Risk Management

Risk Management & Compliance

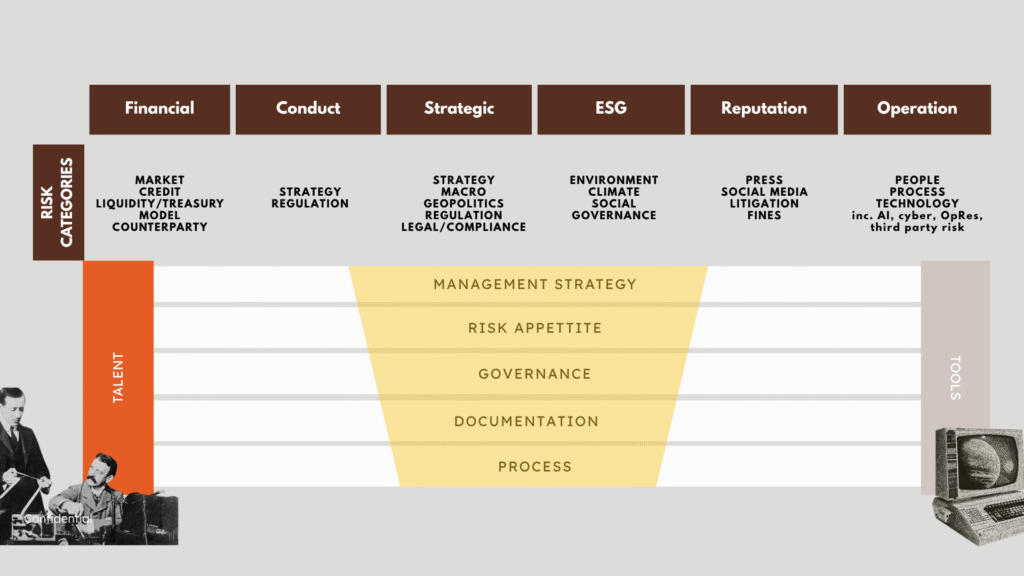

At T3, we provide end-to-end coverage of every type of risk and the entire risk management continuum – from governance and strategy to reporting and implementation.

Our capabilities cover market risk, credit risk, model risk, operational risk, reputational risk, compliance risk management, AI risk, and more.

Regardless of whether you require assistance with implementation, polishing, review, or acting temporarily, T3 has the resources to deliver the full range. We offer customized solutions to complement your risk management system, where it is strong, compliant, and strategically beneficial to your organization.

Risk Framework that Pass the Test of Time

Executive Summary

Integrated Risk Management (IRM)

Companies are integrating conventional siloes (credit, market, reputational, operational risk, ESG, cyber) into dynamic, enterprise-wide systems as part of a broader governance risk and compliance framework. Key elements include:

- Risk appetite flowing down to business units.

- Real-time visibility through dynamic risk dashboards.

- Scenario analysis beyond the realm of financial risk that incorporates climate, cyber, geopolitical, and threats from AI.

Agile & Modular Frameworks

- Modular: A plug-and-play risk architecture that is easily reconfigured as fintechs, neobanks, or regtech companies change their business models. This responsiveness enables new products and services to launch with the appropriate protections, enabling innovation to proceed without compromising compliance.

- Embedded: Integrating risk considerations into each stage of a project—whether cloud migration, deploying an AI model, or creating an ESG report generator, such that security and compliance are inherent from day one. By merging oversight into such lifecycles, companies align new technology projects with regulatory requirements along the way during development, rather than during end-of-project review.

Data-Driven & Automated

- Implementation of GRC platforms (e.g., ServiceNow, LogicGate) to enact policies, controls, KRIs, and reporting.

- Utilizing appropriate AI/ML for timely detection of early risk signals (e.g., fraud, conduct breaches) and more accurate forecasting

Today’s landscape Risk Management & Compliance

1. Market Risk Management

With markets more volatile and globally linked than ever, firms and regulators alike are recalibrating how they approach market risk management and supervise trading risks to keep pace with change.

- UK: The PRA has pushed back Basel 3.1 market risk rules to January 2027, giving firms more time to prepare while keeping alignment with global peers..

- EU: The European Commission is also deferring full FRTB rollout to 2027, balancing stronger risk standards with the realities of implementation.

- US: The Fed is tightening stress testing and market risk assessments, especially for firms with large trading books, while responding to calls for greater clarity.

- Switzerland: FINMA remains on track to bring in the final Basel III rules, including market risk reforms, by January 2025, keeping Switzerland among the frontrunners.

AI and social media are redefining market risk – both as volatility amplifiers and as instruments of risk identification.

