Risk Management

Internal Capital AdequacyAdequacy Assessment

Process (ICAAP)

Contact us

Is Your ICAAP Ready for What’s Next?

Executive Summary

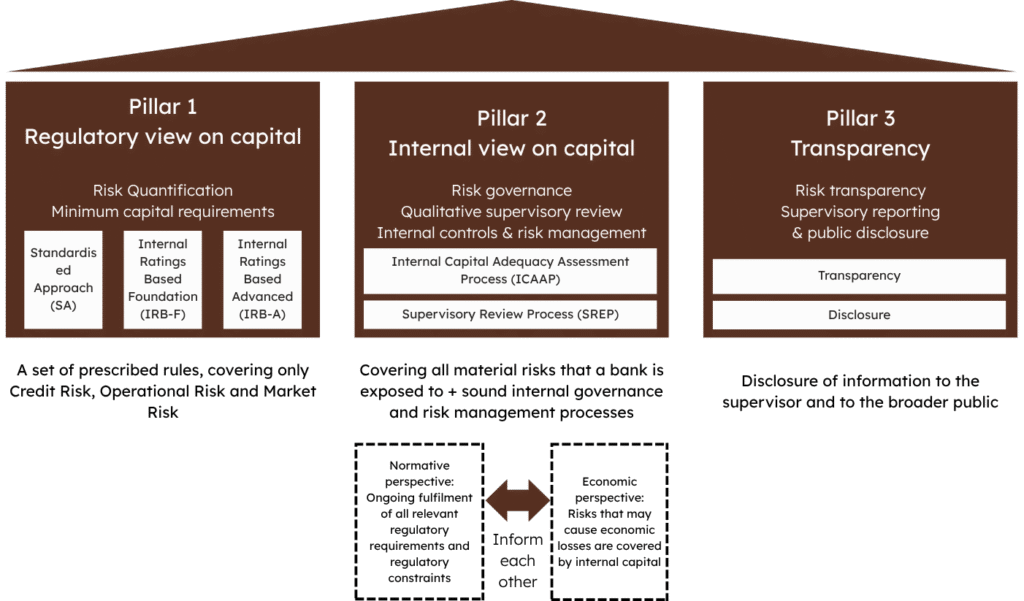

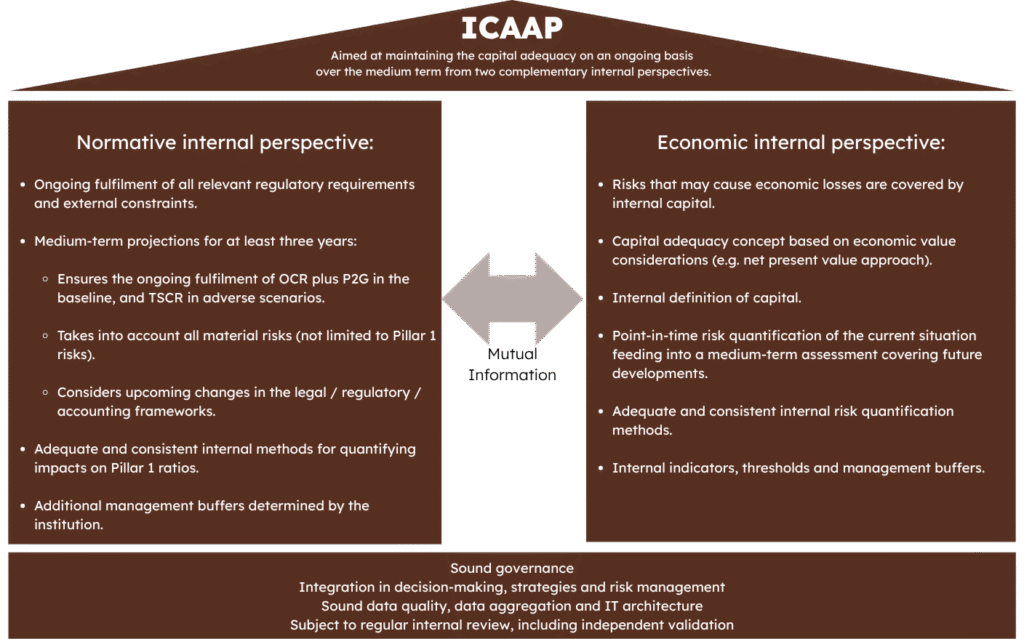

The Internal Capital Adequacy Assessment Process (ICAAP) is a fundamental component of modern financial risk management, enabling institutions to assess and maintain adequate capital relative to their risk profiles. As part of ICAAP Pillar 2 of the Basel Framework, ICAAP goes beyond regulatory minimums, ensuring resilience against a spectrum of risks, including those not explicitly covered under ICAAP Pillar 1.

At T3, we specialize in guiding financial institutions through the intricacies of ICAAP, aligning capital strategies with business objectives and regulatory expectations.

Understanding ICAAP

ICAAP (internal capital adequacy assessment process) is an internal process that requires institutions to evaluate the adequacy of their capital in relation to their risk exposures and business strategies. It encompasses both quantitative assessments and qualitative judgments, ensuring a comprehensive view of capital needs.

Key Components of ICAAP

Risk Identification and Assessment: Identifying all material risks, including credit, market, operational, liquidity, and others specific to the institution’s activities.

