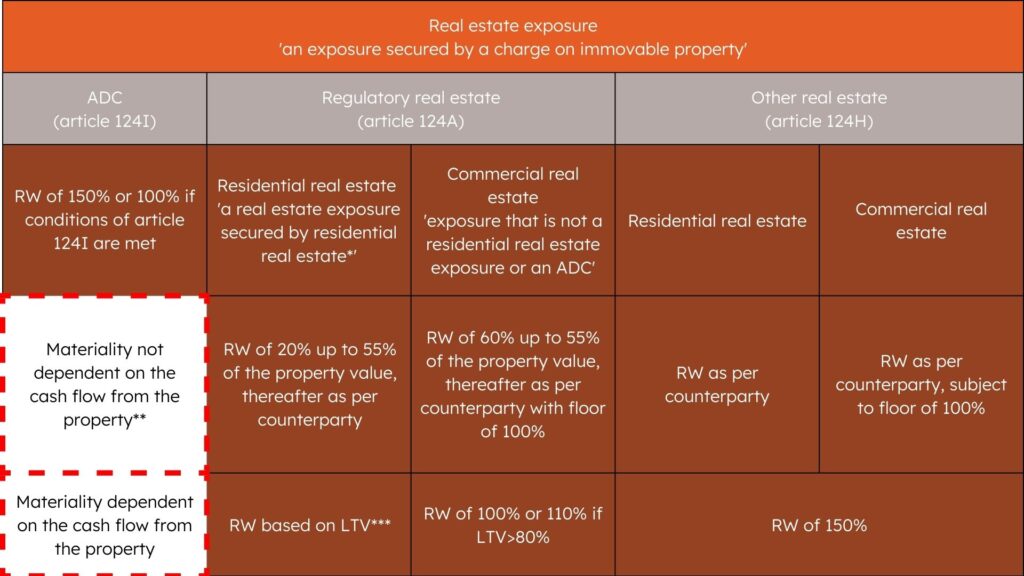

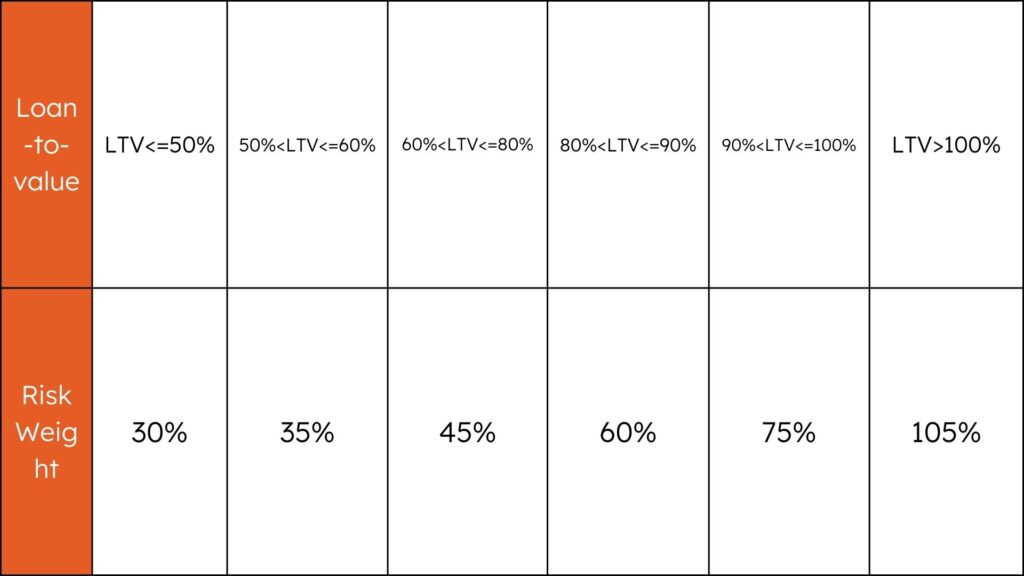

The changes to ‘real estate exposures’ outlined by the PRA include a replacement of the existing ‘exposures secured by mortgages on immovable property’ with a new exposure class, finer categorization into ‘regulatory real estate’, ‘ADC exposures’, and ‘other real estate’ with varied risk weights ranging from 20% to 150% based on the exposure type. There is a particular emphasis on exposures where repayments do not rely materially on the cash flow generated by the property, with a preferential risk weight of 100% unless conditions of Article 124 are met, which would then allow for a reduced risk weight. This reformation aims to foster a more detailed and risk-sensitive approach, taking into consideration factors like the loan-to-value ratio and the material dependency on property cash flow, to ensure a more precise and secure financial environment.

Existing (Basel 3.0) classification and Risk Weights:

Proposed (Basel 3.1) classification and Risk Weights:

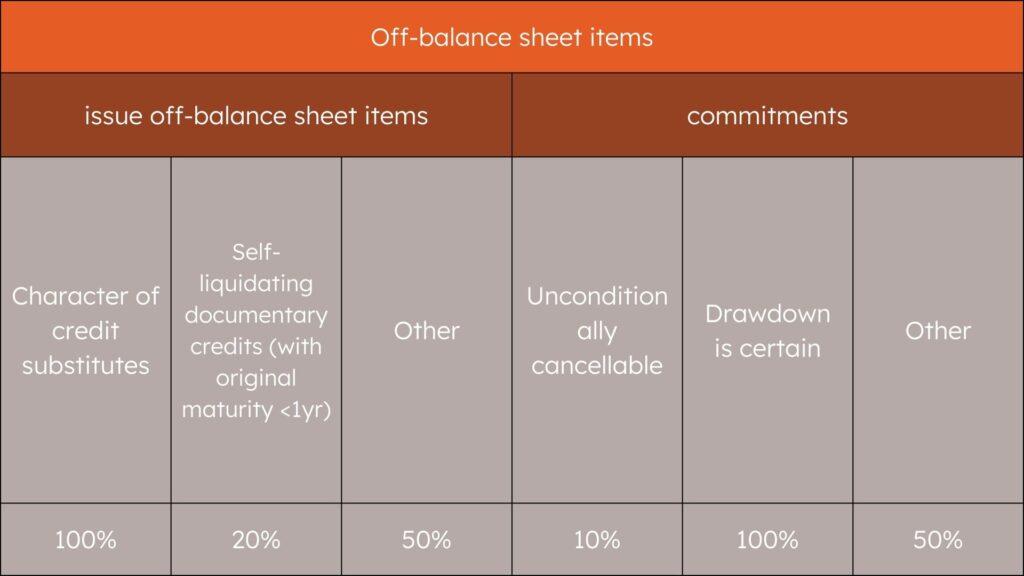

g) Off-balance sheet items:

2. Operational Risk

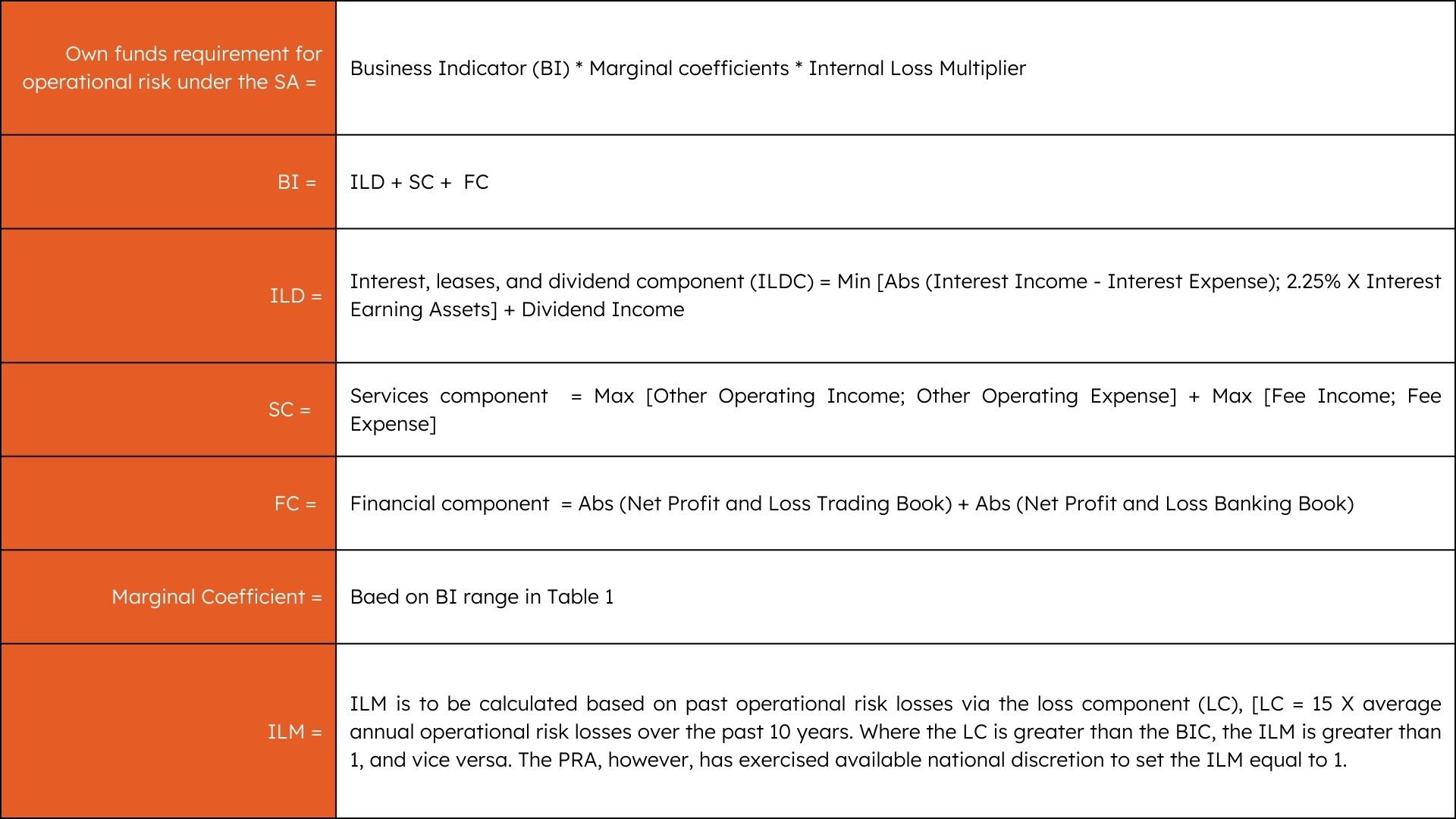

The Prudential Regulation Authority (PRA) issued Policy Statement 17/23 (PS17/23) on 12 December 2023, outlining the transition to Basel 3.1 standards, with an implementation date of July 1, 2025. This statement marks the culmination of a consultation process initiated with Consultation Paper 16/22 (CP16/22) and establishes new rules for the calculation of operational risk capital requirements for financial institutions. The key development introduced is the substitution of previous operational risk calculation methods — the Basic Indicator Approach (BIA), the Standardised Approach (SA), and the Advanced Measurement Approach (AMA) — with a revised Standardised Approach (SA) for operational risk.