- Volatility surges: Sites such as X and Reddit can induce sudden price movements fueled by emotions, rather than fundamentals—exemplified in events such as GameStop or crypto blowups.

- Model fragility: Artificial intelligence–based trading models could act erratically under stress, amplifying market momentum and procyclicality risk.

- Systemic feedback loops: Herding is a consequence of the extensive use of similar AI instruments, whereas viral content can skew liquidity expectations.

- Smarter surveillance: Regulators and companies are employing AI to monitor sentiment, identify manipulation, and predict flash crashes in real time.

At T3 Consultant, market risk management consultancy is focused on helping institutions navigate these emerging challenges by integrating AI awareness, real-time surveillance, and proactive risk strategies into their trading risk frameworks.

VaR , ES efinement and optimization

New event risk scenarios definition

Today’s landscape Risk Management & Compliance

2. Credit Risk Management

Credit risk approaches are being redesigned everywhere to limit RWA volatility, decrease dependence on internal models, and tie in capital obligations with true economic risk.

As part of this global shift, institutions are increasingly turning to credit risk management services to navigate these evolving regulatory landscapes and ensure compliance.

UK: Basel 3.1 credit risk implementation postponed to January 2027. Reforms include new credit risk mitigation provisions, refashioned off-balance-sheet exposure treatment, and implementation of the output floor to limit internal model decreases in RWAs.

EU: Last Basel III reforms to be implemented in January 2025. EBA roadmap encourages harmonisation and global competitiveness by amending standardised and internal ratings-based (IRB) methods.

US: Basel III Endgame proposal (from July 2025) does away with sophisticated internal credit models. Large banks need to convert to standardised credit risk methods—increasing CET1 capital by ~16% and RWAs by ~20%.

Switzerland: Final Basel III reforms (including credit risk amendments) effective January 2025. Seeks to minimize RWAs variability and maximize capital comparability among institutions.

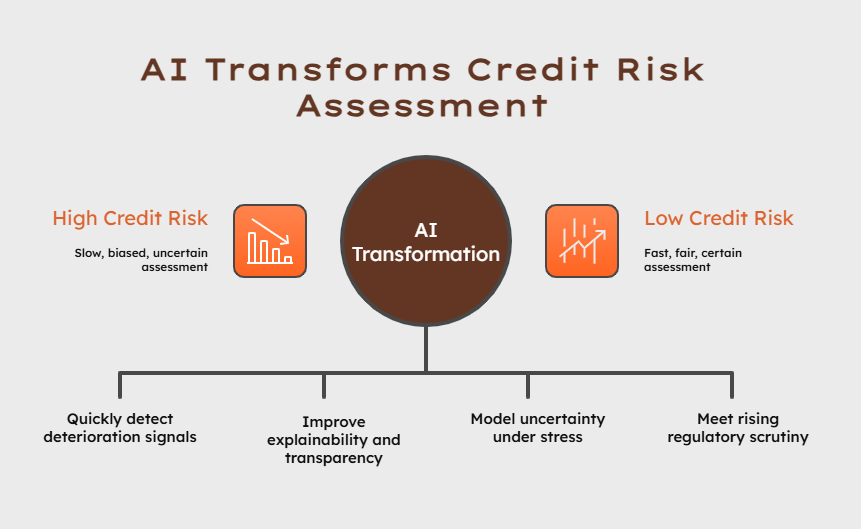

Credit Risk: AI and Real-Time Data Are Redefining Exposure Monitoring

- AI is revolutionizing the way companies evaluate and respond to credit risk—enhancing credit risk assessment with greater velocity and transparency.

- Earlier this signals: AI solutions deliver through real-time transaction data, ESG, and alternative data (e.g. social media, supply chain feeds). They identify borrower stress sooner—but challenge model clarity on questions of governance.

- Bias and explainability threats: AI credit scoring could reinforce current disparities or disguise decisioning logic, leading to regulatory issues concerning fairness and consumer protection.

- Macro stress uncertainty: AI models developed during favorable times could perform poorly in novel stress environments, leaving lenders to blind spots in recession situations.

- Regulatory scrutiny increasing: Regulators such as the EBA and PRA are demanding more robust validation, governance, and auditability of AI-based credit models under IRB and IFRS.

Credit scoring models

PD, LGD, EAD modeling

Portfolio risk management

Credit stress testing

Counterparty Credit Risk

Today’s landscape Risk Management & Compliance

3. Model Risk Management

Model Risk Management Services: From Legacy Models to AI Governance

Regulators are sharpening expectations on model risk, particularly in light of AI models increasing in scale across key banking activities.

