Master ERM Operational Risk: Strategies & Applications

Enterprise Risk Management (ERM) and Operational Risk Management

Enterprise Risk Management (ERM) is an organization-wide approach to identifying, assessing, and managing risks that aligns risk appetite and tolerance with strategy and objective setting. All types of risks (strategic, financial, and operational risks) are considered. Operational risk is the risk of loss resulting from inadequate or failed internal processes, people, systems, or external events and is a key component of ERM.

Operational risk is often seen as one of the most challenging aspects of risk management because it is so unpredictable. This is because it covers the day-to-day activities of the organization that can fail with errors or breaks. Within ERM, operational risk is one of the key risk categories that is considered alongside other categories of risk and ensures that risks are not siloed, but looked at in an integrated approach. This supports an organization’s resilience and decision-making. By understanding how these categories interact, organizations are better able to understand and manage the potential impacts on their performance and reputation.

Frameworks and Differences ERM and Operational Risk Management

ERM and Operational Risk Management are essential elements of an effective risk management program. An organization interested in efficiently managing risks should understand the frameworks used as well as the differences between the two.

ERM Frameworks

An ERM framework is a structured, consistent, and continuous process that addresses all risks throughout the organization. The COSO ERM Framework is a widely recognized ERM framework. The COSO ERM framework is built on COBIT principles of aligning risk appetite and strategy, enhancing risk response decisions, and reducing operational surprises and losses. Another well-established framework, ISO 31000, provides principles and guidelines for integrated risk management within governance, strategy, and decision-making processes.

Operational Risk Management Frameworks

Operational risk management is the process by which organizations manage risks that arise from day-to-day operational activities. One operational risk management framework is found in the Basel II Accord, which sets out the minimum capital requirements for a bank’s operational risks. Further, the RCSA (Risk and Control Self-Assessment) process is a common supplement to these frameworks. It is a process wherein organizations self-identify their risks and control mechanisms.

Key Differences Between ERM and Operational Risk Management

Although both ERM and operational risk management strive to manage risk, the scope and focus of the two differ. ERM is broad and all-encompassing (covering strategic, financial, operational, and other risk types) and aligned with business objectives and strategy.

On the other hand, operational risk management narrows its focus to risks arising from internal processes, personnel, systems, or from external events leading to disruption in day-to-day operations. It is a component of ERM and offers a detailed view of operational breakdowns or failures.

To protect the organization, ERM brings a strategic, broad view, and operational risk management provides a detailed day-to-day operational account of risks. Leveraging both frameworks successfully allows an organization to build a solid risk management foundation.

Integration in Organizations: Strengthening Risk Management and Operational Resilience

Integration within organizations is fundamental for the enhancement of risk containment and operational resilience in today’s changing business environment. Integration of Enterprise Risk Management (ERM) with operational risk disciplines enables organizations to adopt a unified methodology to identify, evaluate, and reduce risks. This fusion signifies more than just an alignment of strategies; it is essential to the sustainable and enduring success of an entity.

The Integration of ERM and Operational Risk: A Mutually Supportive Relationship

At the core, Enterprise Risk Management (ERM) is a disciplined and structured approach to assessing and responding to threats related to an organization’s entire scope of operations. It extends to strategic, financial, operational, and reputational risks at hand and helps firms to align their risk appetite with their strategy to attain their operational goals. On the contrary, operational risk specifically deals with the potential losses occurring from ineffective or broken internal processes, human error, system failure, or external events. The convergence of ERM and operational risk management generates a complementary force for smart organizational risk strategies.

By embedding ERM ethos into operational risk activities, organizations may achieve an integrated risk culture. This includes utilizing consistent language, frameworks, and systems thereby integrating risk identification and evaluation processes. Effective integration breaks down silos and encourages cross-functional teamwork, ensuring that risk management is an essential part of day-to-day operational and decision-making processes.

Exemplary Integrations for Success

Many entities have successfully comprised ERM with operational risk management, offering benchmarks for others to follow. A case in point is the multinational bank, JPMorgan Chase. The bank has formulated an advanced risk management apparatus that blends together ERM with operational risk management to defend against potential financial and reputational damages. By leveraging advanced technology and analytics, the bank can predict risk events and initiate risk reduction actions without delay.

Another prototype for this is the manufacturing powerhouse, Siemens. Siemens has implemented a comprehensive operational risk integration program that embeds risk throughout its operations, from its supply chain to product creation. Not only has its integration advanced its operational resilience, but it has also bolstered its capacity to nimbly react to alterations in market conditions, thus affirming its leadership in the sector.