- Capital Planning: Determining the amount and quality of capital required to cover identified risks over a forward-looking horizon, typically 3 to 5 years.

- Stress Testing: Evaluating the institution’s resilience under adverse scenarios to ensure capital adequacy during periods of stress.

- Governance and Oversight: Establishing robust governance frameworks to oversee the ICAAP process, ensuring accountability and continuous improvement.

Regulatory Expectations

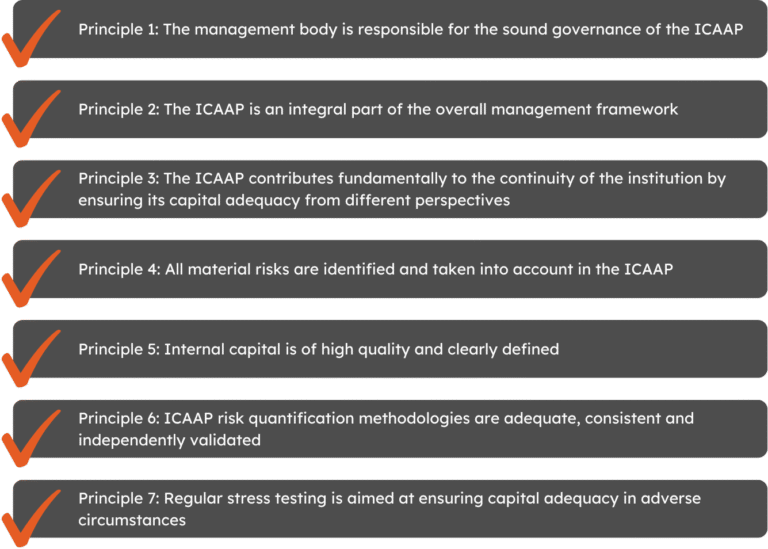

Regulatory bodies, such as the European Central Bank (ECB) and the Prudential Regulation Authority (PRA), emphasize the importance of a sound ICAAP. The ECB’s guide outlines principles for effective ICAAPs, including the integration of ICAAP into the overall management framework and the necessity for comprehensive risk coverage. Similarly, the PRA’s supervisory statement SS31/15 details expectations for firms’ ICAAPs, highlighting the role of capital stress testing and the Supervisory Review and Evaluation Process (SREP).

While the core principles of ICAAP are consistent across jurisdictions, specific regulatory expectations and implementations can vary between the UK and the EU.