- UK – PRA: Published SS1/23 and PS6/23, setting out five principles: governance, categorization, development, validation, and risk mitigation. Applies to all model types, including AI/ML. Phased implementation in progress.

- EU – ECB / EBA: ECB revising its Guide to Internal Models to meet CRR3 and cover AI/ML governance.

- EBA mounting examination of model validation, change control, and transparency.

- US – Federal Reserve: SR 11-7 is still the bedrock, but regulators are emphasizing more controls on AI — including fairness, explainability, and robust validation.

- Industry call for more guidance on AI-specific risks.

- Switzerland – FINMA:FINMA would have AI risk incorporated into model governance. Emphasis on oversight, bias controls, and transparency in accountability.

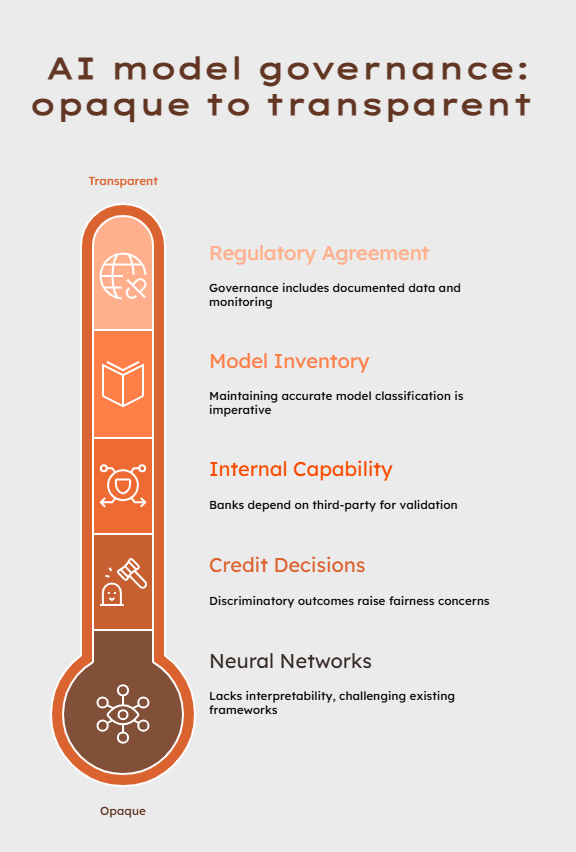

AI and ML models are leading to a fundamental transformation in how model risk is viewed, validated, and regulated:

- Opacity & explainability: AI models (such as neural networks) tend to be non-interpretable, making it difficult to apply traditional MRM frameworks. As a result, organizations are increasingly turning to advanced model risk management solutions to address these challenges.

- Bias & fairness risks: Regulators are increasingly worried about discriminatory effects in credit, pricing, and hiring choices — prompting calls for fairness audits and moral controls.

- Validation strain: Most banks don’t have the in-house capability to robustly validate sophisticated AI models, resulting in third-party reliance and possible gaps in supervision.

- Proliferation & inventory risk: With AI built into operational, risk, and customer-facing applications, keeping an accurate and classified inventory of models is now a regulatory necessity.

- Global convergence unfolding: Across jurisdictions, regulators generally concur that governance of AI models should entail:

- Record development and training data practices.

- Constant monitoring of performance and drift detection.

- Human-in-the-loop auditing for high-impact decisions.

- Increased internal audit and board visibility.

Model governance frameworks

Risk model auditing

Scenario analysis

Model tuning and optimization

Today’s landscape Risk Management & Compliance

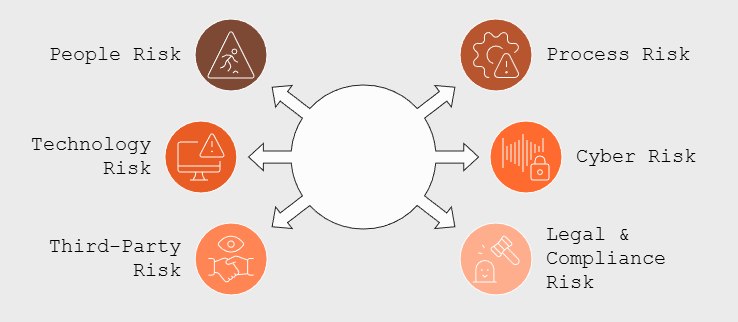

4. Operational Risk Management

Regulatory Developments (UK, EU, US, Switzerland)

- UK – FCA/PRA: Firms are required to demonstrate strong operational risk management capabilities and compliance with operational resilience regulations (PS21/3) by March 2025, including the capacity to stay within impact tolerances in extreme situations (e.g. large outages or cyber attacks).