Enabling Operational Resilience through Integration

Embedding operational resilience in the core operations of the entity is crucial to the business’s ability to survive disruptions and continue to run its critical functions. By combining ERM with operational risk disciplines, organizations can graph potential disruptions and dependencies. This proactive approach allows companies to develop proactive and reactive continuity blueprints. An integrated method sets out a coherent understanding of a firm’s risk position, cultivating a culture of resilience that penetrates deep within the company.

In summary, the melding of ERM and operational risk disciplines is indispensable for any organization seeking to fortify its risk management achievements and operational resilience. As proven by the likes of industry front-runners such as JPMorgan Chase and Siemens, successful integration leads to improved outcomes and enhanced agility in volatile circumstances. By grasping this unified method, organizations can rest assured that they are ripe for forthcoming challenges, eventually empowering them to flourish in an ever-evolving corporate sector.

Application Exercises: A Practical Guide to ERM and Operational Resilience

The effective implementation of risk management is critical to the long-term viability of any organization. ERM is a structured and consistent risk management process that’s applied across an entire organization to identify potential events that may affect the organization and to manage risks to stay within its risk appetite. Learn how to start the process of implementing ERM & operational risk strategies, as follows:

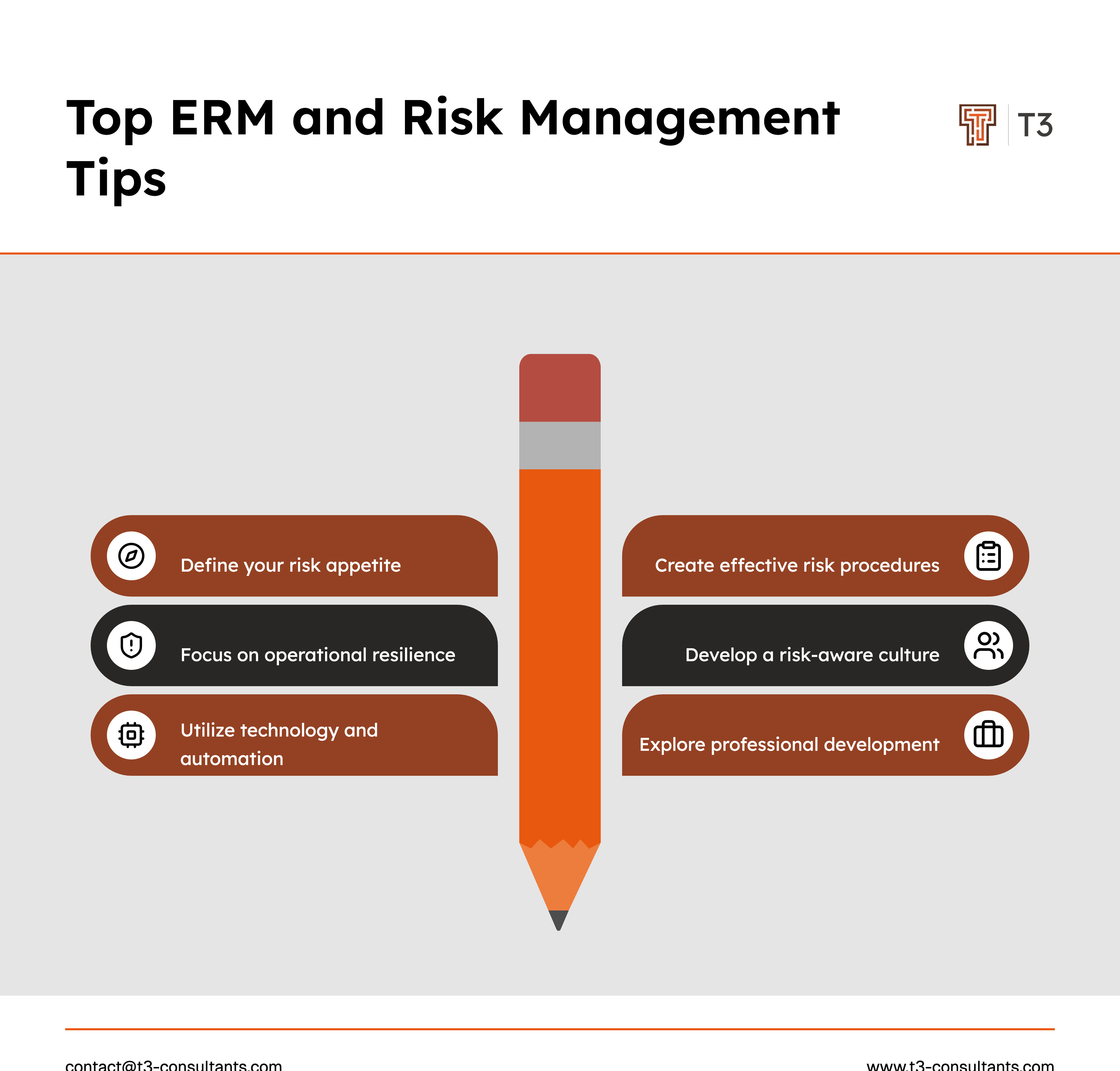

Define Your Risk Appetite

Begin by clearly articulating your organization’s risk appetite by establishing the quantum of risk the organization is prepared to tolerate when achieving its objectives. Clearly defined risk appetite is of high importance as this guides decision-making and strategic planning—it balances an organization’s strategies by bringing them in line with what risks are acceptable and what risks are not.