Under the new SA framework, the calculation of the Own Funds Requirement for operational risk is based on two main elements: the Business Indicator Component (BIC) and the Internal Loss Multiplier (ILM). The BIC is calculated using a formula that incorporates financial statement components such as interest, dividends, and service fee income, adjusted by marginal coefficients that correspond to predefined BIC ranges. The Internal Loss Multiplier is a scaling factor initially set at 1, which could be adjusted in relation to an institution’s historical loss experience. Certain items are expressly included in the calculation of the BIC, such as net trading profit and fee income, while others like administrative expenses and depreciation on tangible assets are excluded. This new approach is designed to standardize the operational risk capital calculation across institutions, intending to make it more risk-sensitive and streamlined.

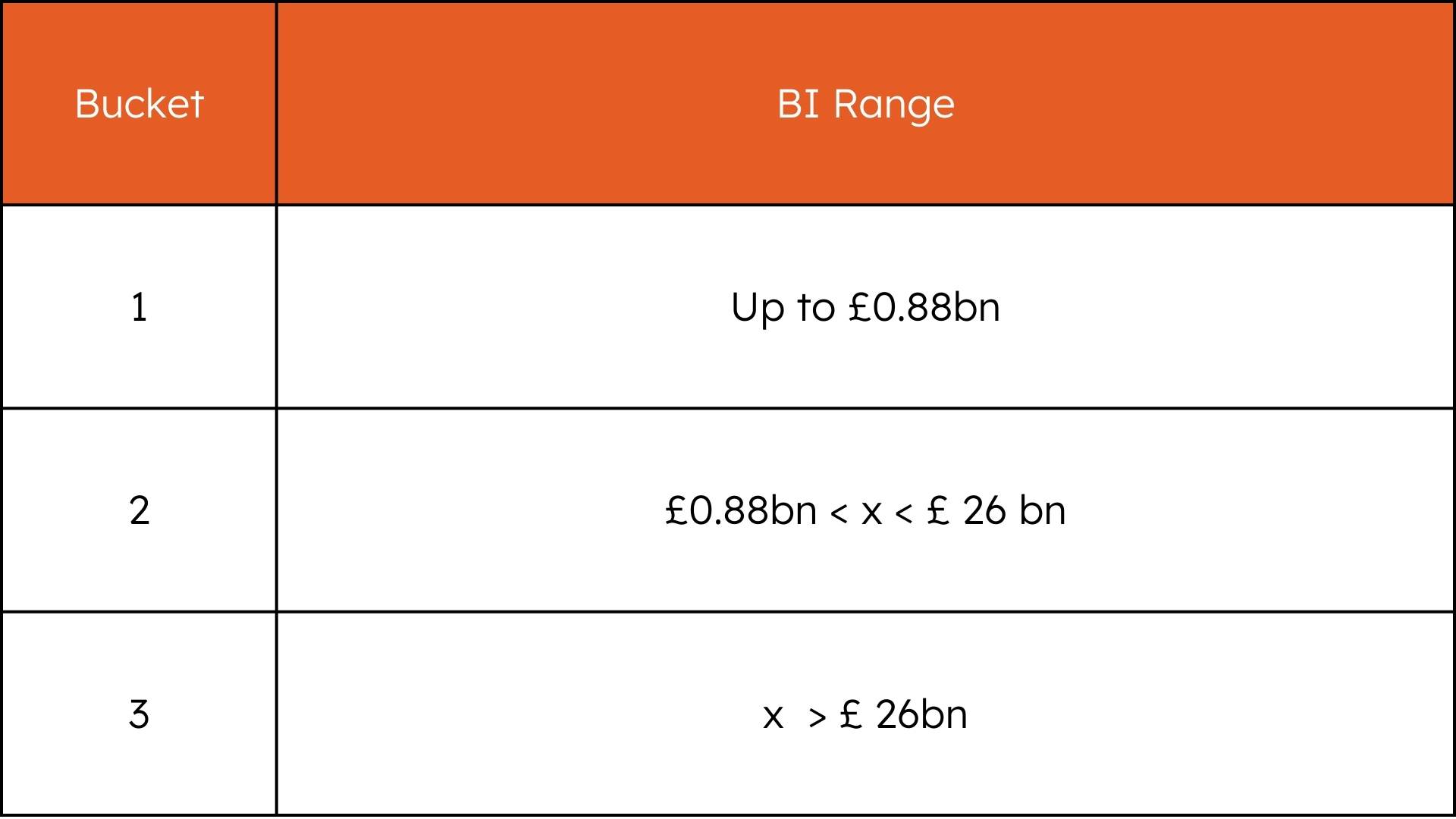

Table 1: The following table outlines the Business Indicator range and associated marginal coefficient:

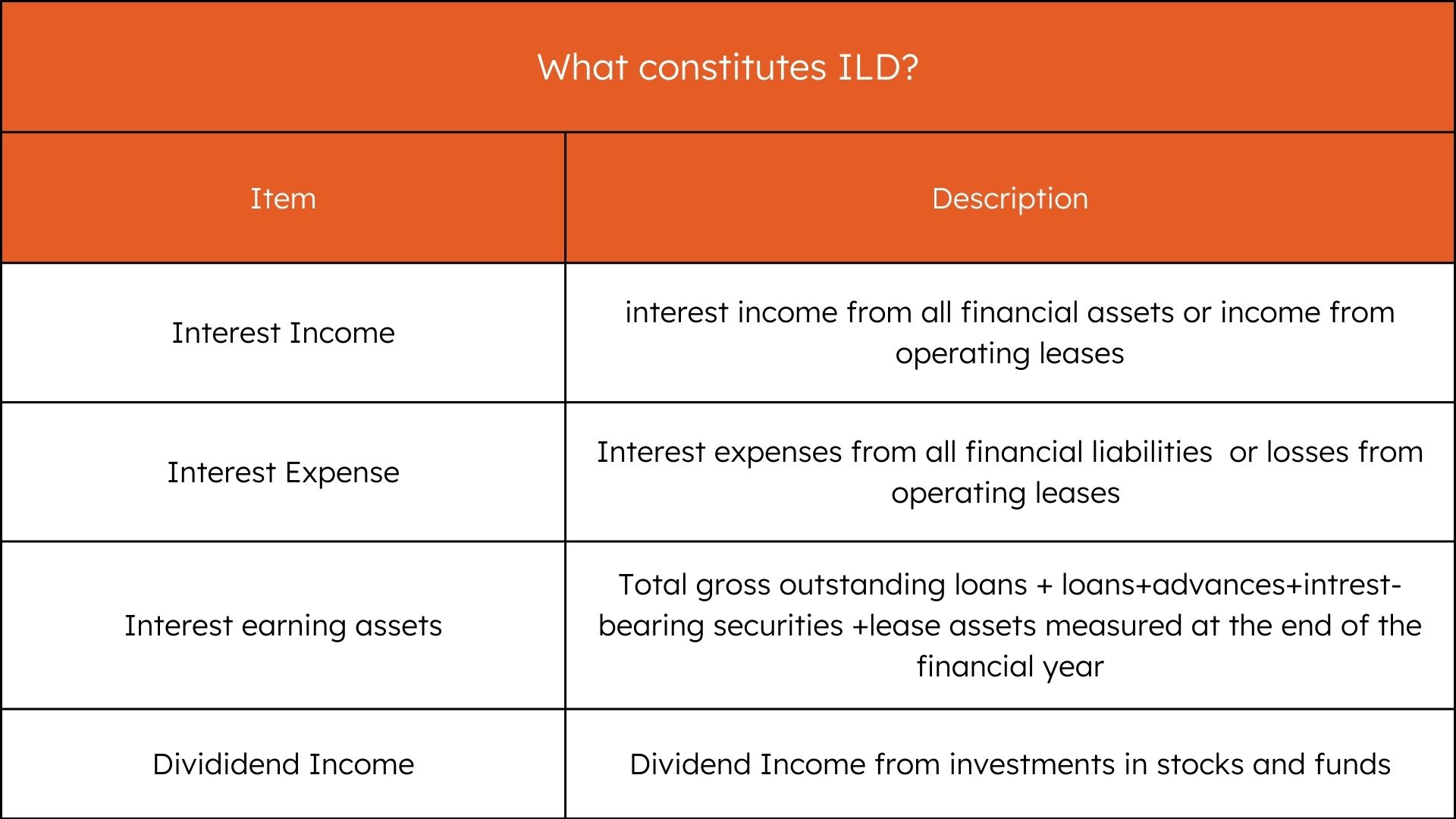

Note 1: Items to be included in the calculation of each BI element are given below:

Items to be included in ILDC:

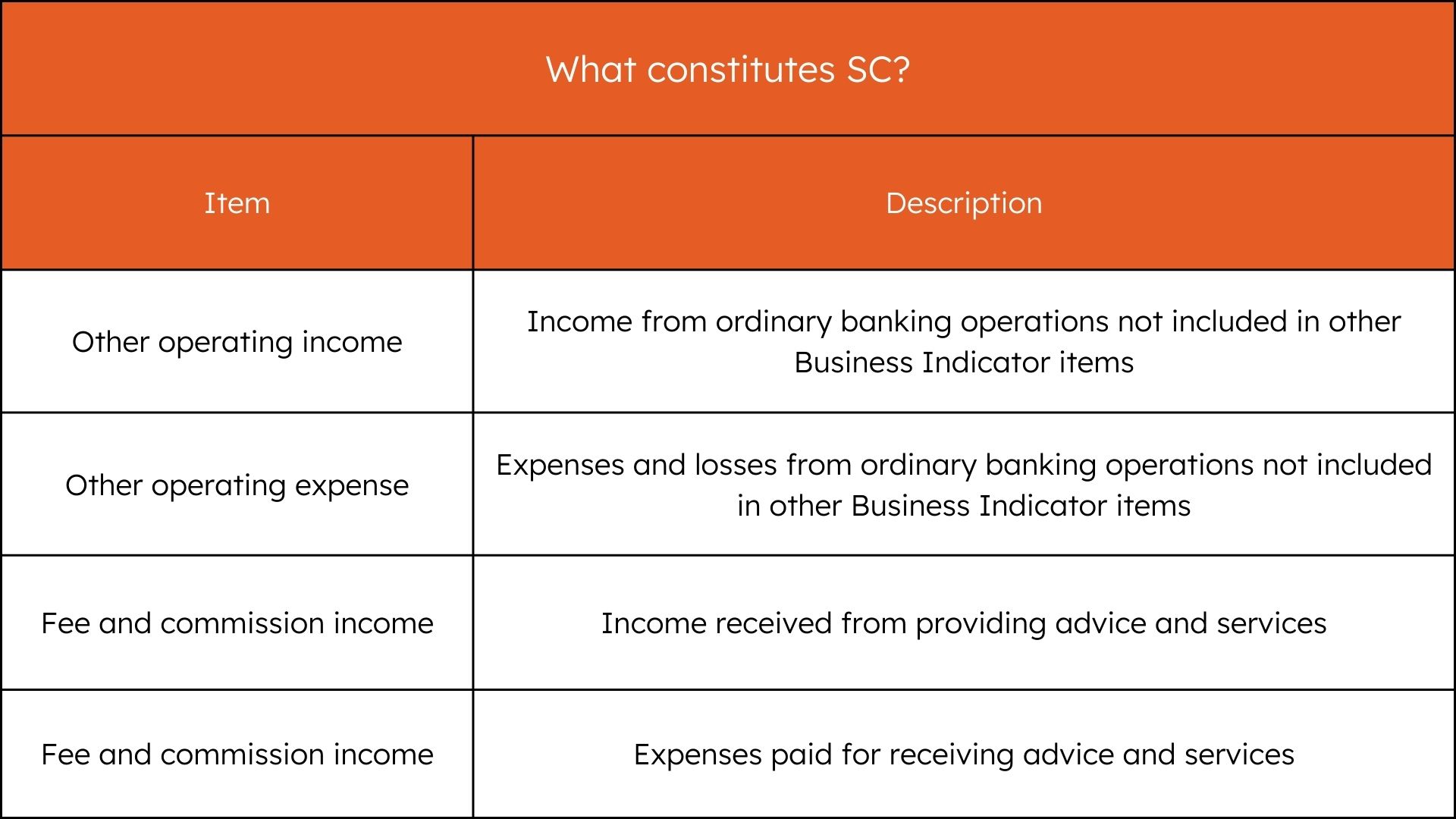

Items to be included in SC:

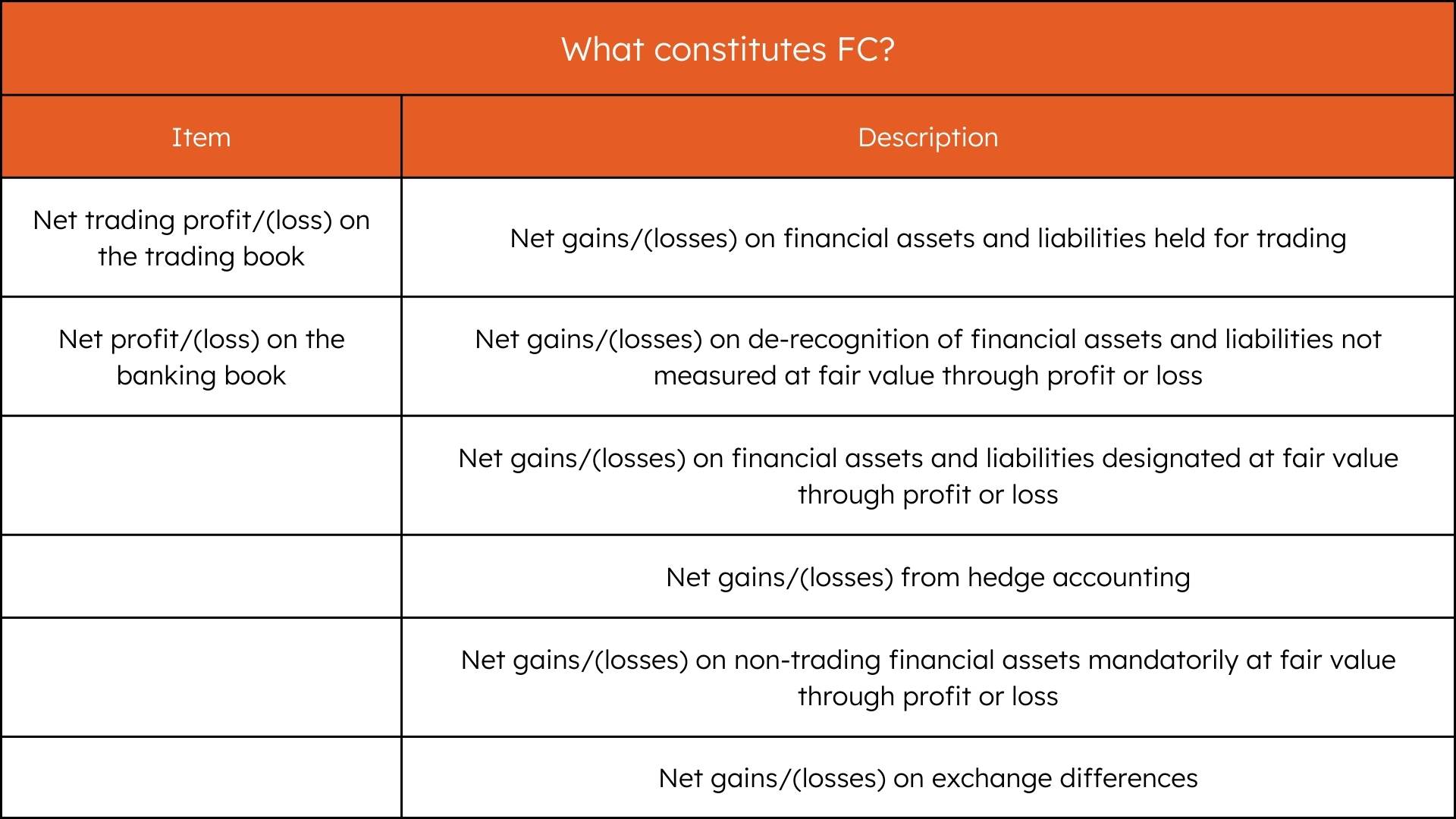

Items to be included in FC:

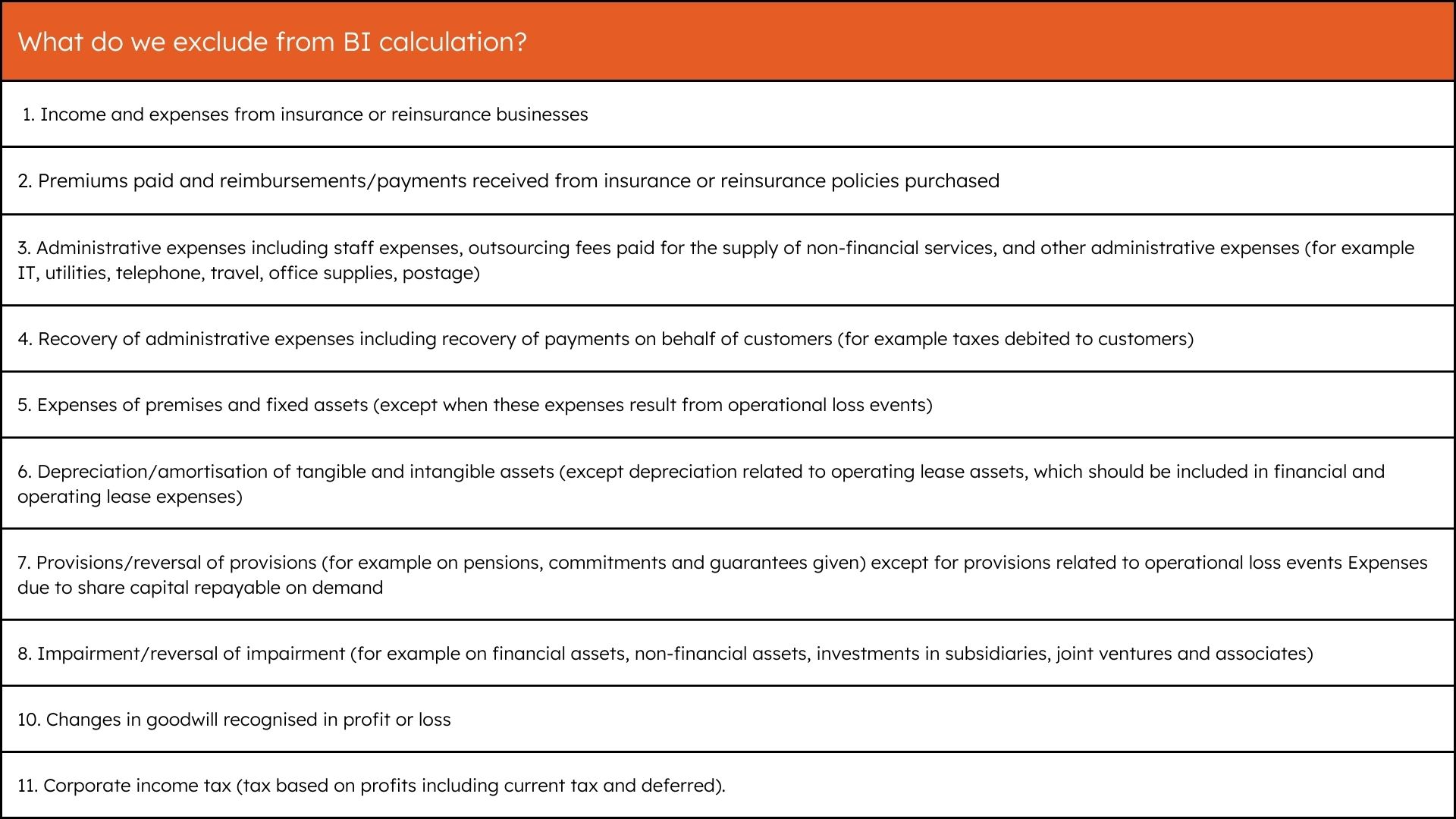

Items excluded from the BI calculation:

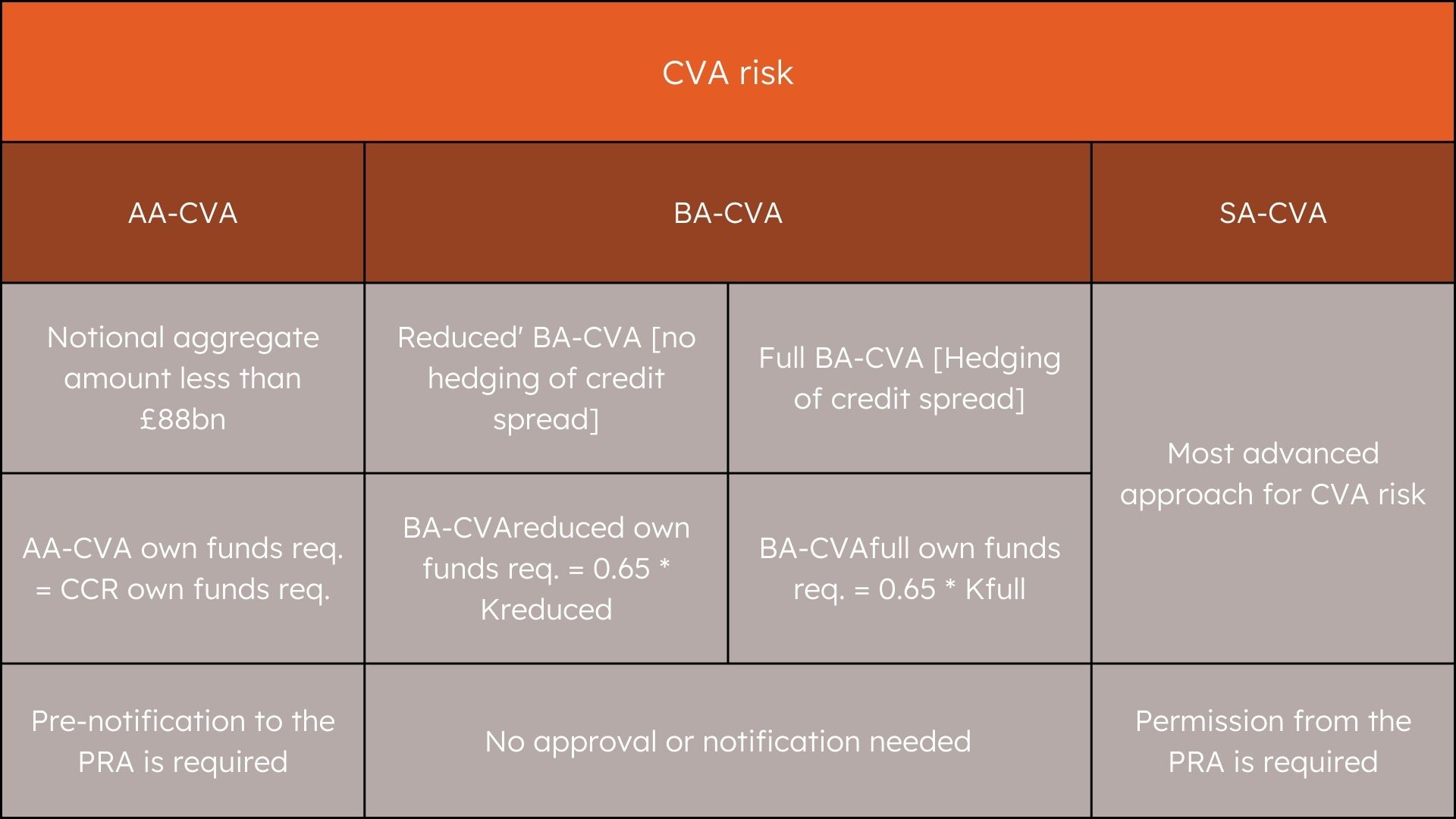

3. Credit Valuation Adjustment (CVA) and Counterparty Credit (CCR) Risk

The Prudential Regulation Authority (PRA) has announced key changes to the credit valuation adjustment (CVA) and counterparty credit risk (CCR) as part of the Basel 3.1 standards, scheduled for implementation on July 1, 2025. To update the framework for calculating CVA risk, three new methodologies have been introduced. The Alternative Approach (AA-CVA) is suitable for firms with limited non-centrally cleared derivatives exposures. The Basic Approach (BA-CVA) is available to all firms and has a ‘reduced’ version for those that do not hedge CVA risk. Lastly, the Standardised Approach (SA-CVA) requires prior permission from the PRA and an annual attestation to its continued appropriateness.

Furthermore, the PRA has expanded the scope of the CVA risk framework to include exposures to sovereigns, non-financial counterparties, and pension funds. Additionally, under the standardised approach to counterparty credit risk (SA-CCR) framework, adjustments have been made to the ‘alpha factor’ for pension funds, reducing it from 1.4 to 1. These reforms are intended to refine the risk sensitivity of the capital framework, aligning it more closely with the actual CVA risk borne by firms. The revised approach offers a spectrum of methodologies from which firms can choose, contingent on the scale of their derivatives exposures and their specific risk management strategies.

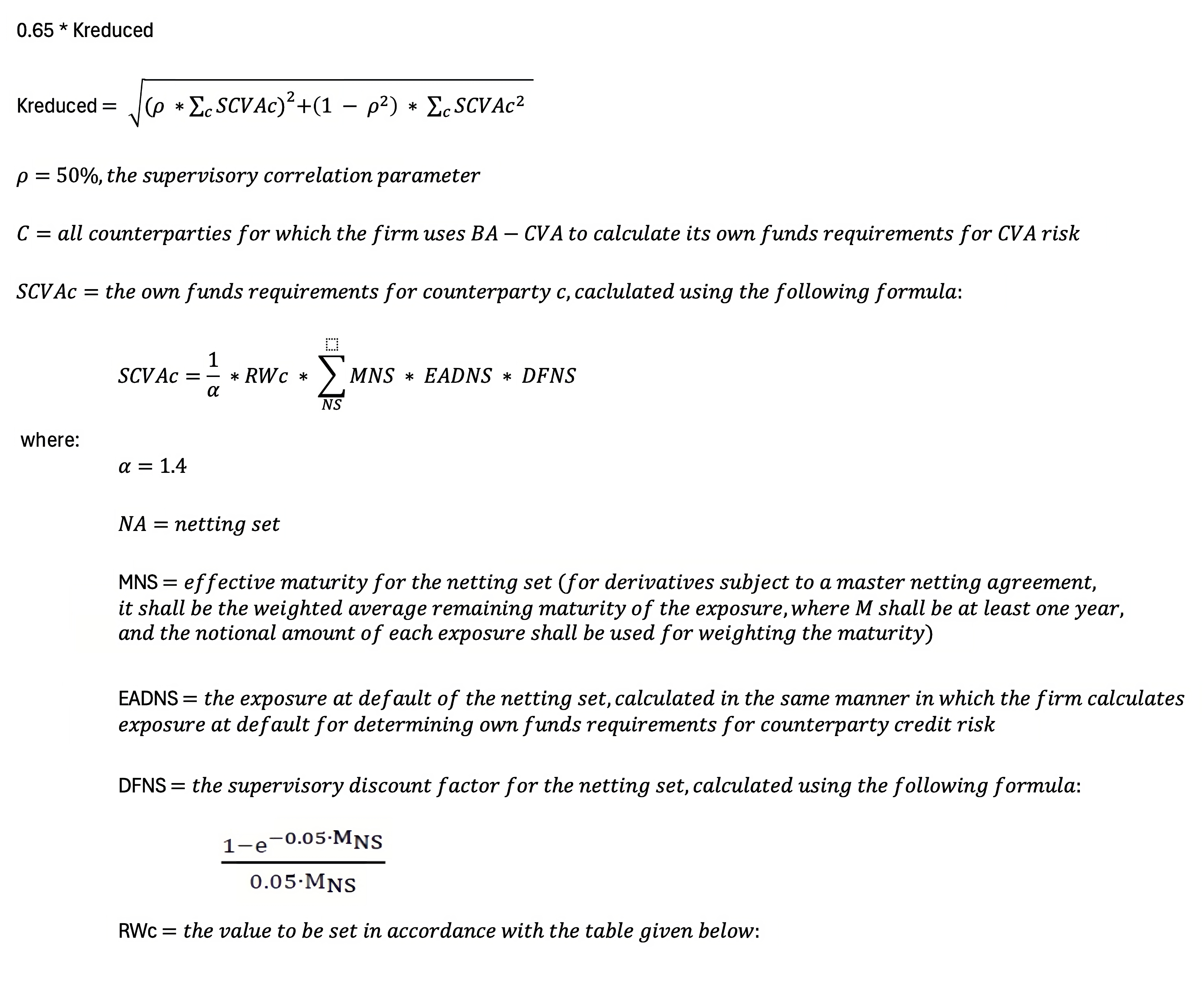

BA-CVA Reduced: A firm should calculate its own funds requirements for CVA risk under this approach using the following formula:

Own funds requirements under Ba-CVA Reduced:

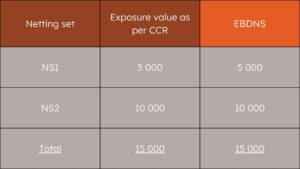

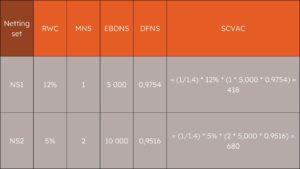

Step 1: Evaluate the Exposure at Default (EADNS). EADNS would be equal to the CCR exposure value

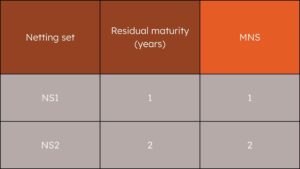

Step 2: Identify the value for the other variables

– MNS cannot be below 1, as the minimum effective maturity should be 1year

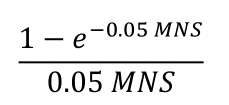

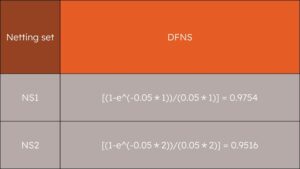

– DFNS is calculated using the following formula:

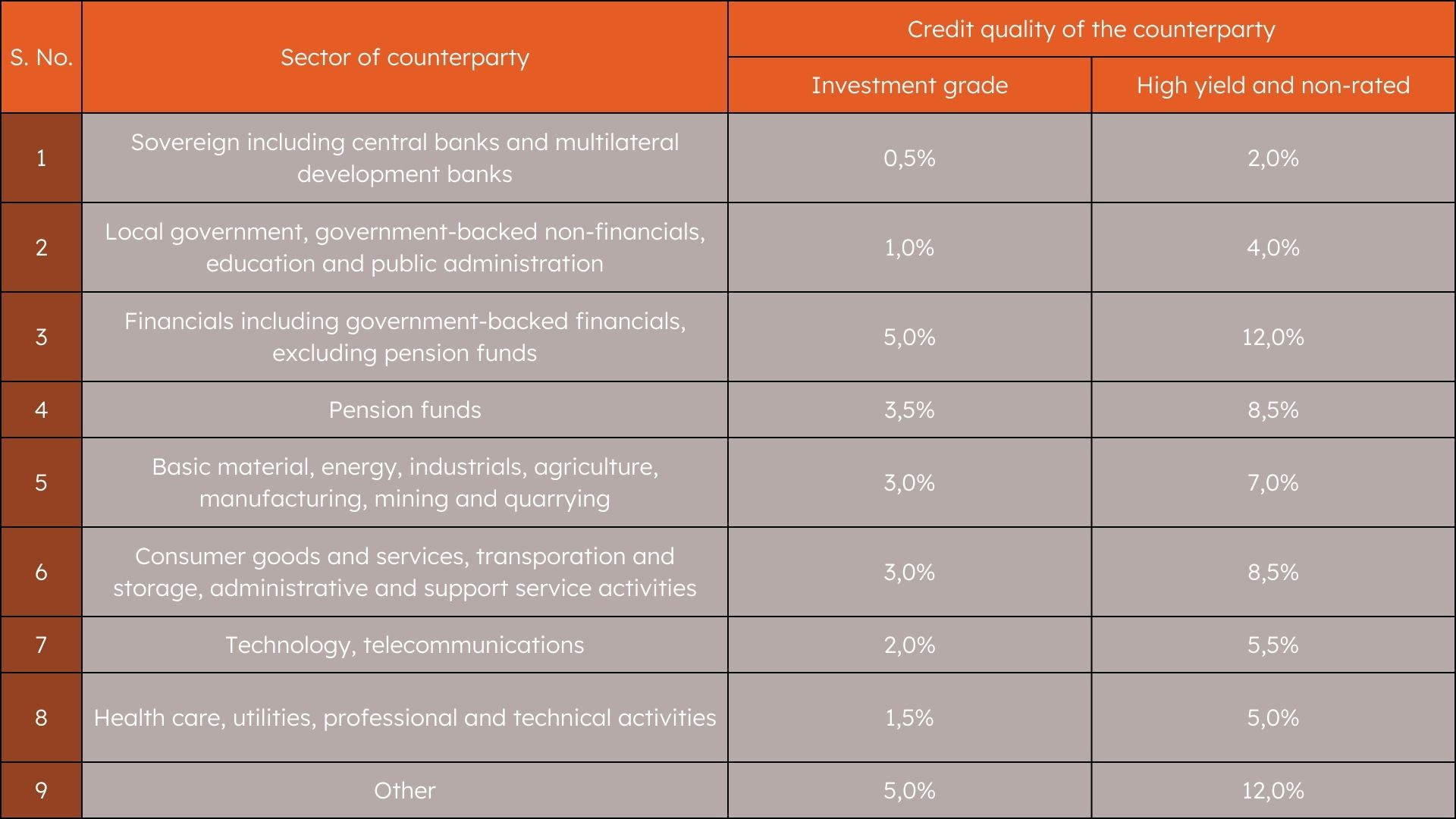

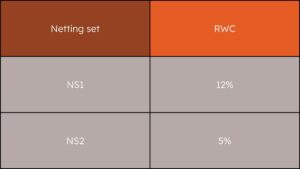

– RWC is taken from Table 1 above looking at the sector and rating of the counterparty:

Step 3: Calculation of SCVAC using the following formula:

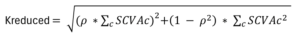

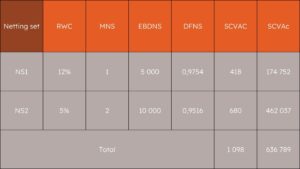

Step 4: Calculation of Kreduced using the following formula:

Step 5: Calculation of the own funds requirement using the following formula:

Own fund requirement = 0.65 * 883 = £574

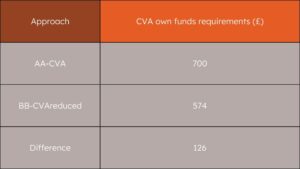

Comparison of the own fund requirement under AA-CVA and BA-CVA Reduced:

In this example, the own funds requirement under BA-CVA Reduced is around 18% lower than the own funds requirement under AA-CVA

