Greenwashing: Navigating the new era of Eco-Transparency Regulation

IMPACT ON THE FINANCIAL SECTOR

Greenwashing denotes a deceptive practice whereby financial institutions make false or exaggerated claims regarding their sustainability practices. Below are some well-known examples:

– Misleading stakeholders into believing that a financial institution is investing in the fight against deforestation, while simultaneously investing in corporations whose activities are linked to deforestation in the Amazon;

– Advertising the commitment to tackle climate change, while at the same time financing oil companies operating in the Arctic;

– Claims that a financial institution strives to reduce global CO2 emissions, while offering loans to corporations that build coal-fired power plants;

Below are the key repercussions of greenwashing practices on the financial sector:

Consumer deception

Greenwashing can mislead consumers into believing that a product or an institution is more environmentally conscious whereas this may not be the case. Consumers may therefore be pushed to make purchasing or investment decisions based on false information, thereby being prevented of their right to make informed and environmentally friendly choices.

Truly eco-friendly financial products undermined

Greenwashing allows less environmentally responsible competitors to appear as though they are on par with genuine eco-friendly products and portfolios. This can promote unfair competition and discourage businesses from investing in truly sustainable products.

Environmental harm

Greenwashing may mislead consumers to invest in products and activities that are not genuinely environmentally responsible thereby contributing to environmental harm, increased resource consumption, and pollution.

Erosion of trust

Repeated incidents of greenwashing can undermine consumer trust in environmental claims. Consumers may find it harder to discern products that truly promote sustainability objectives.

Market distortion

Greenwashing can distort market dynamics by allowing less environmentally responsible products to compete unfairly with truly environmentally responsible products.

GREENWASHING LEGISLATION: OVERVIEW

The prevalence of greenwashing is on the rise, with reports indicating a notable increase in such incidents globally. For example, according to a report published in May 2023 by the European Banking Authority, it appears that the number of greenwashing instances in the banking and financial sector has increased significantly with around 206 cases reported in 2022 against 40 in 2018. The majority of false claims related to fossil fuels. A recent Eurobarometer survey carried out by EIOPA shows the 63% of EU consumers do not trust sustainability claims made by providers.

European Union

At the EU level, the EU Green Deal, which proposes stricter rules for making environmental claims, reflects a growing legislative impetus to foster genuine sustainability within the financial sector. Within that context, in July 2020, the Taxonomy Regulation came into force, setting out 4 overarching conditions that an economic activity has to meet in order to qualify as environmentally sustainable. In March 2021 the Sustainable Finance Disclosure Regulations (SFDR) came into effect. The SFDR lays down harmonized disclosure requirements to standardize sustainability disclosures and ultimately make the sustainability profile of funds more comparable and better understood by end-investors, thereby preventing greenwashing. To supplement the existing ex ante framework, in March 2022, the European Commission proposed a Directive on empowering consumers for the green transition which – among other – aims at ensuring consumers’ ex post protection in greenwashing litigation cases.

United Kingdom

In the UK, in November 2023, the Financial Conduct Authority (FCA) published a policy statement on ‘Sustainability Disclosure Requirements (SDR) and investment labels’: among others, the FCA introduced an anti-greenwashing rule for all FCA-authorized firms in order to reinforce that sustainability-related claims are fair, clear and not misleading. Even advertising standards authorities across the globe, including the UK’s Advertising Standards Authority (ASA) and the US’s Federal Trade Commission (FTC), are stepping up efforts to curtail misleading environmental marketing practices.

In a market where green credentials are increasingly a metric for investment and consumer loyalty, the stakes are high. The reputational damage from greenwashing scandals can lead to loss of consumer trust, hefty financialpenalties, and long-term brand damage. As such, there is a compelling need for the provision of financial services that can validate environmental claims and ensure that institutions’ sustainability assertions are supported by concrete actions and reliable data.

