Change Management

Post Merger IntegrationIntegration Consulting

Contact us

Post-Merger Integration (PMI)

Executive Context

Empirical evidence suggests that while merger strategy can create potential value, integration execution is where 70–90% of deals succeed or fail.

T3’s focus: As a post merger integration expert, T3 emphasizes value protection and value acceleration, blending operational resilience, regulatory fluency, and cultural integration into a disciplined change architecture.

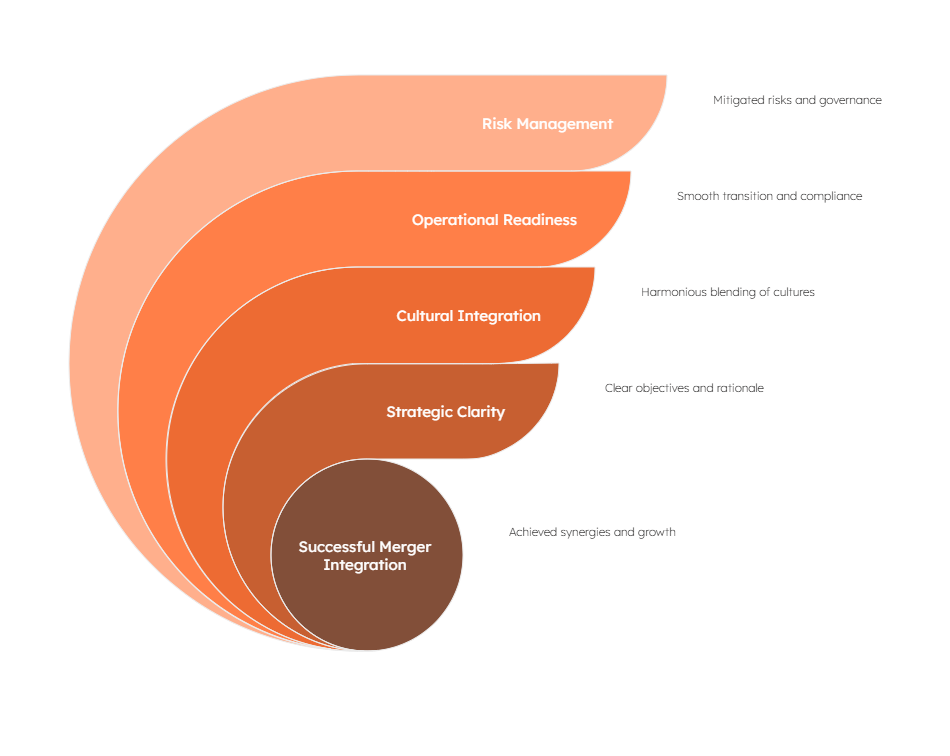

Key Stages of PMI

- Set a “single version of the truth”, an agreed-upon strategic ambition across leadership.

- Build an Integration Management Office (IMO) staffed by respected leaders from both legacy firms.

- Prioritise initiatives using the DICE framework (Duration, Integrity, Commitment, Effort) to predict execution risk.

- Early engagement with FCA, PRA, ESMA, national authorities.

- Map legal entity structures, authorisations, and reporting frameworks.

- Apply “Day 1 Compliance” rule: no regulatory gaps on licenses, operational resilience, or reporting lines.

- Conduct Cultural Due Diligence pre-close: measure differences in risk appetite, leadership styles, incentives, decision rights.

- Construct a new cultural template from “best of both” practices.

- Coordinate symbolic leadership behaviors (“quick wins”) to establish new cultural norms, tangible changes that set tone from the top.

- Validate or invalidate synergy assumptions within 60 days of close, brutal revalidation.

- Distinguish “critical must-do synergies” from “optional nice-to-haves” on basis of contribution to enterprise value.

- Establish a Synergy Execution Office under the CFO and IMO.

- Re-design governance to account for the new group’s strategy direction (e.g., regulatory risk management enhanced after integration).

- Arm managers with playbooks, mentoring, and rewards to support fresh behaviours.

- Construct a feedback loop, bi-monthly change diagnostics to support adapting interventions based on real-time data.

Culture Alignement

FEAR ISIS THE ENEMY OF PROGRESS

Aligning Incentives ahead of Everything

Aligning incentives post-merger is critical to securing the strategic value of the newly formed organisation and avoiding cultural fragmentation. Leadership must first establish a shared value narrative that resonates across legacy organisations, then harmonise structures and performance metrics to reward integration-focused outcomes.

Focusing on synergy delivery, customer retention, and cross-functional collaboration. Transitional incentives (e.g. retention bonuses or equity grants) can help retain key talent, while tying rewards to integration-specific KPIs ensures that behaviour aligns with strategic goals. Crucially, non-financial recognition and cultural alignment initiatives should reinforce desired values and help unify the workforce under a common identity.