4. Market Risk Adjustments

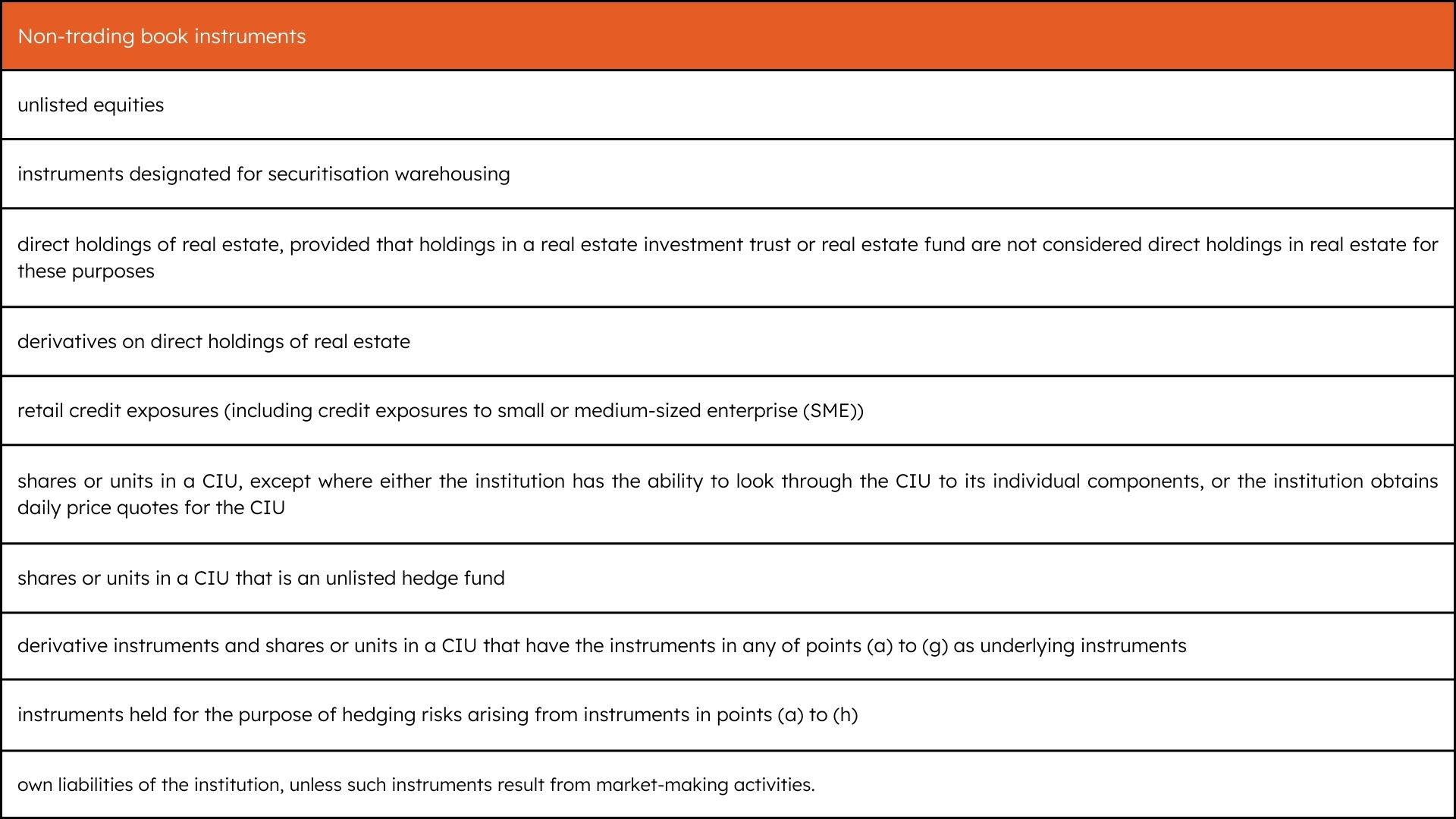

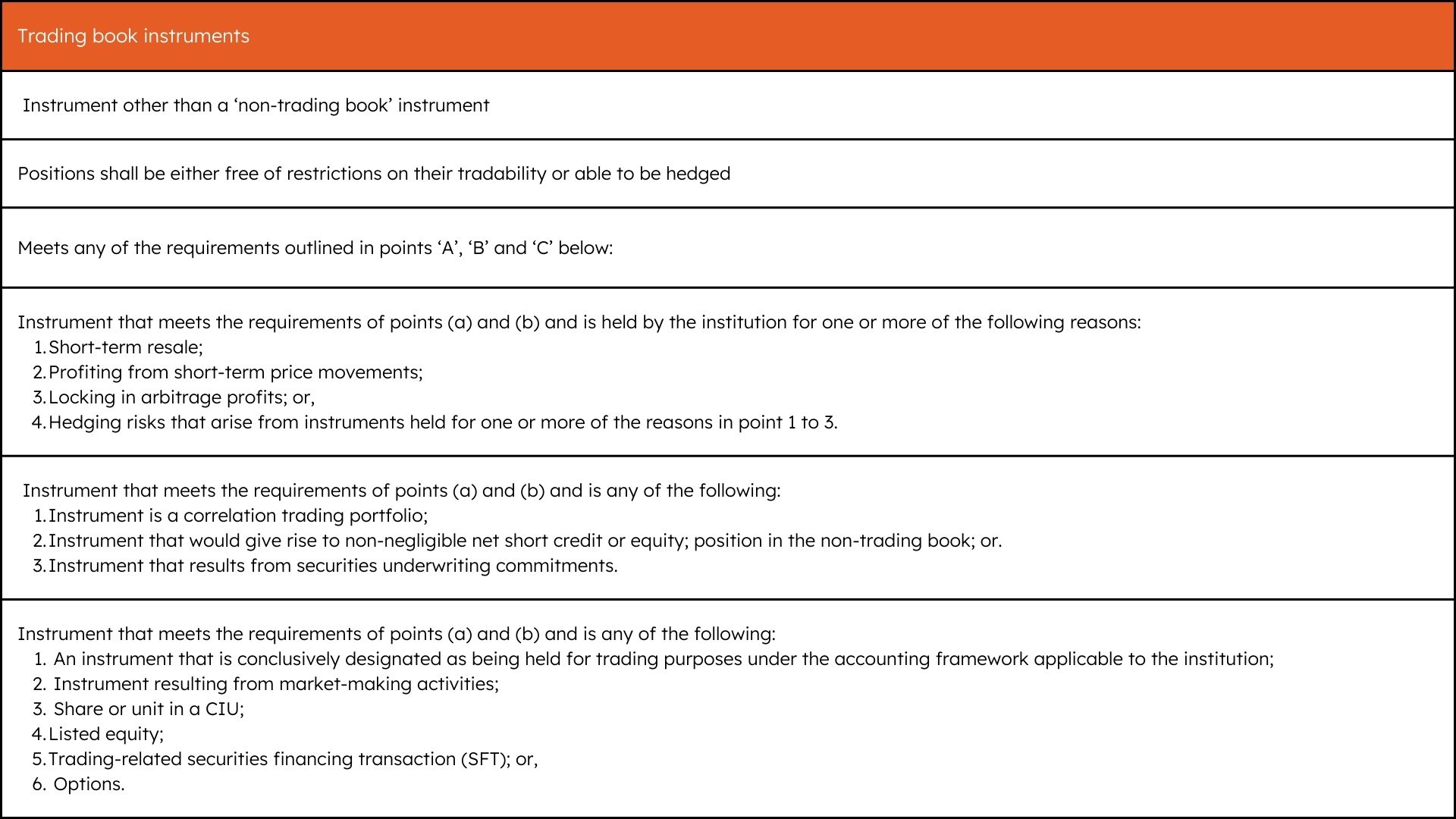

The Prudential Regulation Authority (PRA) has detailed changes to the market risk framework under the incoming Basel 3.1 standards, slated for implementation on July 1, 2025. These changes are documented in Policy Statement 17/23 (PS17/23) and focus on a more granular separation between the trading book and the non-trading book. Positions are to be classified according to a prescribed list, with the possibility of deviations subject to PRA’s permission. There are also constraints on reassigning positions between books, with firms required to hold additional capital during any reassignment period until maturity.

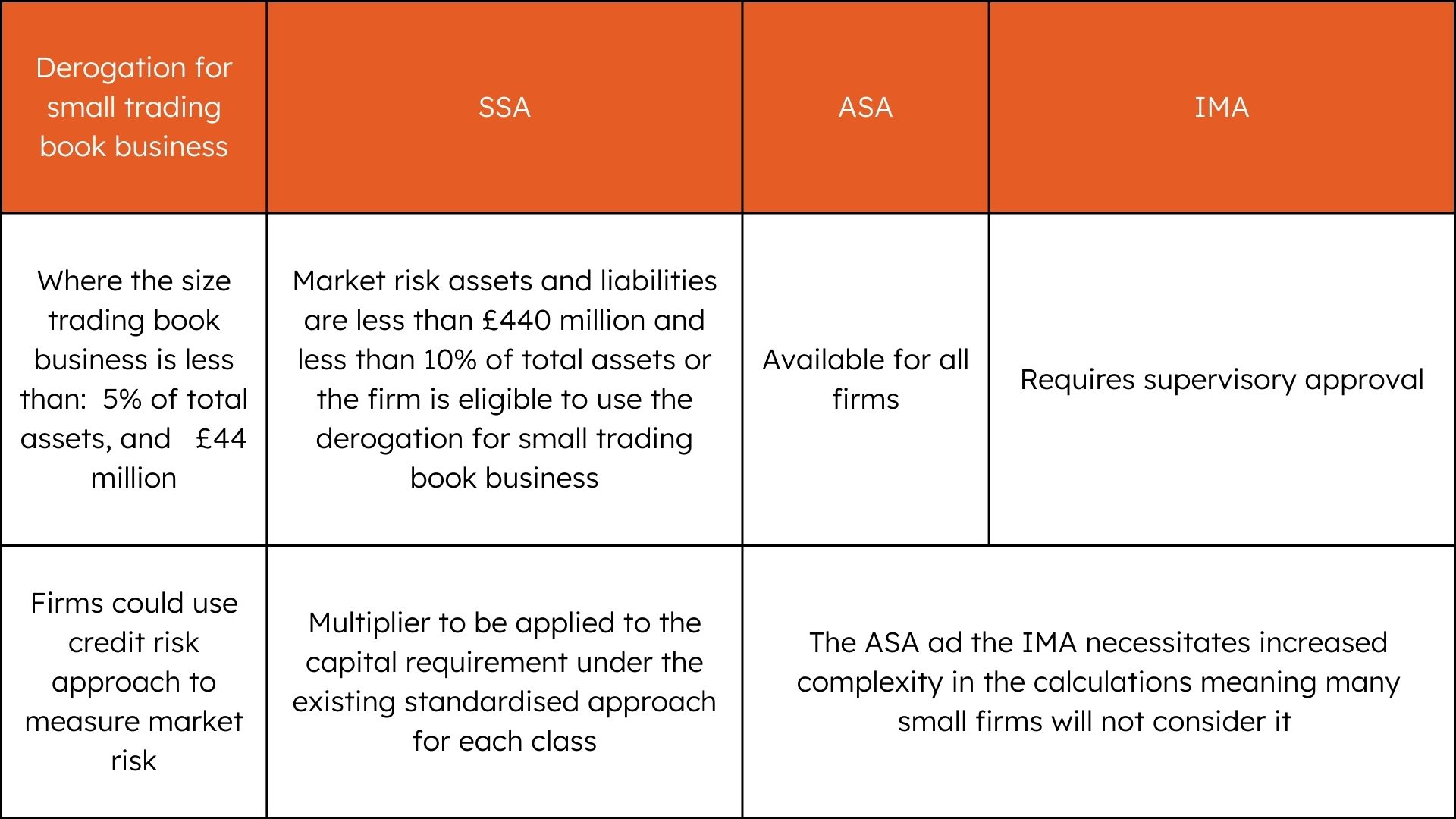

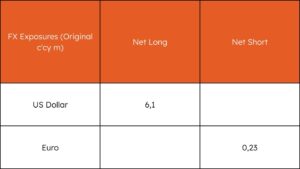

Moreover, the Standardised Approach for market risk has been recalibrated to the Simplified Standardised Approach (SSA), which is now available for firms with market risk assets and liabilities below £440 million and less than 10% of total assets. This new approach is aimed at smaller institutions that could otherwise face disproportionate regulatory burdens. An Advanced Standardised Approach (ASA) and a newly formulated Internal Model Approach (IMA) have also been introduced. The ASA is accessible to all firms, while the IMA requires supervisory approval. The PRA has made provisions to account for foreign exchange positions in market risk calculations, proposing certain positions held at historical exchange rates be excluded from Pillar 1 capital requirements but considered under Pillar 2. These adaptations serve to streamline the capital requirements calculation, ensuring a proportionate regulatory response to market risk.

Table 1: Summary of the revised approaches for market risk capital requirements is given below:

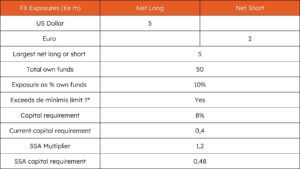

SSA Illustration:

* Do the firm’s foreign exchange and gold positions exceed 2% of its total own funds?

