Machine Learning in Risk Management: Strategies & Impact

Risk management, in the contemporary fast-moving and volatile world, fosters the protection of the business and its longevity. Traditional risk management comprised of risk identification, assessment, and prioritization followed by the application of resources to minimize, monitor, and control the probability and impact of unfortunate events. Consequently, it has substantially evolved mercurially, owing to machine learning, in the way organizations have begun to view informational and operational risks.

In artificial intelligence, machine learning has started to have a profound effect on risk management by offering sophisticated tools for more precise predictions and quicker insights. The underlying machine learning algorithms could identify patterns and anomalies that may be missed by human eyes from the analysis of large quantities of data. The technology substantially aids the decision-making process to anticipate risk, and manage resources effectively. The continuous evolution of machine learning could potentially revolutionize the approach for creating resilient and effective risk management strategies, leading to smarter and more agile responses at the organizational front.

Exploring Machine Learning within Risk Management

Machine learning, one subset of artificial intelligence, is reshaping traditional sectors, including risk management. At its core, machine learning consists of creating computer systems capable of self-learning and decision-making using data patterns. These systems, which incorporate data-driven iterative algorithms that enable autonomous evolution and improvement in decision-making over time, represent a departure from conventional programming in which a predesigned set of rules governs each procedure, providing a more manageable approach to solving intricate problems.

In risk management, machine learning represents a possible game-changer in the capacity for effective risk prediction and mitigation. Existing risk management methodologies frequently depend on historical information and static models, which may fail to capture the dynamism of today’s financial markets and business environments. The introduction of learning machines to risk management can empower organizations to rapidly process enormous quantities of data and identify patterns that may reveal potential risks. For instance, algorithms can analyze ongoing financial transactions in real time to identify irregularities indicative of fraud, thereby allowing for immediate action to be taken.

Machine learning in risk management also simplifies the construction of forecast models for identifying future risks through a combination of both historical and real-time records. These models can be particularly invaluable in highly volatile settings by suggesting potential outcomes and their associated impacts on an organization’s operations. This forward-looking mindset can inspire firms to develop courses of action to stave off potential hazards before they come to pass.

However, effectively weaving machine learning technologies into risk management protocols requires a coordinated plan of action. Such an initiative should include dedicating resources to infrastructure capable of capturing, storing, and handling data. Organizations additionally must commit to training stakeholders to handle and interpret machine learning results. By doing so, companies stand to adopt a more dynamic and preemptive approach to managing risk, protecting their operations, and reinforcing resilience in a world of growing ambiguity.

Strategies to Employ Machine Learning

Implementing machine learning (ML) effectively relies on a working combination of strategies and understanding various techniques and frameworks. In the fast-evolving landscape of risk management, machine learning techniques open up entirely new avenues of insight and predictive capabilities not offered by traditional methods.

Understanding Machine Learning Techniques

It is important to start with the suite of learning techniques available for risk management. The three main categories are supervised learning, unsupervised learning, and reinforcement learning.

- Supervised Learning: Provides a model for identifying potential risk patterns in historical data, due to the training in labeled datasets.

- Unsupervised Learning: Uncovers hidden patterns in data without the need for pre-existing labels, ideal for identifying new risk factors.

- Reinforcement Learning: Makes sequences of decisions through interaction with an environment, a technique that can be particularly useful for dynamic risk assessment scenarios.

Frameworks

Choosing the right framework is key to successful implementation. In machine learning, two commonly used frameworks are TensorFlow and PyTorch:

- TensorFlow: An appropriate choice for large-scale machine-learning model construction and is suitable for the rigorous implementation of supervised and unsupervised learning algorithms involved in risk assessment processes.

- PyTorch: Used where projects require fast prototyping and dynamic computation, providing tools needed to assess rapidly changing risks.