Merger Integration Challenges

Key Pitfalls of Post-Merger Integration (PMI)

Mergers fail due to underestimated post merger integration challenges, which can ruin deal value if not countered by an effective post merger integration framework.

Over 70% of mergers fail to deliver their expected value (Harvard Business Review, 2024). In regulated sectors like financial services, integration risks are amplified by stringent compliance requirements and cultural complexities. The following are the most common pitfalls that derail post-merger integrations.

- Description: Failing to clearly define and continually communicate the strategic motivation behind the merger results in unaligned post merger integration initiatives. It is considered one of the most common post merger integration challenges.

- Impact: Teams work at cross purposes; resource allocation gets fragmented.

- Description: Culture clashes are the #1 reported reason integrations fail (source: HBR, 2024). Leaders tend to fall back on “one culture will trump”, a risky assumption.

- Impact: Latent resistance, loss of key talent, inefficiency in operations.

- Description: Most companies concentrate significantly on legal close and overlook operational, regulatory, and customer-facing readiness for Day 1.

- Impact: Confusion of customers, operational disruption, regulatory fines.

- Description: Synergy numbers dictate storybooks for deals, yet risks (regulatory risks in particular) tend to be downplayed to preserve the “deal story.”

- Impact: Value leakage via fines, customer attrition, licence problems (particularly for financial services businesses under FCA, PRA, ESMA regulation).

- Description: Post-merger integration organizational arrangements are frequently ambiguous, undermandated, or politically challenged.

- Impact: Cross-team resentment, decision paralysis, duplication of effort.

- Description: Premature loss of valuable staff, particularly those with client, operational, or regulatory experience.

- Impact: Business continuity threats, defection of clients, delays in implementation.

- Description: Particularly in regulated industries (banking, insurance, payments), companies underplay the importance of proactive regulatory interaction.

- Impact: Investigations, forced divestitures, fines, or licence suspensions (e.g., FCA, PRA Change in Control failures).

- Description: Without early visible successes, organisational momentum and morale suffer.

- Impact: Customers and employees lose trust in the merger’s worth.

- Description: The “frozen middle”, middle managers tend to resist or water down change if not sufficiently involved.

- Impact: Slowed execution, inconsistent messaging, hidden sabotage.

- T3 Approach: Middle Manager Enablement Program (coaching, incentives, realignment of authority), led by a post merger integration expert to ensure engagement and alignment.

- Description: Change Management tends to be regarded as a “soft” addition and under-funded.

- Impact: Employee confusion, process breakdowns, high resistance levels.

- T3 Approach: Change Management staffed as a dedicated, central workstream within the Integration Office and tightly

integrated into the post merger integration strategy.

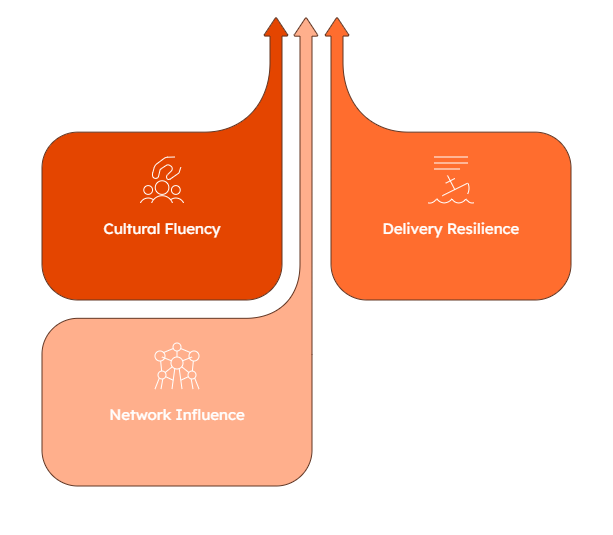

The Pillars of Effective Leadership

Best Practice: 3 Rules

1. Organisational Catalysts

Organizational Catalysts are trusted insiders who: Understand the DNA of the organisation, are credible with both leadership and peers and can execute with during transformation efforts.

In some organisations they are referred to as experts in project managements or experts in change management, but often they are individuals that have a balance of skills : change, organisation & people.

These catalyst need to have a simple set of rules on how to make decisions: Is the organisation leaning towards process A vs B or looking to explore what is best. How to define what is best? Is it cost saving or minimal risk. Some upfront thinking is required in order for organisational catalysts to roll our a change governance that is effective and agile.

