Banking Law Explained: Key Regulations & Legal Framework

Introduction to Banking Law: Insight into the Legal Framework and Regulations

Banking law is a branch of legislation that focuses on the control, operation, and legal context of financial entities, such as banks, credit unions, and other industry stakeholders. Banking law legislation contributes to the stability and reliability of the financial sector by asserting regulatory standards. In this way, the interests of consumers, investors, and the aggregate economy are safeguarded against fraudulent behavior. A plethora of conventions, acts, and procedures comprise the legal structure of banking law. This vocabulary, enforcing powers, rules, and other documents are kept in check by supervisory bodies, such as central banks, financial supervisory authorities, and government organizations. Several critical components of this framework include minimum capital levels, lending principles, anti-money laundering measures, and overall consumer security.

For financial stakeholders, a familiarity with banking law and its governing frameworks is essential for rule abiding and avoiding contentious situations or legal sanctions. It also establishes a groundwork for dispute resolution, risk management, and trust development in the financial sector. While in regards to consumer and industry-related parties’ interests, banking law legislation offers the necessary transparency, equality, and responsibility for monetary activities.

In conclusion, banking law is the very fabric of the financial industry that furnishes it with legislative standards and frameworks for maintaining a well-established, law-abiding, and secure ecosystem.

Key Regulations in Banking Law

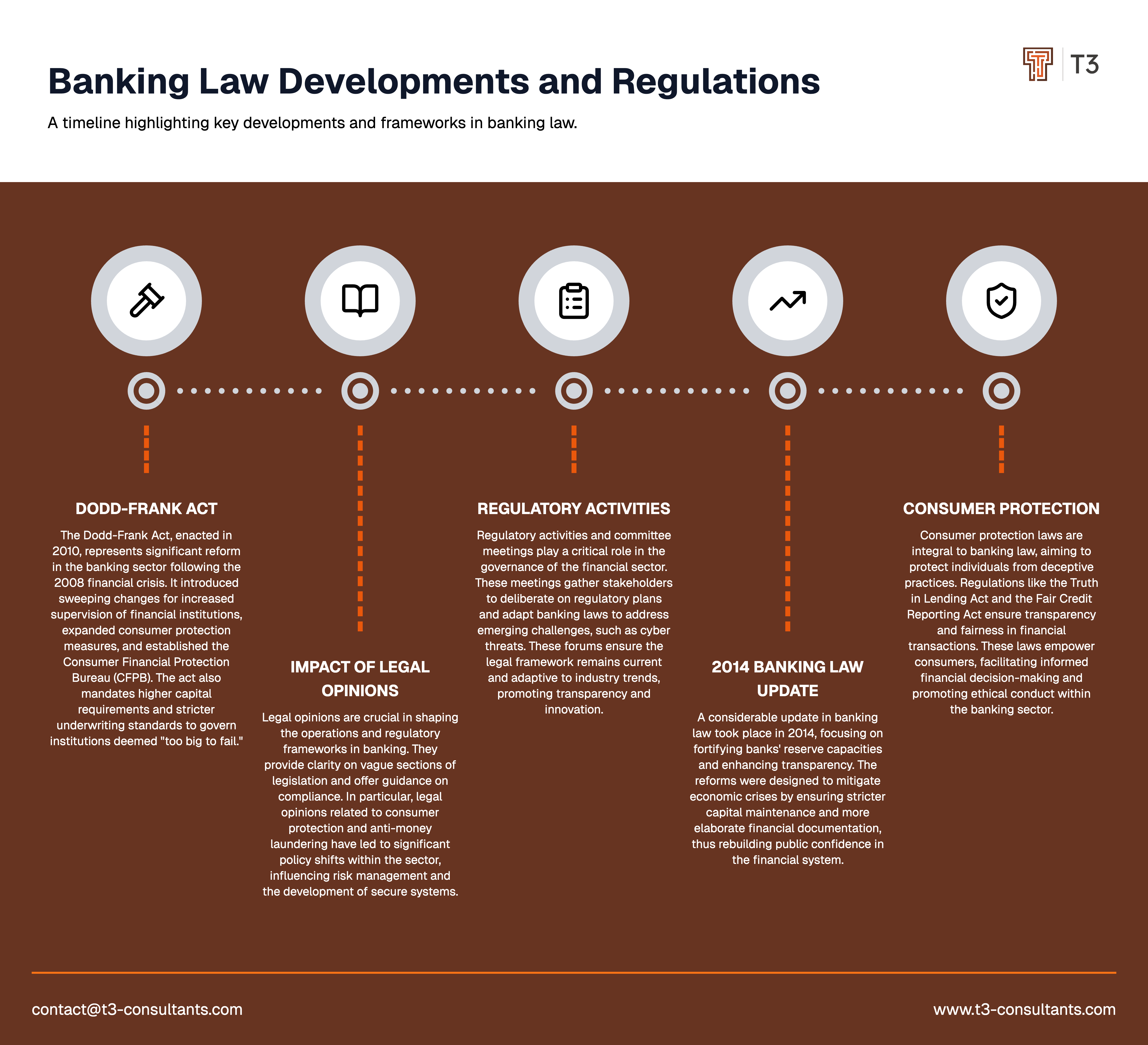

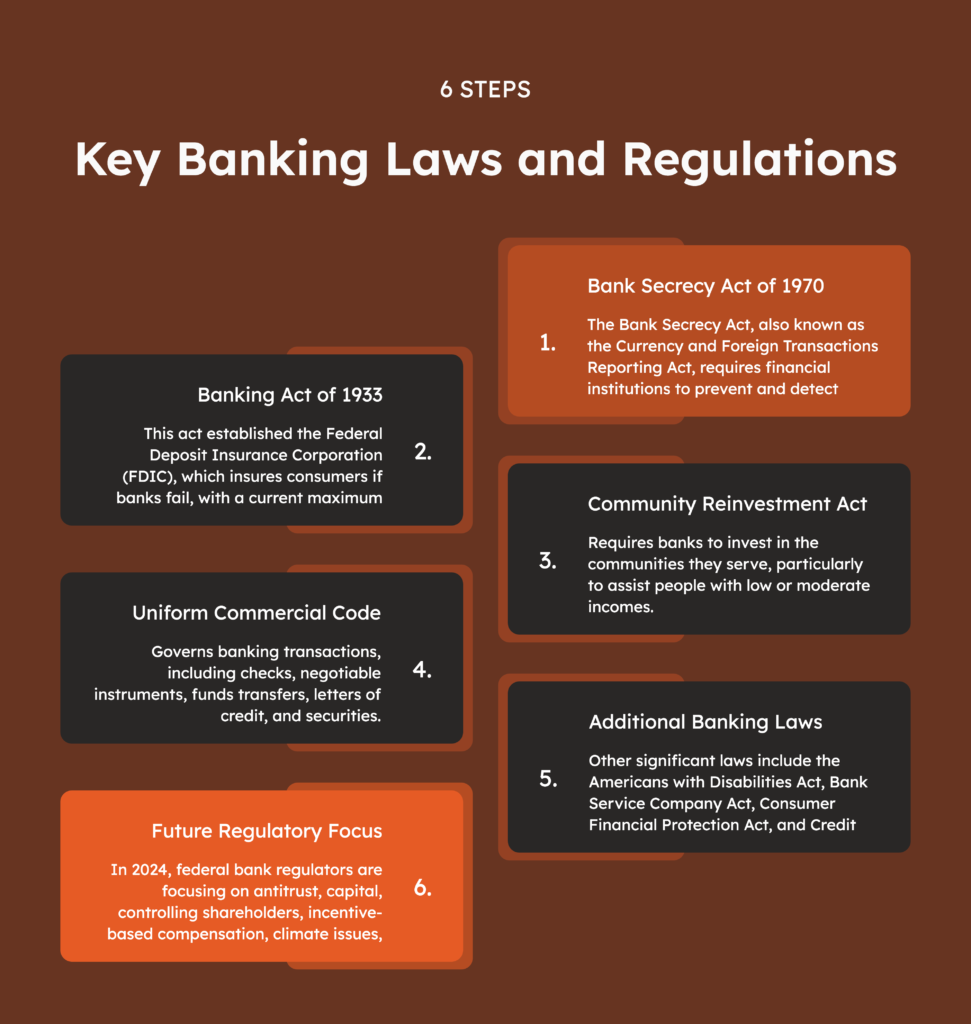

The banking industry is governed by a comprehensive set of laws that have been developed to protect the stability, interests, and regulatory compliance of financial institutions. Among the most influential pieces of legislation is the Dodd-Frank Act, enacted in 2010 as a response to the 2008 financial crisis. This act was a thorough reform that covered a spectrum of areas, namely:

- Increased supervision of financial institutions’ performance.

- Expansion of consumer protection measures.

- Establishment of the Consumer Financial Protection Bureau (CFPB).

The Dodd-Frank Act also establishes governance for risk management in dealing with financial institutions deemed “too big to fail.” It enforces intensified regulations, including:

- Higher capital requirements.

- Regular examinations to test assets and overall performance.

- Stricter underwriting standards.

In the preservation of these laws, the Federal Reserve holds a critical responsibility. Its tasks include:

- Implementation of monetary policies.

- Supervision and control of banks.

- Ensuring compliance with federal banking laws.

The Federal Reserve collaborates with other institutions, such as the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC), to create a safe regulatory environment for banks and provide technical expertise in supervising them.

Legal opinions play a significant role in shaping the banking sector. Courts and regulatory entities issue judgments that interpret obscure sections of legislation, invalidate laws, and address emerging issues within the finance sector. These opinions guide banks on how to operate and what actions to take when standards are not met.

Understanding these regulations and the roles of institutions like the Federal Reserve is crucial for anyone involved in the finance sector. Compliance ensures safety, builds trust, and facilitates growth while protecting consumer rights.

Analysis of Legal Opinions in the Banking Sector and Their Effects

Legal opinions have a significant impact on the banking sector in terms of regulatory implementation, operation, and oversight. They are formal and authoritative statements on legal matters issued by either the courts or legal professionals. Through interpretation, legal opinions result in clarification and the establishment of parameters that guide or structure operations in the banking sector.

