Master ICAAP Guidelines: Enhance Financial Strategies

Introduction to ICAAP

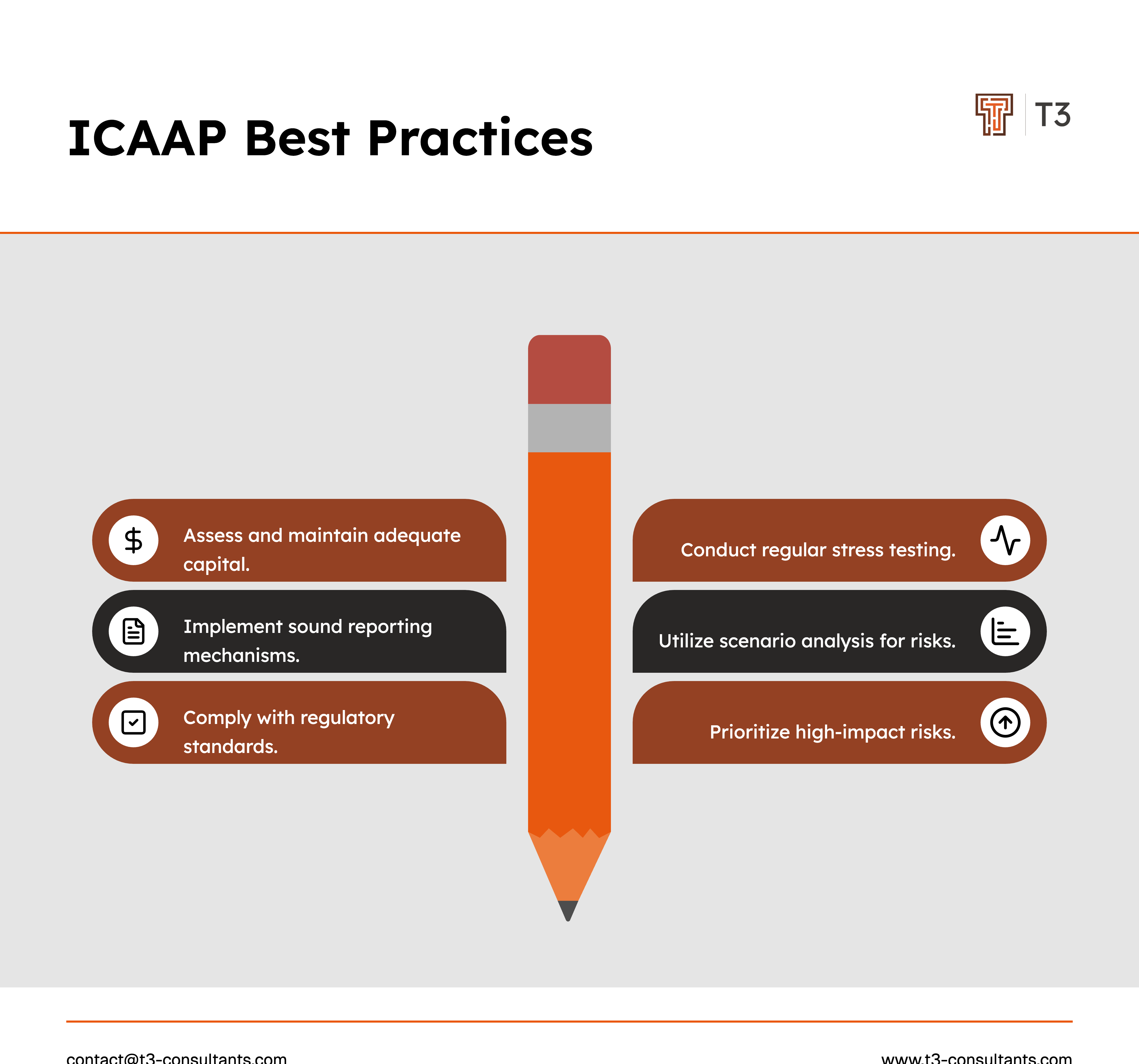

The Internal Capital Adequacy Assessment Process (“ICAAP”) remains a critical component in maintaining sound capital management of a financial institution in today’s ever-evolving financial institutions landscape. It is actively used as a strategic framework by institutions to assess and maintain adequate capital covering all risks linked to the institutions, thereby protecting its ongoing health and stability.

In essence, the fundamental objective of ICAAP is to enable financial institutions to evaluate their present and future risk profile comprehensively and ensure that their capital reserves are sufficient to minimize all possible losses. This is fundamental in maintaining credibility and trust within financial markets. The significance of capital adequacy should not be underestimated, as it forms the basis for a financial institution’s financial health and robustness by providing a cushion against adverse movements arising from volatile financial conditions and unexpected economic crises. Through in-depth analysis of risk elements, ICAAP helps financial institutions match risk with capital in place to effectively handle and manage financial strains and reflect on growth potentials.