United Kingdom (UK)

In the UK, the Prudential Regulation Authority (PRA) oversees ICAAP implementation. The PRA expects firms to take full responsibility for ensuring adequate capital, with ICAAP being an integral part of the firm’s management process. The process should be proportionate to the nature, scale, and complexity of the firm’s activities. For institutions seeking help with ICAAP, understanding the PRA’s emphasis on stress testing and scenario analysis is essential for accurately assessing capital adequacy. (see more about the official paper here)

European Union (EU)

In the EU, the European Central Bank (ECB) provides guidance on ICAAP through its Single Supervisory Mechanism (SSM). The ECB expects institutions to integrate ICAAP into their overall management framework, using it for strategic planning, monitoring capital adequacy indicators, and ensuring the effectiveness of the risk appetite framework. (see more about the official paper here)

European Banking Authority:While both jurisdictions emphasize the importance of ICAAP, the UK places a stronger emphasis on firm-specific responsibility and proportionality, whereas the EU focuses on integration into the broader management framework and strategic planning.

The concept of ICAAP has evolved significantly since its inception under the Basel II framework. Initially, ICAAP was introduced to complement the minimum capital requirements (Pillar 1) by addressing risks not fully captured under standardized approaches.

Over time, the financial industry has witnessed several enhancements to the internal capital adequacy assessment process ICAAP:

- Integration with Strategic Planning: ICAAP has become a tool not just for regulatory compliance but also for strategic decision-making, helping institutions align capital allocation with business objectives.

- Enhanced Risk Coverage: The scope of risks considered under ICAAP has expanded to include emerging risks such as cyber threats, climate change, and geopolitical uncertainties.

- Advanced Stress Testing: Institutions now employ sophisticated ICAAP stress testing methodologies to assess resilience under various adverse scenarios.

Greater Transparency and Disclosure: Regulators and stakeholders demand more detailed disclosures regarding ICAAP processes, assumptions, and outcomes.

These developments underscore the dynamic nature of ICAAP and its central role in promoting financial stability.

Conducting an effective ICAAP involves several critical steps:

- Risk Identification and Assessment: Identify all material risks, including those not covered under ICAAP Pillar 1, such as reputational and strategic risks.

- Quantitative Measurement: Quantify the potential impact of identified risks using appropriate models and methodologies.

- Capital Planning: Determine the amount and quality of capital required to cover the assessed risks over a forward-looking horizon.

- Stress Testing and Scenario Analysis: Evaluate the institution’s resilience under various adverse scenarios to ensure capital adequacy.

- Governance and Oversight: Establish robust governance structures to oversee the ICAAP process, ensuring accountability and continuous improvement.

- Documentation and Reporting: Prepare a comprehensive ICAAP document detailing the ICAAP process, methodologies, assumptions, and outcomes for internal and regulatory review.

Each step should be tailored to the institution’s specific risk profile, business model, and regulatory environment.

- Re-design governance to account for the new group’s strategy direction (e.g., regulatory risk management enhanced after integration).

- Arm managers with playbooks, mentoring, and rewards to support fresh behaviours.

- Construct a feedback loop, bi-monthly change diagnostics to support adapting interventions based on real-time data.

Mastering ICAAP

The PillarPillar 2 Powerhouse for Proactive Risk Management

Deep Dive into ICAAP

Understanding ICAAP

ICAAP is an internal process that requires institutions to evaluate the adequacy of their capital in relation to their risk exposures and business strategies. It encompasses both quantitative assessments and qualitative judgments, ensuring a comprehensive view of capital needs.

Key Components of ICAAP

Risk Identification and Assessment: Identifying all material risks, including credit, market, operational, liquidity, and others specific to the institution’s activities.

- Capital Planning: Determining the amount and quality of capital required to cover identified risks over a forward-looking horizon, typically 3 to 5 years.

- Stress Testing: Evaluating the institution’s resilience under adverse scenarios to ensure capital adequacy during periods of stress.

- Governance and Oversight: Establishing robust governance frameworks to oversee the ICAAP process, ensuring accountability and continuous improvement.

Regulatory Expectations

Regulatory bodies, such as the European Central Bank (ECB) and the Prudential Regulation Authority (PRA), emphasize the importance of a sound ICAAP. The ECB’s guide outlines principles for effective ICAAPs, including the integration of ICAAP into the overall management framework and the necessity for comprehensive risk coverage. Similarly, the PRA’s supervisory statement SS31/15 details expectations for firms’ ICAAPs, highlighting the role of stress testing and the Supervisory Review and Evaluation Process (SREP).