A recent prominent legal opinion related to the doctrinal construction of undefined or vaguely defined elements in banking legislation or regulations. Various court decisions on the Dodd-Frank Act have provided clarity on consumer protection in finance and the obligations of banks with respect to preventing and punishing predatory loans. Such legal opinions are not only prescriptive in resolving disagreements or uncertainties but also formative, guiding banks on structuring and organizing operations to comply with the law and avoid violations.

Legal opinions significantly impact developments in the banking sector. They influence the creation of new rules, shape industry policy, and affect risk management practices. For example:

- Legal opinions on data protection have forced banks to invest in secure networks and data systems to protect customer privacy.

- Opinions on anti-money laundering (AML) regulations have led banks to develop comprehensive transaction monitoring systems to control financial fraud.

In conclusion, legal opinions form the building blocks of the banking industry and are critical to its transparency, accountability, and security. Their analysis helps stakeholders prepare for regulatory adjustments and ensures the system remains robust and trustworthy.

Regulatory Activities and Committee Meetings

Regulatory activities and corresponding committee meetings are vital in governing and overseeing the financial sector. These activities encompass the establishment, implementation, and execution of rules and regulations that direct the conduct of financial institutions. They are designed to guarantee that such institutions engage in their activities transparently and trustworthily.

Regulatory authorities address current challenges such as cyber threats, economic instability, and changing consumer demands in ways that promote innovation while safeguarding public rights and a competitive economic environment.

Committee meetings play an instrumental role in regulatory actions. They bring together specialists, managers, and stakeholders to:

- Address specific subjects.

- Deliberate and examine draft regulatory plans.

- Develop final banking laws.

These consultations allow divergent views to be heard, ensuring that regulatory decisions are well-rounded and support a better-regulated environment. Committee meetings also provide a public forum for citizens to stay informed and guarantee that the financial system’s legal underpinning remains up to date.

The outcomes and recommendations of these meetings directly influence regulatory actions. For example, they regulate:

- Banking entities’ borrowing practices.

- Public protections.

- Overall stability of banks.

By addressing contemporary legal problems and industry trends, committee meetings help shape a more adaptive financial system.

In conclusion, regulatory activities and committee meetings are necessary for the success of a well-structured financial system. They promote legal priorities through extensive public communication, consultation, and flexible, transparent, and economically sustainable regulatory activities.

Recent Developments in Banking Law

Recent developments in banking law primarily occurred in 2014 and the years following. These revisions focused on adapting to developments in the banking sector, ensuring transparency, and strengthening consumer protection. The most notable change introduced was the strict capital maintenance requirements for banks to fortify their reserve capacity against economic crises. This reform was based on lessons from the 2008 global financial crisis, where failed capital maintenance mechanisms contributed to widespread financial breakdown.

The 2014 update also brought about enhanced regulatory practices, requiring banks to present more elaborate financial documentation. This facilitated more efficient monitoring of the financial sector, leading to fewer incidents of misconduct and theft. Additionally, the revision included consumer protection laws, such as more disciplined compensation of fees and interest rates, empowering consumers to make informed financial decisions.

The reform was adopted for multiple reasons, including:

- The need for a more resilient banking system.

- Rebuilding public confidence in the financial sector.

- Ensuring transparency and safeguarding the country’s finances.

In summary, the 2014 changes were essential developments in the banking sector, promoting regulated and secure monitoring, consumer protection, and economic stability.

Consumer Protection in Banking Law: Defending Your Diverse Financial Concerns

Consumer protection in banking law is a protective and fundamental regulatory framework that sustains the equality, openness, and wellbeing of individuals involved in banking transactions. These provisions safeguard customers from deceitful dealings, corrupt duties, and deceptions, fostering confidence within the economic system.

One of the steps employed by banking management to ensure customer rights are secured is the approval of regulations that dictate how banking activities ought to be conducted. These measures compel banks to present all conditions and terms relevant to their facilities and products (e.g., loans, credit cards, and savings accounts) in a clear and plain language approach. This ensures that customers are well-equipped with the information needed to make informed decisions.

Prominent examples of consumer protection regulations include:

- Truth in Lending Act (TILA): Mandates lenders to disclose the provisions, conditions, fees, and rates attached to financial services.

- Fair Credit Reporting Act (FCRA): Controls the dissemination of credit information, enabling clients to safeguard their credit data.

- Consumer Financial Protection Bureau (CFPB): Establishes regulations governing speculative actions and dispute resolution processes.

These measures empower the consumer banking sector and compel banks to comply with proper ethics and codes of conduct. They facilitate a safe, reliable, and trustworthy environment where customers can make informed decisions and responsibly manage costs.

In conclusion, consumer protection in banking law is a fundamental aspect of promoting and preserving the standards needed in the banking sector.

Conclusion and Further Resources

In summary, this guide has provided essential information to assist you in summarizing key points for various purposes. Whether you wish to accomplish your objectives, optimize your strategies, or expand your comprehension of the material, this advice can help.

If you want to enhance your abilities or investigate more advanced concepts, what you’ve learned here will prove to be a valuable asset.