Overview of ICAAP Procedures

The Internal Capital Adequacy Assessment Process (ICAAP) is the primary mechanism by which banks and financial institutions confirm they hold sufficient capital to cover the risks to which they are exposed. A detailed understanding of ICAAP procedures is necessary to comply with regulatory requirements and improve risk management practices.

Main Procedures

- Risk Assessment: Institutions identify and assess all risks, such as credit, market, operational, etc., that may affect their capital adequacy. This assessment allows institutions to accurately measure their total risk.

- Capital Planning: This step determines the quantity of internal capital necessary to mitigate these risks over a strategic horizon.

- Stress Testing: Allows the assessment of the potential impact on a bank’s financial situation under severe economic scenarios, thus checking the solidity of the institutions’ capital.

- Internal Controls and Governance Review: Ensures that procedures for risk follow-up and decision-making are robust and align with the entity’s risk appetite.

The ICAAP report must be updated and reviewed by senior management and boards regularly, adapting to the evolution of market conditions.

Impact of Regulatory Standards

Regulatory standards are fundamental for defining ICAAP’s development path. Standards such as the Basel III Accord provide banks with minimum capital requirements and stress testing recommendations to foster stability and the confidence of markets. They impact how financial institutions establish their ICAAPs, reinforcing the need for capital buffers and strong risk management systems. Complying with these standards not only limits regulatory risks but reinforces the entity’s credibility with its stakeholders.

In summary, knowledge of ICAAP procedures is essential for any financial institution wishing to make its way through a complex regulatory environment while confirming the quality of their risk management practices. Proper implementation can help entities protect themselves from potential financial shocks and secure their operational continuity.

The Importance of Stress Testing in the Risk Management Process

Stress testing plays a key role in the financial sector by determining financial institutions’ ability to withstand adverse situations. The stress tests assess the resilience of banks, insurers, or other financial institutions to financial crises and economic shocks, focusing on their risk management capabilities. Stress testing uses different techniques to analyze an organization’s readiness and vulnerabilities.

Techniques

- Scenario Analysis: Simulate fictitious adverse situations (e.g., economic recession or high-interest rates) to consider the impact on the entity’s financial situation.

- Sensitivity Analysis: Evaluates the effects on the financial situation for specific risks, such as changes in market prices or credit losses.

Risk assessment is core to the stress testing process. Identifying where an organization may be weak helps companies find the areas of most exposure to financial stresses.

In short, stress testing and risk assessment are critical tools for financial stability. If financial organizations can identify potential risks and analyze them under different stress test programs, they can strengthen themselves against unforeseen financial turbulences.

Significance of Scenario Analyses and Sound Reporting Mechanisms in ICAAP

Scenario analyses form the foundation of the Internal Capital Adequacy Assessment Process (ICAAP) by allowing management to assess potential financial risks and ensure capital sufficiency under various scenarios. These analyses determine the extent to which external shocks could disrupt a business, preparing the organization to formulate strategic responses to maintain adequate capital cushions.

Effective reporting mechanisms guide the communication of these insights for strategic decision-making. Robust reporting ensures that scenario analysis outcomes are accurately communicated to management, enabling informed decisions.

The marriage of scenario analyses and efficient reporting mechanisms into the ICAAP reinforces risk management frameworks and promotes organizational readiness to navigate financial intricacies.

Advanced Risk Management Strategies: A Complete Walkthrough

Effective risk management is crucial for organizations to succeed and cope with potential threats in today’s business environment. Building strong risk management strategies involves identifying, analyzing, and responding to risks effectively.

Formulating Successful Risk Management Strategies

- Risk Examination: Identify risks prevalent in your sector and industry.

- Comprehensive Risk Assessment: Uncover potential risks affecting your business, ranging from financial to compliance, operational disruptions, and strategic risks.

- Prioritization and Management: Classify risks by likelihood and impact. Manage high-priority risks through strategies such as avoiding, reducing, sharing, or accepting.

Dissecting Tools and Frameworks

Deploying effective risk management strategies requires sophisticated tools and frameworks. Common tools include:

– Risk Assessment Software: Automates risk evaluation and identification.

– Risk Management Dashboards: Provides data for improved decision-making.

Frameworks such as COSO ERM or ISO 31000 offer detailed roadmaps for creating risk management protocols, structuring methodologies, and integrating risk management into business ethos.

Boosting Organizational Preparedness

Through the proactive adoption of advanced risk management strategies, organizations can shield themselves from the unexpected and enhance their preparedness.

In conclusion, advanced risk management strategies are essential in today’s business climate. Investing in these strategies is key to achieving operational excellence and staying ahead of the competition.

Compliance with the ICAAP guarantees sufficient capital and financial stability in an institution, allowing detailed risk identification essential to achieving optimal financial performance and commitment to long-term sustainability.