2. Priority over Perfection

In traditional PMI frameworks, control, precision, and planning are sen to be core strengths. However, in large-scale change initiatives, where uncertainty is high, variables are shifting, and stakeholder fatigue is real, rigid perfectionism can stall momentum.

Whilst ensuring key decisions are made with the correct data and insight, a tiering of plans is essential to minimise operational risk and cost.

“In times of ambiguity, the job of a change leader isn’t to deliver a flawless plan. It is to deliver clarity, foster trust, and reduce organisational drag.”

Real Client Examples:

Data Completion: Delaying a go-live because full data validation across legacy systems isn’t complete.

Do this: Proceed with a controlled roll-out using the 80% of data that has been validated, and monitor for anomalies in real-time.

Heavy Steering Committee: Spending 4 weeks developing materials for “perfect” stakeholder engagement plan with 12 personas and multiple comms pathways.

Do this: Break down decisions in meaningful sets and identify delegates in middle management to help accelerate buy-in. Implement simple communication updates, test resonance, and refine based on feedback loops.

3. Keep Focus on Bottom Line

Even well-rationalised mergers risk value erosion if integration disrupts revenue, inflates cost, or distracts leadership.

Post-merger integration (PMI) must be executed with the same financial discipline as the deal itself. Profitability preservation—through customer retention, cost control, and regulatory stability—is critical. Shareholders expect returns, not restructuring delays. Below, we outline the most common PMI pitfalls that jeopardise the bottom line, with practical actions T3 applies to safeguard financial performance during integration.

M&A Share Price Impact

Mega-Deals Trail Behind: A survey by Reuters of 60 mega-deals greater than $10 billion since 2020 found that 75% of the acquiring companies trailed their industry peers with a median 5 percentage points underperformance annually. The trend was especially pronounced in the financial sector and healthcare sectors where acquirers trailed 9–10 percentage points annually.

Short-Term Losses

A National Bureau of Economic Research study noted that shareholders bear about 5.9 cents in losses for every dollar invested in buying a public company and see aggregate losses amounting to $257 billion over two decades.

Stock-Based Transactions Are Risky: S&P Global Market Intelligence reported that acquirers using stock as payment lagged peers over 1-, 2-, and 3- year horizons since taking control.

Recent Trends: During Q1 2024, companies carrying out M&A deals valued above $100 million trailed the general market by 13.1 percentage points, a pattern of negative performance duplicated in the previous quarter.

Strategic Implications

The above results underscore the paramount importance of proper post-merger integration (PMI) planning and execution. To safeguard profitability and shareholder value

Culture and Change Management Latest Stories

Our Impact on Culture and Change Management

We partner with organizations across the private and public sectors to spark the behaviors and mindset that turn change into value. Here’s some of our work in culture and change.

Failure to achieve strategic goals

Cultural misalignment as barrier

Critical talent voluntary attrition (Year 1)

Customer attrition post poor PMI

Regulatory breaches post-merger (FS)

Shareholder return premium for fast integrators

WHO DOES IT IMPACT?

All firms looking to reduce cost

Asset Managers

Banks

Commodity House

Fintechs

Services we Provide

Strategic Integration

- Integration Strategy Playbook

- IMO Operating Model

- Executive Alignment Workshops

Regulatory and Operational Risk Management

- Regulatory Change Roadmap

- Day 1 Compliance and Licensing Plan

- Operational Resilience Assurance Framework

Due Diligence and Leadership Alignment

- Cultural Compatibility Diagnostic

- Leadership Story and Change Model

- Middle Management Engagement Toolkit

Early Wins Delivery

- Synergy Realisation Tracker

- 30-60-90 Day Early Wins Portfolio

- Value Delivery Dashboard

Frequently Asked Questions

Change management is augmented by artificial intelligence (AI) to predict the mood of employees, identify resistance points, personalize messaging, help with training programs, and track acceptance metrics in real time. It accelerates implementation, enhances decision-making, and facilitates data-driven customization of change plans.

No, AI will assist change managers but not replace them. Human leadership is still needed to manage emotions, build trust, and work through complex organizational dynamics during transition, even as AI can automate administrative tasks, reveal insights, and suggest actions.

Artificial intelligence (AI) for change management refers to the application of AI techniques, including machine learning, natural language processing, and predictive analytics, to aid in decision-making, communication, risk management, and employee engagement in transformation efforts.

- Understand business priority

- Assess the saving & pain point by engaging domain leads across business units (repetitive process, error prone, high data volume, bottlenneck in decision making etc.)

- Apply capability mapping (pattern recognition, NLP, Computer Vision genAI)

- Prioritise with an AI Scoring matrix

- Prototype & test

If you want truly to understand something, try to change it.

Kurt Lewin

Want to hire

Change Management Expert?

Book a call with our experts

Contact