AREAS OF COMPLEXITY

Regulatory Divergence

Financial markets participants operate globally, and are thus confronted with various environmental regulations with which they must comply. Firms must navigate these divergent regulations which can be complex and sometimes even contradictory.

Supply Chain Scrutiny

For financial services providers with extensive supply chains, ensuring that suppliers adhere to sustainability standards adds an additional layer of complexity.

Evidence and Reporting

Providing evidence for environmental claims can be technically and scientifically demanding. Firms must establish credible metrics and reporting standards, and often third-party verification is required to lend credibility to green claims.

Marketing Integrity

Aligning marketing strategies with genuine environmental performance is a complex tax.Financial institutions must ensure that their marketing teams are well-informed and that their campaigns reflect the true extent of their environmental initiatives.

Stakeholder Expectations

Investors and consumers are becoming more knowledgeable and expectations for environmentally friendly activities are increasing. Institutions must thus go beyond superficial claims and demonstrate deep, systemic commitment to sustainability.

Product and Service Design

Creating financial products and services that genuinely embody sustainability principles can be complex. It requires a rethinking of traditional product development processes to integrate sustainability at every stage.

Technological Solutions

Leveraging technology to improve sustainability can be complex. Firms must invest in new technologies and systems that support sustainable operations and reporting.

Ethical Corporate Culture

For the providers of financial services, avoiding greenwashing requires the embedment of a genuine sustainability culture into their corporate DNA. As the industry evolves, the ability to demonstrate real environmental stewardship will become an increasingly critical factor in maintaining a competitive edge, attracting investment, and fostering long-term customer loyalty.

CONSEQUENCES FOR NON-COMPLIANCE

The repercussions for non-compliance with greenwashing regulations in the financial services sector can be significant and varied, depending on the jurisdiction and specific circumstances of the infringement. Below is a summary of the key repercussions:

Regulatory Investigation and Enforcement action

Providers of financial services can expect increased scrutiny from regulators, shareholders, customers, and other stakeholders. Non-compliance may lead to enforcement actions, including regulatory investigation and enforcement action.

Reputational Damage

Even accusations of greenwashing are capable of damaging a firm’s reputation. In the long run, consumer distrust can impact a firm’s market position and its financial performance.

Increased operational, litigation and liability risks

The anticipated increase in litigation based on greenwashing claims underscores the need for firms to address this issue proactively.

Penalties

Competent national authorities that oversee financial market participants’ compliance with the Taxonomy Regulation are empowered to impose measures and penalties in accordance with national law.

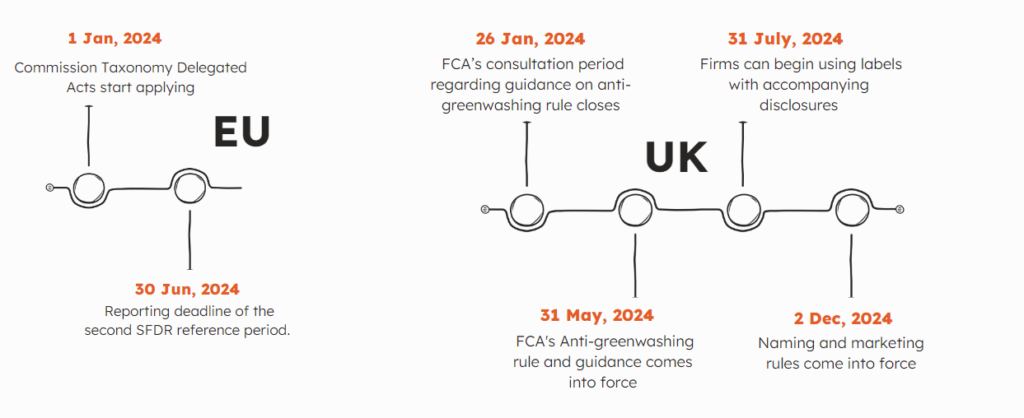

IMPORTANT DEADLINES

SERVICES

“This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, T3 Consultants Ltd, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.