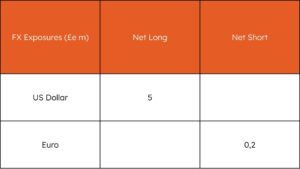

ASA Illustration:

Appendix:

A list of positions and their classifications between trading and non-trading is shown in the table below.

5. Pillar 3 Disclosure Updates

The Basel Accords, orchestrated by the Basel Committee on Banking Supervision (BCBS), have set a global standard for the prudential regulation of banks. The most recent iteration, Basel III, structured around three pillars, serves to fortify the banking sector against financial stresses. Pillar 1 defines the minimum capital requirements, setting forth clear guidelines for banks to calculate and manage credit, market, operational, and liquidity risks. Pillar 2 emphasizes a supervisory review process, mandating that banks undertake rigorous internal assessments of capital adequacy (ICAAP) and liquidity (ILAAP) to support the risks they face. Pillar 3 focuses on market discipline by enforcing comprehensive public disclosures about a bank’s capital and liquidity adequacy, as well as their risk management practices, with the goal of fostering a transparent and stable banking system.

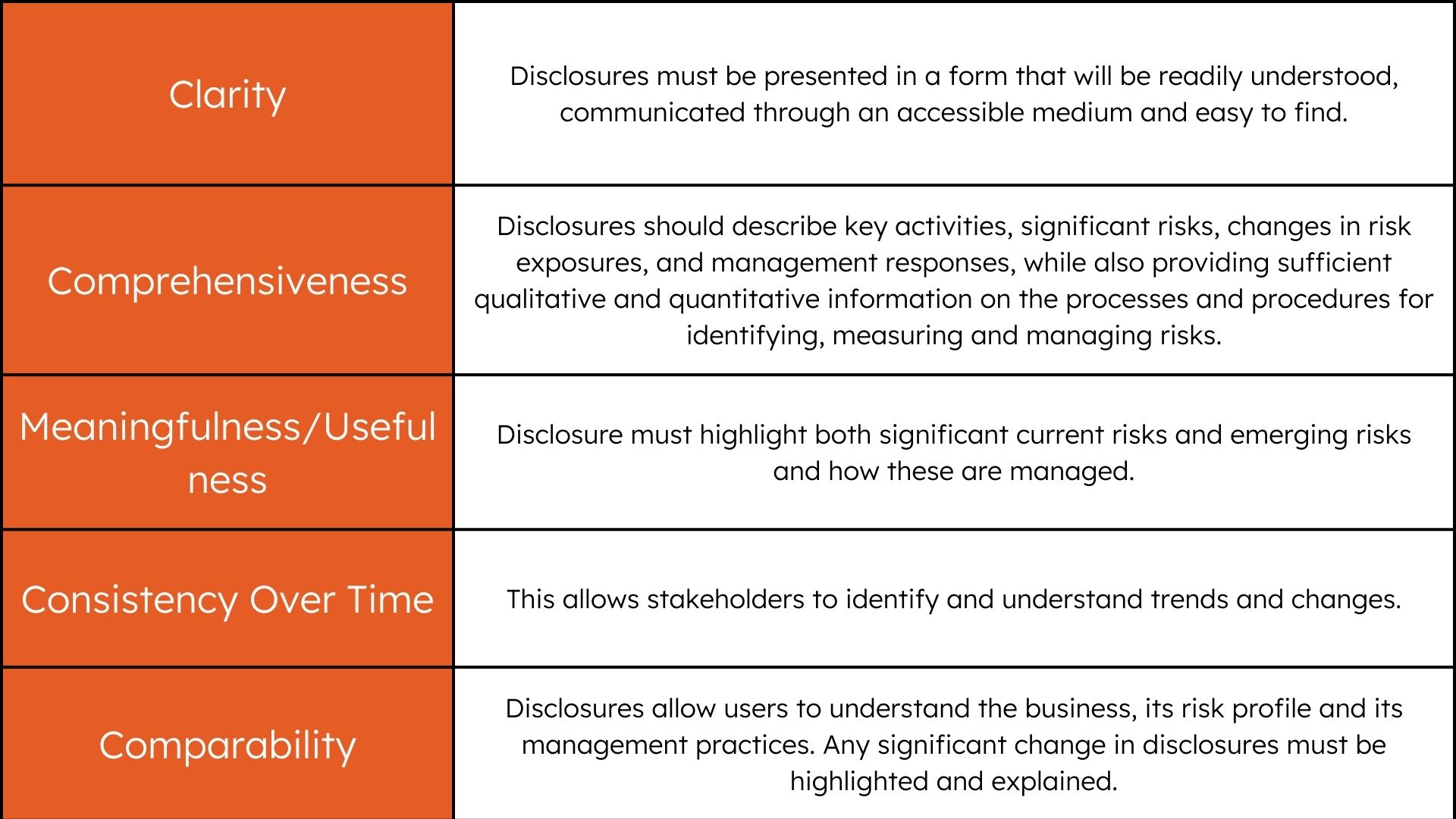

In the UK, Basel III disclosures pertain to various financial entities, including banks, building societies, and investment firms. These disclosures, standardized from January 2022, must present both qualitative and quantitative facets of a bank’s operations in an accessible electronic format. The degree of disclosure is proportionate to the size and complexity of the institution, with different reporting requirements prescribed for ‘small and non-complex’ institutions compared to larger, more complex entities. These classifications influence the frequency and detail of the required disclosures. The guiding principles of the disclosures are designed to ensure they are clear, comprehensive, consistent, and comparable across institutions and over time. The detailed framework outlines specific templates and tables for various disclosure requirements, including key metrics, risk management policies, and the scope of application, ensuring that stakeholders can accurately assess and compare the financial health and risk profile of banks.

1. The Basel Accords, established by the Basel Committee on Banking Supervision (BCBS), consist of three pillars:

These pillars are designed to ensure that financial institutions maintain enough capital on account to meet their obligations and also absorb unexpected losses.

2. Guiding principles for Pillar 3 disclosures as per the Bank for International Settlements (BIS)

Pillar 3 disclosures are underpinned by the following guiding principles:

3. Key features of the revised disclosure requirements:

4. Scope:

5. Extent of the requirement for disclosure and frequency:

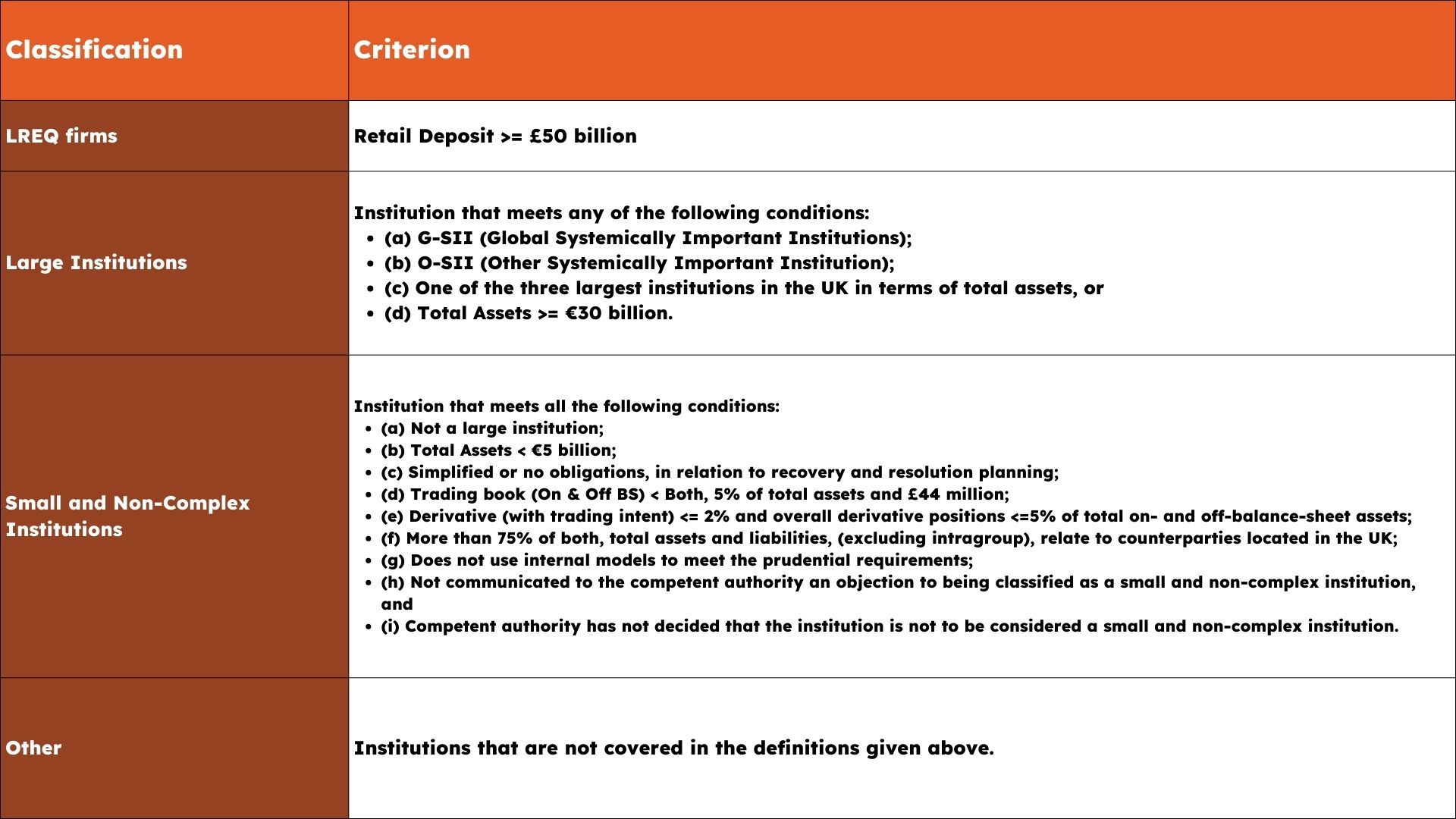

To determine the minimum disclosure requirements and their frequency, the initial step is to establish the firm’s classification, as this dictates the extent and frequency of various disclosure elements.