ICAAP Across Jurisdictions: UK vs. EU

While the core principles of ICAAP are consistent across jurisdictions, specific regulatory expectations and implementations can vary between the UK and the EU.

United Kingdom (UK)

In the UK, the Prudential Regulation Authority (PRA) oversees ICAAP implementation. The PRA expects firms to take full responsibility for ensuring adequate capital, with ICAAP being an integral part of the firm’s management process. The process should be proportionate to the nature, scale, and complexity of the firm’s activities. The PRA also emphasizes the importance of stress testing and scenario analysis in assessing capital adequacy. (see more about the official paper here)

European Union (EU)

In the EU, the European Central Bank (ECB) provides guidance on ICAAP through its Single Supervisory Mechanism (SSM). The ECB expects institutions to integrate ICAAP into their overall management framework, using it for strategic planning, monitoring capital adequacy indicators, and ensuring the effectiveness of the risk appetite framework. (see more about the official paper here)

European Banking Authority:While both jurisdictions emphasize the importance of ICAAP, the UK places a stronger emphasis on firm-specific responsibility and proportionality, whereas the EU focuses on integration into the broader management framework and strategic planning.

ICAAP Reimagined

Aligning CapitalCapital Adequacy with Strategic Resilience

Evolution of ICAAP

The concept of ICAAP has evolved significantly since its inception under the Basel II framework. Initially, ICAAP was introduced to complement the minimum capital requirements (Pillar 1) by addressing risks not fully captured under standardized approaches.

Over time, the financial industry has witnessed several enhancements to ICAAP:

- Integration with Strategic Planning: ICAAP has become a tool not just for regulatory compliance but also for strategic decision-making, helping institutions align capital allocation with business objectives.

- Enhanced Risk Coverage: The scope of risks considered under ICAAP has expanded to include emerging risks such as cyber threats, climate change, and geopolitical uncertainties.

- Advanced Stress Testing: Institutions now employ sophisticated stress testing methodologies to assess resilience under various adverse scenarios.

Greater Transparency and Disclosure: Regulators and stakeholders demand more detailed disclosures regarding ICAAP processes, assumptions, and outcomes.

These developments underscore the dynamic nature of ICAAP and its central role in promoting financial stability.

Key Steps in Performing an ICAAP

Conducting an effective ICAAP involves several critical steps:

- Risk Identification and Assessment: Identify all material risks, including those not covered under Pillar 1, such as reputational and strategic risks.

- Quantitative Measurement: Quantify the potential impact of identified risks using appropriate models and methodologies.

- Capital Planning: Determine the amount and quality of capital required to cover the assessed risks over a forward-looking horizon.

- Stress Testing and Scenario Analysis: Evaluate the institution’s resilience under various adverse scenarios to ensure capital adequacy.

- Governance and Oversight: Establish robust governance structures to oversee the ICAAP process, ensuring accountability and continuous improvement.

- Documentation and Reporting: Prepare comprehensive documentation detailing the ICAAP process, methodologies, assumptions, and outcomes for internal and regulatory review.

Each step should be tailored to the institution’s specific risk profile, business model, and regulatory environment.

Merger Integration Challenges

Our Impact

At T3, we have a proven track record of assisting financial institutions in developing and enhancing their ICAAP frameworks. Our impact includes:

- Enhanced Capital Planning: Assisted clients in optimizing capital allocation, leading to improved financial resilience.

- Regulatory Compliance: Supported institutions in meeting regulatory expectations, reducing the risk of supervisory interventions.

- Risk Management Integration: Facilitated the integration of ICAAP into broader risk management frameworks, promoting a holistic approach to risk and capital management.

Risk Management Latest Stories

ICAAP by the Numbers: What It Really Takes

Behind every robust ICAAP lies a complex, data-driven process that demands time, precision, and cross-functional alignment. These 10 key figures highlight the true scale, intensity, and strategic importance of getting it right. At T3, we help you boost both the efficiency and quality of your ICAAP, transforming regulatory obligation into a competitive advantage.

