Independent Review of Risk Management Framework

RISKS IMV AIMS TO ADDRESS

Independent Model Validation (IMV) aims to address several key risks associated with the use of statistical, financial, or mathematical models. These risks include:

Model Risk

This is the primary risk IMV seeks to mitigate. Model risk arises from potential inaccuracies or errors in models used for decision-making. These errors might be due to incorrect assumptions, mathematical mistakes, or data quality issues.

Financial Risk

Inaccurate models can lead to poor financial decisions, such as incorrect pricing of products, inadequate risk assessments, or suboptimal investment strategies. IMV helps in identifying and correcting these inaccuracies.

Operational Risk

This includes risks arising from failures in internal processes, people, and systems. IMV can identify if a model is too complex or if there are issues in its implementation, which might lead to operational challenges.

Strategic Risk

When models are used for strategic decision-making, errors in these models can lead to flawed strategies. IMV ensures that the models align well with the strategic goals and are robust enough for long-term planning.

Market Risk

For models used in trading or market analysis, inaccuracies can lead to incorrect assessments of market risk. IMV checks the validity of these models under various market conditions.

Credit Risk

In models used for assessing creditworthiness, IMV ensures that the models correctly evaluate the risk of default, thus protecting against credit losses.

Liquidity Risk

This is the risk that an entity might not be able to meet its short-term financial obligations. IMV ensures that models used for liquidity management are accurate and reliable.

Counterparty Risk

For models assessing the risk of a counterparty defaulting on a transaction, IMV ensures these assessments are accurate, minimizing potential losses.

By addressing these risks, Independent Model Validation plays a crucial role in enhancing the integrity and reliability of financial decision-making processes.

IMV: OVERVIEW

The integration of sophisticated quantitative models in financial decision-making processes has significantly enhanced the ability of institutions to assess and mitigate risks. The scope of model risk is extensive, affecting a wide range of activities, including credit scoring, market prediction, portfolio management, and more. At the same time, if not managed appropriately, reliance on complex models introduces significant vulnerabilities.

Recognizing the critical nature of these models, independent model validation has become a key regulatory requirement. This process involves a rigorous examination of the model’s theoretical framework, the underlying assumptions, the mathematical formulation, and its implementation. Independent validation ensures that models are not only theoretically sound but also practical and reliable in the real-world scenarios for which they are intended.

The EU and UK regulations have been at the forefront of establishing norms independent model validation.

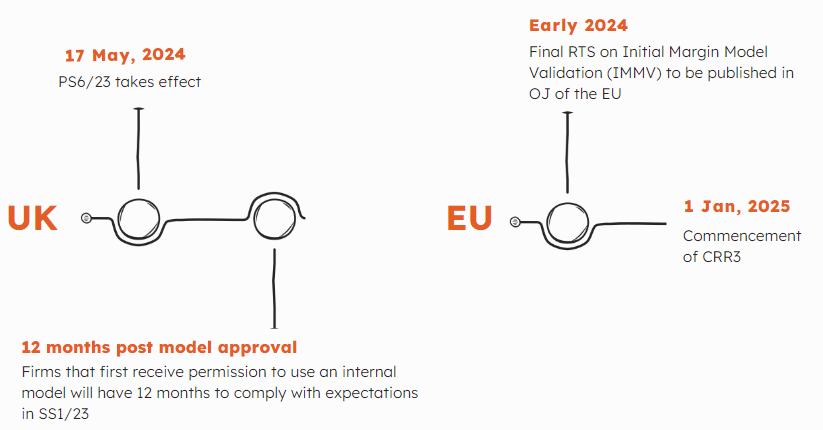

UK

The PRA’s SS1/23 is a framework established to guide banks in managing model risk. Published on May 17, 2023, it is structured around five key principles. Principle 4 which concerns IMV, prescribes that companies need to establish a validation system that continuously, independently, and effectively questions the creation and application of models. The person or group in charge of approving a model within a company should make sure that suggestions for fixing or rebuilding the model, as given in the validation, are implemented. This is to ensure that the models are fit for the purpose they are intended for.

EU

EU Regulations such as the updated Capital Requirements Regulation (CRR3), Markets in Financial Instruments Directive II (MiFID II), EMIR and the Solvency II Directive for insurance firms, have set out clear expectations for the governance, implementation, and ongoing evaluation of financial models. These regulations mandate that institutions not only validate models prior to their deployment but also monitor and re-validate them to ensure their continued accuracy over time. The ECB’s Guide on internal models additionally outlines the EU supervisor’s expectations for external validation of models.

EU Regulations such as the updated Capital Requirements Regulation (CRR3), Markets in Financial Instruments Directive II (MiFID II), EMIR and the Solvency II Directive for insurance firms, have set out clear expectations for the governance, implementation, and ongoing evaluation of financial models. These regulations mandate that institutions not only validate models prior to their deployment but also monitor and re-validate them to ensure their continued accuracy over time. The ECB’s Guide on internal models additionally outlines the EU supervisor’s expectations for external validation of models.

AREAS OF COMPLEXITY

The implementation of Model Risk & Independent Model Validation within financial services involves navigating several intricate and challenging areas, such as:

Defining Model Risk Scope

One of the initial complexities involves defining what constitutes model risk within an institution. The scope can vary widely, from credit risk models to complex trading algorithms, each with different risk profiles and validation needs.

Data Management

Ensuring the quality and integrity of data used in financial models is a significant challenge. Models are only as good as the data fed into them, and poor data can lead to inaccurate outputs and misguided decisions.

Regulatory Evolution

Keeping pace with the evolving regulatory requirements demands constant vigilance and adaptation. As new regulations are introduced and existing ones are updated, financial institutions must continuously align their model risk management frameworks accordingly.

Model Validation Techniques

Developing robust validation techniques that can effectively evaluate the performance and risk of both traditional statistical models and newer AI/ML-driven models adds to the complexity.

Interdisciplinary Expertise

Model validation requires a blend of expertise, including quantitative analysis, risk management, and regulatory knowledge. Fostering such interdisciplinary collaboration can be complex within large institutions.

Technological Infrastructure

Implementing the necessary technological infrastructure to support model risk management and validation processes is both complex and resource-intensive.

Model Governance

Establishing comprehensive governance frameworks that ensure accountability, transparency, and auditability of models is a multifaceted task.

Training and Culture

Cultivating a risk-aware culture and training personnel across the institution to understand model risks and the importance of validation is an ongoing complexity.

IMPORTANT DEADLINES

SERVICES

This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, T3 Consultants Ltd, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.