Create Effective Risk Management Procedures

High-quality risk management procedures need to be constructed to include risk identification, risk assessment, and risk control activities. Tools such as risk matrices and risk assessment frameworks are critical in helping to prioritize risks, based upon their potential impact and likelihood of occurrence. By constantly refreshing and reviewing risk drivers, organizations can maintain the efficiency and relevance of those strategies.

Focus on Operational Resilience

Operational resilience is the ability of an organization to continue to provide critical business functions and services in the face of operational disruptions. Strengthening operational resilience means identifying critical business functions and developing contingency plans to sustain these operations in adverse conditions. This includes investments in technology, improvements to business continuity planning, and enhancements to supply chain management.

Develop a Risk-aware Culture

An important factor in successful implementation is the development of a risk-aware culture throughout the organization. Engage all employees in the risk management process, offer ongoing training, and encourage transparent discussions around risk issues. By promoting a risk-aware culture, organizations can ensure that risk management principles are integrated into automatic, daily organizational thinking.

In summary, successful groundings in the areas of risk appetite, operational resilience, and enhancing risk awareness are key for the successful application of ERM and operational risk strategies. These components collectively enable organizations to navigate potential uncertainties whilst safeguarding objectives and supporting sustainable growth.

Specializing in Financial Services

In the fast-changing landscape of the financial services industry, there are a number of industry-specific challenges for companies to overcome. Central to these is the challenge of risk, which has become more intricate as financial disruption has increased. Disruption to financial systems caused by technological advancements, an economic downturn, or new regulatory requirements requires a robust and flexible risk management framework.

Narrated pressures for financial institutions are not only to manage these risks well but to anticipate them. This involves the use of advanced analytical techniques and technology to develop predictive models that can predict risk before it emerges. In addition, the current environment of risk has forced a heightened need for developing agile strategies that respond to rapid change yet remain in control and deliver reliable financial services.

Also, operational resilience for the financial services sector must consider the regulatory environment that forces the industry to comply tightly, yet also provides potential for growth and leverage in financial innovation. Managing these regulatory extra costs requires detailed knowledge of the global and local financial regulation landscape and a clever strategy to ensure compliance over all operations.

Finally, utilizing technology and automation to control away from man-intensive processes can significantly reduce the risk of human error, an often underestimated risk in financial services, and can revolutionize risk management from reactive to proactive by encouraging innovation and a disruptor mindset rather than resistance.

Today, financial services need to concentrate on buoyant systems which do not just survive but also capitalize on the opportunities arising from financial disruption.

Academic and Professional Resources in ERM and Operational Risk

Starting a career in ERM and operational risk first requires a strong knowledge base and continued professional development. Thankfully, there are many academic and professional resources available to help both students and professionals in the field. Several academic institutions provide full online courses suitable for both beginners and those looking to deepen their knowledge. These courses are typically labeled with a course number that tells you the level of understanding needed to complete the course, allowing students to self-select courses appropriate for their proficiency.

Universities offer online ERM courses, like risk assessment and risk mitigation strategies. These universities’ online courses are a great fit for professionals working full-time because they offer flexibility for students to work at their own pace around their current obligations. Communication with an online person or instructor is key to success in that it helps give a more personalized direction and support network.

Additionally, professional organizations have training programs and certifications in operational risk. Enrolling in any of these programs will help you advance your skills and grow your professional network with thought leaders. To progress a career in ERM, taking advantage of academic opportunities and professional development courses can inspire your journey to reaching your goals.

In summary, the key to organizational resilience and prosperity for any entity lies in the effective management of operational risk using a robust ERM (Enterprise Risk Management) model. Smart businesses mitigate operational risk by employing a strategic risk assessment and response strategy, prepared for the unexpected, and underscore the necessity of professional expertise, urging organizations to consult with specialists to fortify their ERM frameworks. The application of professional knowledge not only simplifies the risk management process but also promotes a full appreciation of the new operational risks. Through the exploration of professional knowledge, firms can fortify their operational risk models, thereby gaining a competitive advantage in the constantly changing business environment of today.