Average Time to Complete an ICAAP

Average Time to Complete an ICAAP

Material Risk Categories Typically Covered

Capital Add-Ons Due to Pillar 2 (SREP Outcome)

Number of Revisions Before ICAAP Completion

WHO DOES IT IMPACT?

All firms looking to reduce cost

Asset Managers

Banks

Commodity House

Fintechs

Services we Provide

T3 offers a comprehensive suite of ICAAP consulting services to support institutions in their ICAAP endeavours:

Designing tailored ICAAP frameworks that align with institutional risk profiles and strategic objectives.

Identifying and measuring material risks to inform capital planning.

Conducting rigorous ICAAP stress testing and adverse scenario analysis to evaluate capital adequacy and institutional resilience.

Enhancing governance structures and policies to support effective ICAAP implementation.

Assisting in the preparation of the ICAAP document, ICAAP reports, and communication with supervisory authorities.

Frequently Asked Questions

ICAAP ensures that your institution maintains sufficient capital to cover its risks, promoting financial stability and meeting regulatory expectations.

Banks need ICAAP (Internal Capital Adequacy Assessment Process) to ensure they have enough capital to cover all material risks, beyond just regulatory minimums. It’s a core requirement under Basel regulations and supervisory expectations in the UK and EU.

ICAAP capital planning consultants can support institutions in aligning their internal capital strategies with regulatory frameworks and risk profiles. ICAAP allows banks to:

- Align capital with their unique risk profile

- Meet regulatory expectations (e.g., PRA and ECB scrutiny)

- Prepare for adverse conditions through robust Capital stress testing

- Demonstrate strong internal governance and forward-looking risk management

This process is not just a compliance exercise – it’s central to sound, strategic capital planning and sustainable growth.

ICAAP should be reviewed regularly, at least annually, or more frequently if there are significant changes in the institution’s risk profile or business strategy.

Stress testing evaluates how your institution’s capital adequacy would be affected under adverse scenarios, helping to identify vulnerabilities and inform capital planning.

ICAAP is part of the broader Basel framework, specifically linked to Pillar 2. The three core pillars of the ICAAP process include:

- Risk Identification & Quantification:Capturing all material risks (credit, market, operational, liquidity, etc.)

- Capital Planning:Assessing internal capital needs under different scenarios, including baseline and stress conditions

- Governance & Review:Ensuring Board-level oversight, integration with strategic planning, and regular internal review

ICAAP is tightly linked to the Supervisory Review and Evaluation Process (SREP), where regulators assess its effectiveness.

ICAAP is used to:

- Assess capital adequacy under normal and stressed conditions

- Guide internal capital allocation aligned with risk appetite

- Inform strategic decisions, mergers, or expansions

- Prepare for regulatory reviews under SREP

Support recovery and resolution planning

It transforms risk insight into capital action, empowering banks to stay ahead of shocks, comply with evolving standards, and demonstrate resilience.

Basel 3 is built on three key pillars, each supporting the soundness and stability of financial institutions:

- Pillar 1 – Minimum Capital Requirements

o Covers core risks: credit, market, and operational

o Sets regulatory capital ratios (e.g., CET1 ratio, leverage ratio)

- Pillar 2 – Supervisory Review

o Focuses on internal risk management and capital planning

o Requires banks to assess their unique risk profile and ensure adequate capital

- Pillar 3 – Market Discipline

o Enhances transparency through public disclosures

o Empowers market participants to assess a bank’s capital strength

o Together, these pillars create a robust, multi-layered regulatory framework, with ICAAP Pillar 2 playing a central role in internal risk management and capital adequacy assessment.

The ICAAP is expected to support strategic decision-making and, at the same time, be operationally aimed at ensuring that the institution maintains adequate capitalisation on an ongoing basis, thereby promoting an appropriate relationship between risks and rewards.

ECB Guide to the internal capital adequacy assessment process (ICAAP Nov 2018) (link here)

Contact