- EU – DORA: The Digital Operational Resilience Act (effective from Jan 2025) aligns ICT risk and operational risk management practices across banks, insurers, and third-party providers, requiring rigorous testing, reporting, and contractual oversight.

- US – OCC/FRB/FDIC: Heightened expectations for third-party and operational risk management frameworks through interagency guidance that emphasizes stronger supervisory controls over cloud and fintech partnerships, in line with the FFIEC Handbook.

- Switzerland – FINMA: FINMA Circular 2023/1 “Operational Risks and Resilience“ outlines the requirements for business continuity, cyber-resilience, and outsourcing; employs a principles-based supervisory approach.

Cross-border alignment:

Regulators now more regularly use the BCBS Principles for Operational Resilience as a universal benchmark; efforts toward alignment are being seen in EU-UK equivalence and US-EU negotiations.

Key Trends in Operational Risk

- AI-based attacks: Financial institutions are being confronted with new threats from generative AI—i.e. deepfake-facilitated fraud, executive spoofing, and synthetic identity construction.

- Risk of cloud concentration: Over-reliance on a few hyperscalers to perform core functions has raised regulatory alarms; companies have to prove exit or multi-cloud strategies.

- Tech debt + legacy systems: Old infrastructure keeps on resulting in outages and integration errors, particularly with the pressure of digital transformation.

- Resilience by design: Companies are integrating resilience into strategic planning, scenario testing, and board-level reporting – especially in reaction to DORA and FCA requirements.

- Data risk as operational risk: Biased algorithms, model risk, and poor data governance are now generally handled as central elements of the operational risk framework.

Understanding Operational Risks

Operational Resilience

Click on header to go to relevant section

AI Risk Management

Click on header to go to the relevant page

Scenario analysis

Third Party Risk Management

Today’s landscape Risk Management & Compliance

5. Reputational Risk Management

Regulatory Developments (UK, EU, US, Switzerland)

- Reputational risk is addressed by the FCA’s Conduct and Consumer Duty regimes and the PRA’s capital planning obligations, with bad outcomes or governance failure resulting in funding distress and regulatory action, prompting firms to strengthen their reputational risk management practices.

- Reputational risk is handled by EU regulators as a result of governance failure, ICT incidents (as specified under DORA), and market conduct issues, especially in outsourcing and algorithmic trading, under the umbrella of the EBA and ESMA, highlighting the growing need for integrated reputational risk management systems.

- US regulators specifically define reputational risk as a standalone area of supervisory concern associated with consumer injury, breaches of compliance, ESG misstatements, and enforcement measures – requiring institutions to adopt proactive reputational risk management strategies to protect financial and franchise value.

- FINMA includes reputational risk within its governance and operational risk expectations, particularly where ICT failure, cross-border investigations, or misconduct could compromise institutional credibility – underscoring the importance of robust reputational risk management frameworks in maintaining regulatory trust.

Reputational Risk : Growing in Crowded Digital Age

- Data Overload: Despite the most efficient algorithms, humans still trust humans when it comes to significant choices and that is partially because trust is an unshakeable currency when it comes to collaborations and evolution.

- AI and algorithmic fairness: Non-disclosure or inability to manage AI damages can cause serious reputation backlash – with regulators narrowing the gap (AI Act, UK AI regulation roadmap).

- Greenwashing: Inconsistent sustainability statements create reputational and regulatory risk, exemplified by recent ESMA, FCA, and ACPR actions.

- Digital behavior and cyber hygiene: Bad UX/UI, deceptive online experiences, or data leaks lead to both regulatory penalties and customer loss.

- Employee activism and whistleblowing: Voice from within can rapidly propel reputational crises – particularly if connected to ethics or compliance deficits.

- Third-party failures: Third-party outages or ethical misconduct under DORA and outsourcing regulations can become company-wide reputation incidents.

Navigating Reputational Risks

Crisis Management Planning

Developing strategies to effectively respond to potential crises that could impact your reputation (more details on Crisis Management)

Stakeholder Communication Strategies

Crafting clear and transparent communication plans to maintain trust during challenging times.

Conduct Risk

Ensuring adherence to relevant regulations to mitigate risks associated with non-compliance.

Reputation Monitoring and Analysis

Implementing tools to continuously monitor public perception and address issues proactively.

Today’s landscape Risk Management & Compliance

6. Liquidity Risk Management

Liquidity risk is the single most frequent cause of bankruptcies and forced acquisitions in the financial services sector, usually precipitated by underlying credit, market, or reputational failures.

Robust liquidity risk management is now a regulatory imperative across major jurisdictions.