Due to the principle of proportionality, disclosure requirements significantly increase when transitioning from a ‘Small and Non-Complex Institution’ to an ‘LREQ firm,’ as illustrated below:

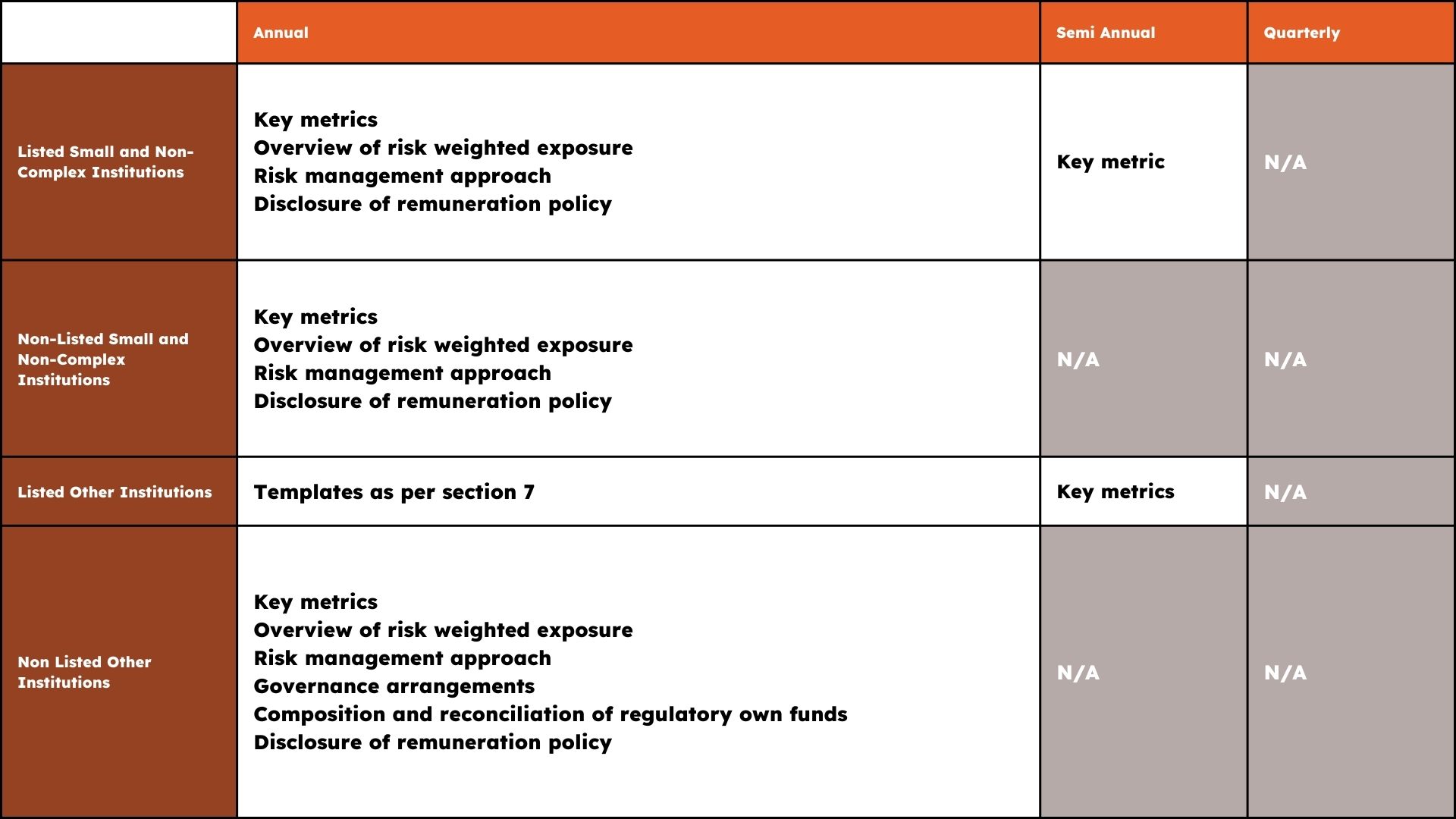

The table below illustrates how disclosure requirements vary based on the firm’s category and listing status:

Following are the possible classifications and corresponding thresholds:

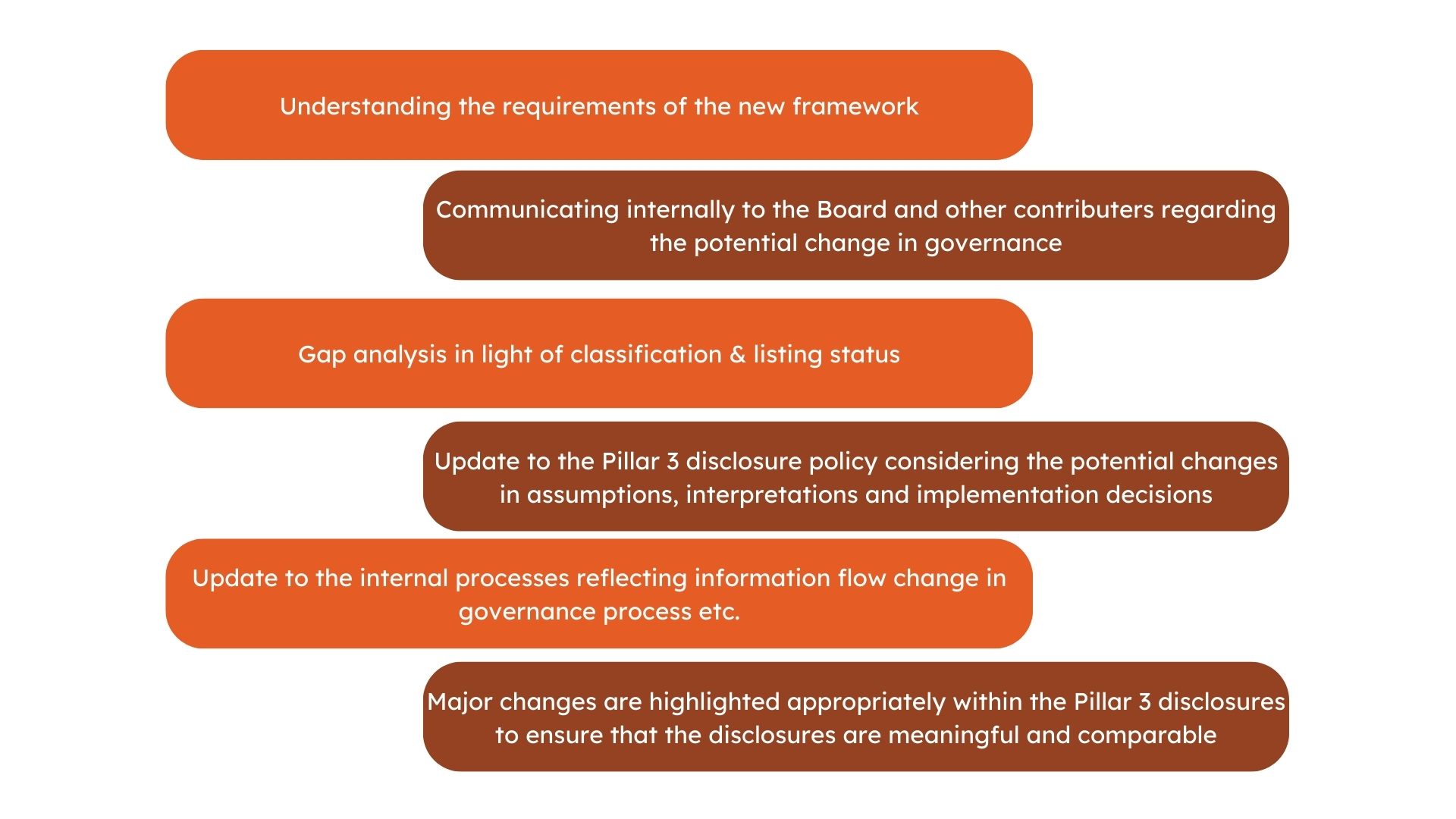

6. Key steps

Key steps to be considered while preparing and publishing the Pillar 3 disclosures as per the revised framework:

6. Reporting Enhancements

The latest revisions proposed by the Prudential Regulation Authority (PRA) under the Basel 3.1 standards, slated for implementation by July 1, 2025, emphasize enhanced clarity and precision in financial reporting. In the realm of Credit Risk, the ‘Standardised Approach’ sees key modifications; for instance, Template C02.00 has been amended to incorporate revised capital requirements for credit, CVA, market, and operational risk. Adjustments to the conversion factor from 0% to 10% for commitments and the inclusion of additional columns to compute the risk exposure amount are particularly noteworthy.

Operational Risk reporting will migrate from current models to a new Standardised Approach. Templates C16.00, C17.01, and C17.02, previously used, will be substituted with a fresh template detailed in CAP16.00, which will accommodate the updated risk capital computation and historical loss data requirements. Credit Valuation Adjustment (CVA) Risk reporting undergoes a restructure with three new methodologies replacing the extant framework, affecting template C25.00 and bringing in CAP26.01, CAP26.02, and CAP26.03 to encapsulate these changes.

Market Risk reporting is also subject to recalibration, with the existing Standardised Approach being refined to a Simplified Standardised Approach (SSA) and an Advanced Standardised Approach (ASA) being introduced. Additionally, the Internal Model Approach (IMA) supersedes the previous modelled approach. A suite of new templates from CAP24.01 to CAP25.11 will be introduced to provide a more granular reporting on market risk, capturing specific risk classes such as interest rate, equity, commodity, and foreign exchange risk.

These updates aim to improve the risk sensitivity and the robustness of the capital framework. Financial institutions must carefully review these changes and prepare their systems and processes to align with the new reporting standards, ensuring a seamless transition to the updated regulatory environment.