Strategies for Effective Implementation

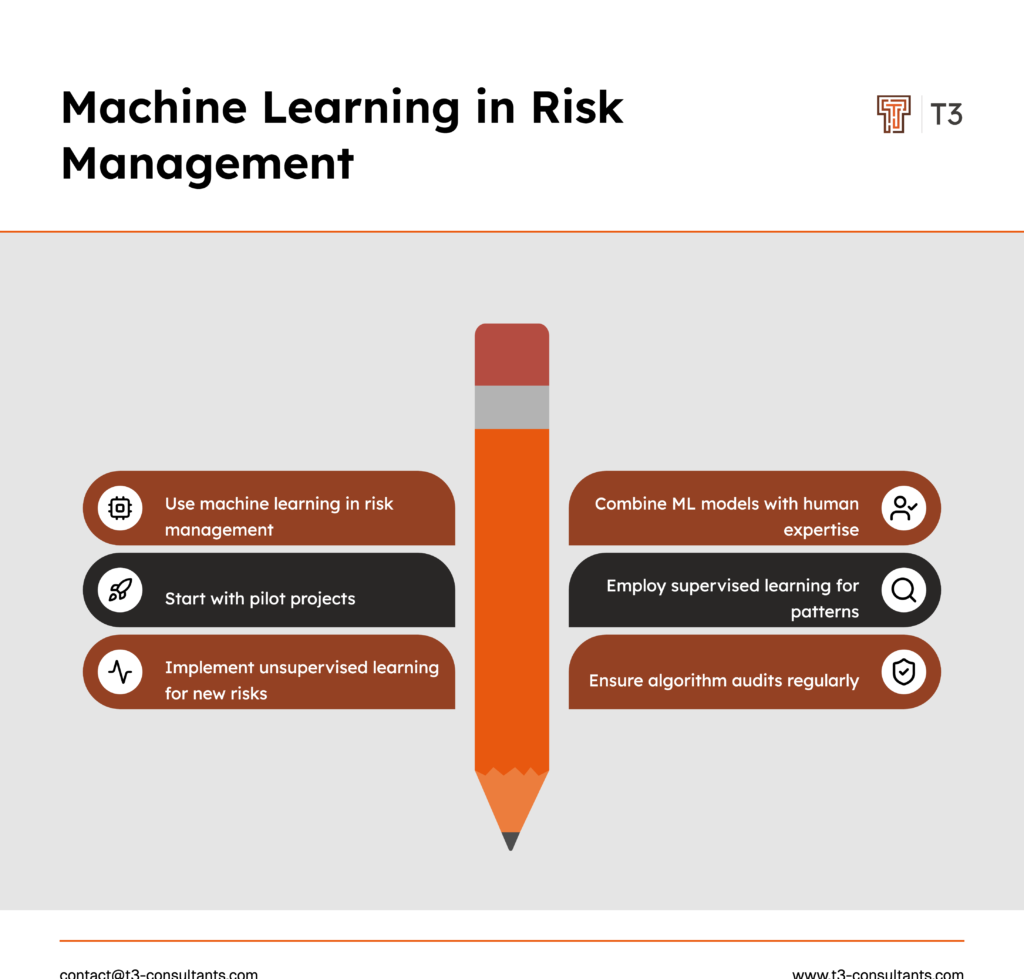

Businesses have employed a range of strategies to effectively integrate machine learning into their risk management processes:

- Pilot Projects: One strategy is to start with a pilot project to test machine learning models under controlled conditions, allowing an organization to gauge how effective the applied ML techniques are and adjust their strategy without exposing the company to unnecessary risks.

- Combination with Human Expertise: Another approach is to utilize machine learning models to support, rather than replace, traditional risk management techniques. Automated alerts for abnormal patterns give human analysts valuable support in focusing on the most important areas.

A textbook example is illustrated in financial institutions. One big bank, for example, applied machine learning to enhance credit risk assessment. By integrating machine learning algorithms, which comb through historical data, the bank found new risk determinants in an expedited process that allowed rapid credit approval and reduced default rates.

In summary, the success of embedding machine learning in risk management relies on picking the right techniques and frameworks and on the strategic application of the full power of machine learning tools.

Practical Applications of Machine Learning in Financial Risk Management

Machine learning techniques have revolutionized the field of financial risk management, offering advanced solutions to the prediction and control of credit risks. By exploring specific use cases, we can see how the industry significantly benefits from these solutions, which allow for improved decision-making processes and increased financial stability.

Credit Risk Evaluation

- Data Analysis: Important applications of machine learning algorithms in large banks and financial institutions are used to evaluate credit risk by means of the collection and analysis of huge amounts of data, such as customer transaction history, demographics, and market trends. This enables more accurate detection of the probability of default.

- Credit Scoring Models: The use of machine learning in credit scoring models has increased the capacity for the identification of high-risk customers while reducing the number of false positives.

Analysis of successful case studies from sources like Google Scholar validates this application. An investigation showed that a financial corporation decreased its loan defaults by 30% using machine learning for risk assessment. Consequently, the company managed not only to protect itself from numerous asset write-offs but also to optimize its portfolio management, guaranteeing good financial health.

Compliance with Regulatory Standards

The inclusion of machine learning in risk management systems provides companies with compliance with regulatory standards. Such compliance is fundamental to prevent fines and to ensure ethical operations. Automated data analysis techniques constantly monitor regulation breach risk factors and produce detailed reports to ensure ethical and transparent operations.

Challenges and Algorithmic Risks

As algorithmic decision-making is increasingly adopted, driven by advances in technology, it is essential to acknowledge the challenges and algorithmic risks present.

Algorithmic Bias and Errors

- Bias: Biases in algorithms, often a result of the input data and the variables included, have the potential to cause unfair decisions that could negatively affect specific groups or individuals.

- Errors: Algorithmic risks relate to potential mistakes in algorithms, which can be severe in high-stakes sectors like healthcare or finance. An absence of transparency about how decisions are made constitutes a significant risk.

Mitigation Measures

Organizations can take several measures to address such risks:

– Thorough Testing and Validation: Using various data sets can reduce biases and errors.

– Explainability Features: Increase transparency and understanding among stakeholders regarding decision-making processes.

– Audits and Human Oversight: Regular audits ensure algorithms operate as expected in line with ethical decision-making.

Keeping Up-to-Date on the Latest Innovations

It is important for professionals and enthusiasts alike to keep up-to-date on the most recent innovations in any field. The rapid evolution of industries with fresh methodologies and technologies leads to competitive advantage.

Sources for the Latest Innovations

- Bulletins and Academic Papers: Online surveys and publications report on the newest research and results. Services such as Google Scholar provide a comprehensive collection of academic and scholarly papers, accounting for innovative research and theoretical advances in various industry areas.

- News Articles: Current articles provided by serious publishers summarize industry results and trends in simpler terms for broader audiences.

- Industrial Bulletins and Journals: These focus on recent findings, providing periodic updates to keep you informed of critical innovations.

Engaging with these sources will enhance understanding and adaptability to change, contributing to growth in professionalism and field knowledge.

Conclusion

The effect of machine learning on risk management is highly disruptive. By leveraging sophisticated algorithms, firms can better predict and prevent risks. Rapidly analyzing massive datasets, machine learning improves decision-making by providing greater intelligence on potential risks. With ongoing sophisticated risks to address, it is imperative that businesses include machine learning in their future risk planning. The adoption of this emerging technology is not only a source of competitive differentiation, but also of strength and future resiliency within a fast-changing environment. Machine learning allows organizations to strengthen their risk management processes to protect assets while capitalizing on opportunities.