- PRA Pillar 2 Liquidity – Live and applied; refreshed through supervisory statements such as SS24/15 and stress testing frameworks customised to the needs of individual firms.

- Basel III (LCR, NSFR) – Already applied globally in the UK, EU, US, and Switzerland; supervised via regular liquidity reports and SREP/ICARA reviews.

- DORA (EU) – Just finalised, effective January 2025; explicitly connects operating failures to liquidity and reputational impact.

- FCA Operational Resilience – Already live as of 2022; firms need to demonstrate they can continue providing business services under conditions of liquidity shortage.

- SEC Liquidity Risk Rule – Currently closely watched in the US fund industry; part of the post-2020 reform trend, with further scrutiny likely in the aftermath of recent fund gating issues.

Liquidity Risk : Growing in Crowded Digital Age

- Exposes firms (e.g., SVB) with long-dated assets and short-term funding to liquidity runs.

- Social media–exacerbated bank runs – Spreading of information quickly ignites sudden withdrawals of deposits and loss of market confidence.

- Great reliance on wholesale funding – Raises refinancing risk, particularly in turbulent or risk-off market environments.

- Changes in customer behavior – Digital withdrawals at higher speed and requests for immediate access to funds put conventional liquidity assumptions under pressure.

- Reputation loss due to ESG or conduct failures – May precipitate bulk redemptions, investor withdrawals, or counterparty line withdrawal.

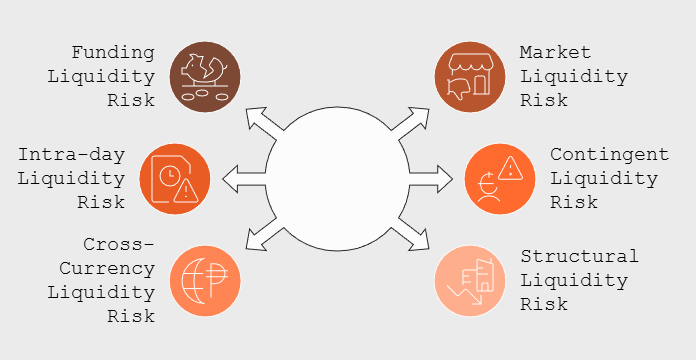

Types of Liquidity Risks

Enterprise Risk Management (ERM) Framework Development

Designing and implementing ERM frameworks tailored to your organization’s needs.

Intraday Liquidity

Systematically identifying and evaluating risks across all business areas.

Frequently Asked Questions

The five core principles of risk management are the foundation of any effective risk strategy, whether in financial services or broader corporate governance. These principles are:

- Identify the Risks: Recognize both internal and external risks that could impact objectives.

- Analyze and Assess: Evaluate the likelihood and impact of each risk.

- Control and Treat Risks: Implement measures to mitigate, transfer, avoid, or accept the risk.

- Monitor and Review: Continuously track risk exposure and the effectiveness of controls.

- Communicate and Consult: Engage stakeholders at all stages to ensure transparency and responsiveness.

At T3, we integrate these principles into every engagement – ensuring that our clients stay ahead of regulatory expectations and operational threats.

Risk management is essential in financial services because it protects firms from financial loss, reputational damage, and regulatory penalties. It enables firms to:

- Make informed strategic decisions

- Maintain regulatory compliance (e.g., under Basel 3.1, PRA, or ECB guidelines)

- Enhance resilience to market volatility, cyber threats, and operational failures

- Build investor and client trust

Without robust risk management, firms face cascading failures – from data breaches to liquidity crises.

T3 helps financial institutions transform risk management from a reactive process into a strategic advantage.

Although closely related, Risk Management, Compliance, and Audit serve distinct purposes:

- Risk Management is forward-looking. It identifies potential threats and sets strategies to mitigate them.

- Compliance ensures adherence to laws, regulations, and internal policies (e.g., MiFID II, SMCR, EU Taxonomy).

- Audit is retrospective. It evaluates how well risk and compliance processes are being followed, often through internal or external reviews.

Think of it as:

- Risk asks “What could go wrong?”

- Compliance asks “Are we playing by the rules?”

- Audit asks “Did we do what we said we would?”

At T3, we bring these functions together to provide integrated risk and compliance solutions – from policy design to control testing and remediation.

Funding Liquidity Risk

Aligning risk management strategies with your business objectives to enhance decision-making.

Contingent Liquidity Risk

Ensuring adherence to relevant regulations and standards to mitigate compliance risks.

WHO DOES IT IMPACT?

Asset Managers

Banks

Commodity Houses

Fintechs

Want to hire

Risk Management Expert?

Book a call with our experts