Technical Mining Advisory & Regulatory Compliance Services

Overview of Technical Advisory in Mining

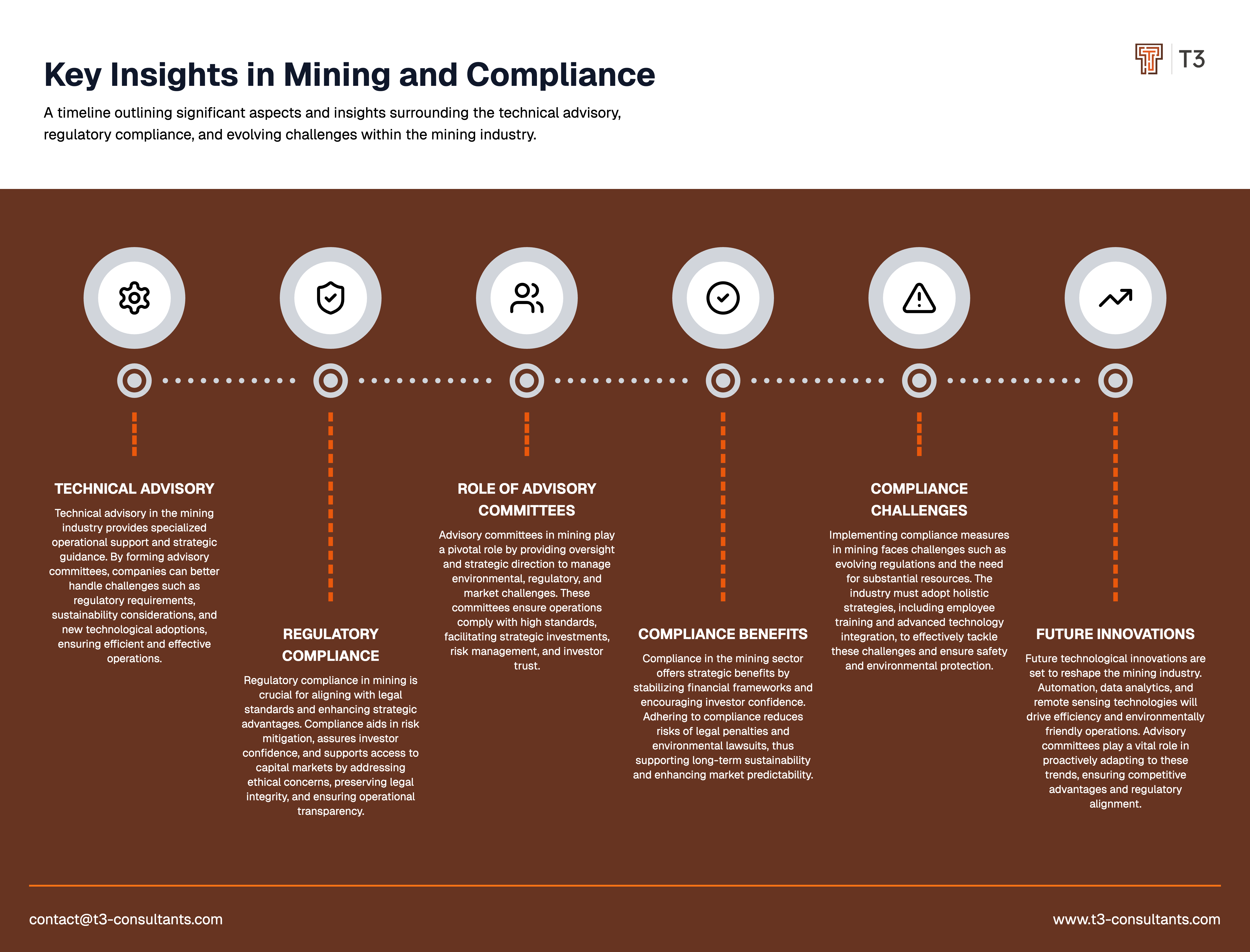

The technical advisory plays an integral part in the ever-changing and complicated mining industry. It is a specialized service to provide professional advice and operational support to mining companies for efficient and effective operations. Technical advisory covers a wide range of areas, such as exploration, environmental management, and operations optimization that are tailored to the industry.

The key element of technical advisory in mining is to establish an advisory committee. The committee is typically constituted of experienced experts with vast knowledge and experience in the field. The main duty is to offer strategic technical advice, decision-making support, and risk management for the mining operation. With the advisory committee’s expertise, mining companies can better handle regulatory requirements, embrace new technologies, and address sustainability issues.

Technical advisory services are predominant in the industry for expertise and an acute focus on ensuring economic viability as well as environmental and social discipline in each mining project. As the mining sector continues to develop, the importance of technical advisory and advisory committees is growing in driving companies towards successful and sustainable operations.

Overview of Regulatory Compliance

For businesses, especially those in the financial sector, navigating regulatory compliance is a fundamental aspect of operations, as it involves conforming to laws, regulations, standards, and other specifications relevant to their operation. Regulatory compliance serves to protect investors, maintain market integrity, foster capital formation, and promote public confidence.

One key area of regulatory compliance is financial reporting. Accurate and timely financial reporting is seen as an indication of a company’s financial health and performance. Companies must follow specific accounting standards and principles when preparing financial statements to provide a true and fair view of their financial position. Failure to comply may lead to fines, legal impacts, and reputation damage.

Regulating and enforcing regulatory compliance falls heavily upon securities commissions. These are government entities, for example, the Canadian securities commissions, that administer and enforce securities laws and regulations. Their objective is to ensure that financial markets are fair and efficient. By licensing, monitoring, and taking enforcement actions, they seek to avoid frauds and other non-compliant activities by companies, under the umbrella of the securities laws.

In Canada, there are distinct rules and regulations surrounding securities, with the various provincial and territorial securities commissions working in unison to streamline processes across the country. These have stringent obligations to make full disclosure and maintain a high level of standards when reporting financials.

In essence, regulatory compliance is an integral part of upholding the integrity of financial markets. Companies must comply with rigorous rules set forth by the securities commissions to maintain a just and honest marketplace. If followed and incorporated extensively in their systems, it should prevent a company from undergoing legal ramifications, instill trust in investors, and help stabilize the financial environment.

The Important Functions of Advisory Committees in Mining

For the mining industry, advisory committees play a pivotal role through guidance and oversight to ensure sustainability and ethical practices. These advisory committees, or advisory panels, are composed of professionals from diverse fields who are able to provide their expertise and experiences.

The main purpose of these advisory committees is to establish strategic priorities. Long-term oriented, they help guide mining companies in dealing with regulatory complexities, environmental issues, and changing market dynamics. Expert input ensures that mining operations are conducted in line with best practices and industry benchmarks.

Technical advisory and monitoring functions are also key duties for such committees. By conducting thorough technical reviews, they assess mining processes to confirm that operations remain efficient and safe. Such monitoring is essential to complying with environmental standards and curbing the environmental impact of mining activities.

Support also comes in investor advisory capacities. Through advice on risk management and strategic investments, these committees maintain existing investor trust and attract new capital. Their insights provide identification of new opportunities and prevention of potential threats, allowing for sustainable expansion and profitability to mining companies.

In essence, advisory committees are the backbone of the mining sector and offer technical resources, strategic oversight, and investor relations support. Their full range of services ensures that mining operations are carried out responsibly, showcasing good governance practices and instilling confidence within the industry.

Importance of Compliance in the Mining Sector

Compliance in the mining sector is more than just meeting legal requirements. For companies in the industry, compliance represents not only a legal necessity but also a strategic advantage that heavily influences investment, capital markets, financial performance, and investor assurance.

A primary benefit of compliance is the mitigation of risks. Compliance with national and international laws and regulations helps mining businesses limit the risk of legal penalties, environmental lawsuits, and operational shutdowns. This lower risk results in a more consistent financial framework—something that most investors are looking for when seeking steady returns and, consequently, one of the main drivers for increasing investor confidence.

In addition, compliant mining companies often find easier access to the capital markets. Investors tend to favour companies with strong compliance records to safeguard their investment from non-compliance risks and ethical concerns. This is helpful for mining companies to fund their expansions and technological improvements when needed.

Regarding market predictability, regulatory compliance also encourages transparency and responsibility, which are fundamental for the long-term sustainability of both individual companies and the industry as a whole. A trustworthy commitment to regulations through all stakeholders, such as investors, gains trust and promotes a stable investment environment where the capital markets can perform efficiently.

Eventually, compliance in the mining sector elevates the reputation and credibility of a company and increases its attractiveness to investors, hence favouring market predictability and financial sustainability.

Challenges Implementing Compliance Measures within the Mining Industry

Significant challenges continue to affect the mining industry in adopting compliance systems to secure securities for environmental and personnel safety. The main challenge is adapting to rapidly evolving regulatory environments, which often require significant resources to understand and comply with accurately. Complex regulations and securities demand the attention of mining companies to bring operations into compliance with protected securities.

Technical challenges also exist in integrating compliance securities into current operations while maintaining productivity. The technical mining challenge may create efficiencies by industry unless sensibly managed. The implementation of new leading technologies to support environmental securities may require a large investment from smaller operators.

Solutions to these challenges require a holistic strategy. Significant investment into extensive training for employees may improve understanding of securities across all employee levels. Utilizing state-of-the-art compliance management technology will optimize securities oversight, ensuring flexibility for changes in securities. Engagement with legal and regulatory authorities can also assist in a seamless transition through understanding expectations and potential mining securities hazards. With a focus on explicit communication, in-depth training, and technology strategy, mining companies can tackle these compliance challenges to maintain securities of employees and often the environment.

In summary, the complex mining landscape continues to change, with future regulations acting as a key catalyst in its direction. Understanding regulatory developments is crucial to compliance and sustainable operations. Tightening environmental and safety criteria place a requirement on companies to embrace additional regimes of compliance and relief from penalties, and to maintain stakeholder reputation.

Future technological innovations and processes are anticipated to drive the industry towards more efficient and environmentally benign practices. Automation, data analytics, and remote sensing technologies are seen as the next trends that the industry will need to adopt, shaping the old mining methodologies. By also engaging advisory input in proactively adapting to these changes, companies are likely to sustain a competitive advantage.

Furthermore, forming collaborative partnerships with regulators and adopting a compliance partnership approach could further strengthen a firm’s agility and sustainability against regulatory evolution. By focusing on compliance and engagement, the mining industry can look to continue operation in this fluid environment.